Hong Kong’s Hang Seng Index (HSI) is home to several high-dividend blue chips offering yields above 5% that are relatively insulated from US–China tariffs. These companies earn most of their income from domestic markets or essential services, making them less vulnerable to trade-war disruptions.

Below, we highlight 11 such HSI components (grouped by sector), explaining why their businesses are shielded from tariffs and what underpins their attractive dividends. (Note: We’ve excluded banks and property developers, despite their yields, due to their exposure to global finance and the China property crisis.)

#1 Link REIT (7.7% yield)

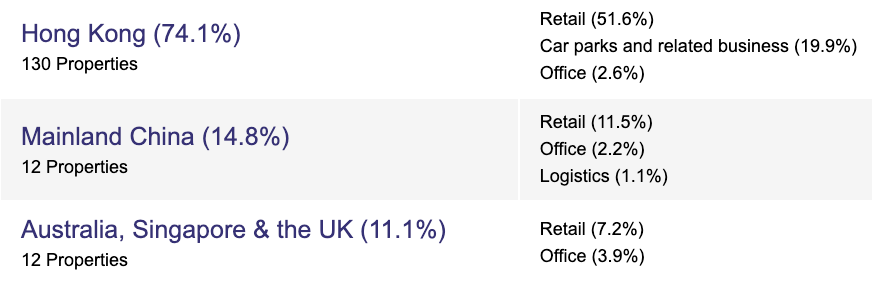

Link REIT is Hong Kong’s largest real estate investment trust, focusing on local retail properties and car parks. Over 70% of its portfolio consists of neighbourhood shopping malls and parking facilities in Hong Kong, with additional assets in Mainland China.

This domestic-centric portfolio means Link REIT’s rental income is driven by local consumer foot traffic rather than export markets. Even if Sino-US tariffs hurt Hong Kong’s export sectors, people still shop for daily necessities at local malls, providing Link with stable tenants and cash flows. Despite recent pressure from higher interest rates on property values and dividends, Link REIT’s retail assets have shown resilience. At a 7.7% trailing yield—well above its 5-year average of 5.7%—the stock may present an oversold opportunity for income-focused investors.

#2-3 Consumer Staples – Hengan International (7.2% yield) & Tingyi (5.2% yield)

Hengan International is one of China’s top producers of household necessities like tissues, sanitary napkins, and diapers.

The company enjoys a leading market share in hygiene products across China, and its sales come almost entirely from domestic consumers. Hengan doesn’t rely on exports—if anything, it’s deepening its reach into China’s vast population. Tariffs don’t affect demand for tissues and diapers. With a roughly 70% payout ratio and stable earnings, its 7.2% dividend looks sustainable. This is a pure-play on China’s consumption of daily essentials—making it a classic tariff-proof income stock.

Tingyi (Master Kong), another consumer-staples giant, is China’s leading instant noodle and ready-to-drink beverage maker. If you’ve ever seen rows of “Master Kong” instant noodles in a Chinese supermarket, that’s Tingyi’s product.

Whether the economy is booming or slowing, people still eat noodles. With virtually no export exposure, the impact of tariffs is negligible. The stock yields about 5.2%, and while payouts vary with profits, Tingyi has a consistent track record of paying dividends. For yield-seeking investors, it offers exposure to China’s domestic consumer demand—with a comforting bowl of resilience.