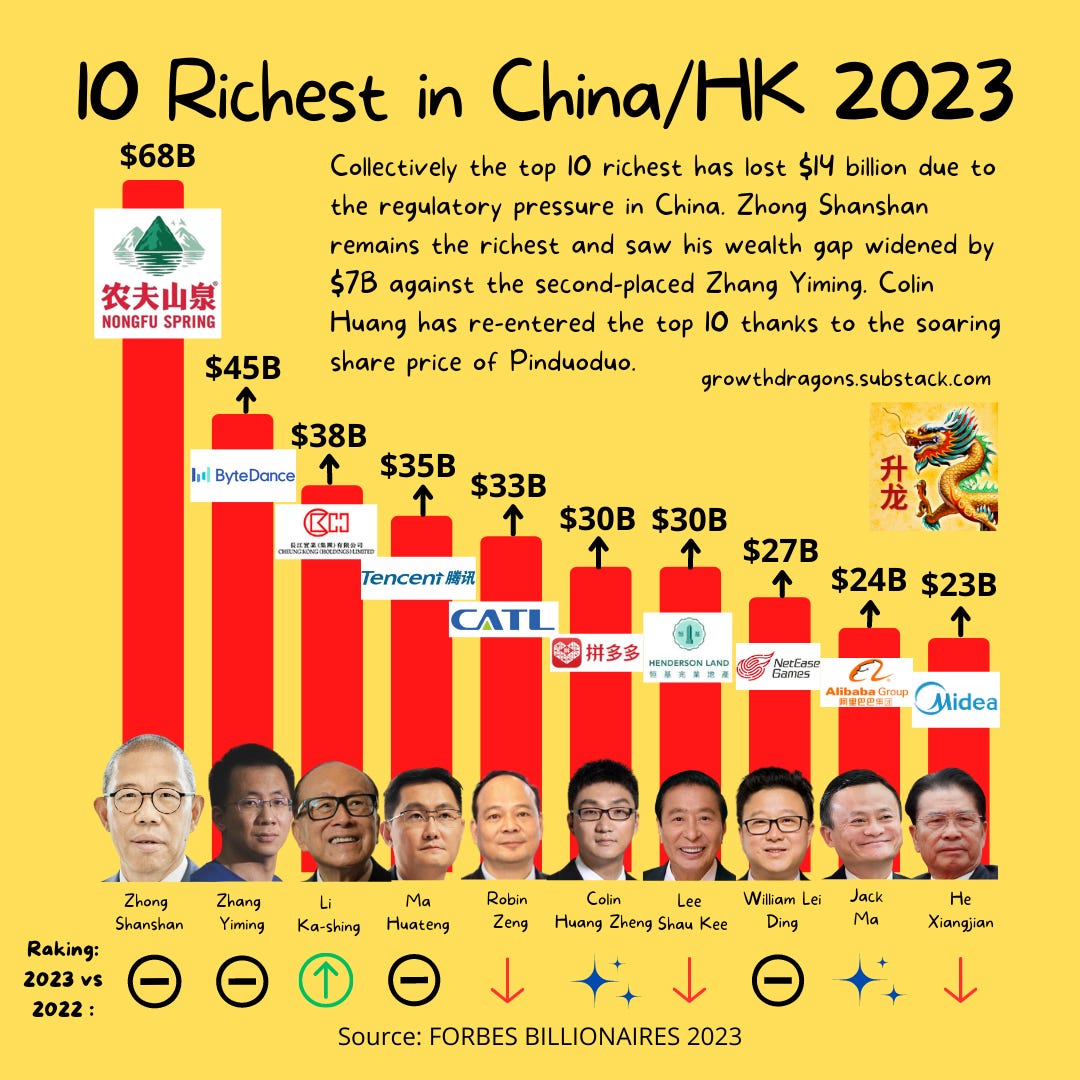

10 Richest in China 2023

Forbes has released its annual Billionaire ranking, and in this post, we'll be focusing on the wealthiest individuals in China.

Zhong Shanshan, the beverage mogul behind China's Nongfu Spring, has maintained his position at the top of the list with a net worth of $68 billion. This represents an increase of $2.3 billion from the previous year. Meanwhile, the gap between Zhong and the second-placed Zhang Yiming, founder of Bytedance, has widened by $7.3 billion. Bytedance has been facing challenges such as a lower valuation due to the economic slowdown, regulatory concerns in China, and the potential ban or sale of TikTok in the US.

Wealth Gains

Out of the top ten wealthiest individuals in China, five saw their net worth increase. Colin Zheng experienced the biggest gain in wealth, thanks to the soaring share price of Pinduoduo and the company's successful entry into the US market with Temu.

Colin Zheng, Pinduoduo (NYSE:PDD) +$18.9b

Li Ka-Shing, Cheung Kong Holdings (SEHK:1113) +$3.2b

Zhong Shanshan, Nongfu Spring (SEHK:9633) +$2.3b

William Ding, NetEase (NASDAQ:NTES/SEHK:9999) +$1.5b

Jack Ma, Alibaba (NYSE:BABA/SEHK:9988) +$0.7b

Wealth Declines

The collective wealth of the top ten wealthiest individuals in China has decreased by $14 billion, as the losses incurred by some billionaires outweighed the gains of others.

Robin Zeng, the leader of CATL, the world's largest EV battery manufacturer, experienced a significant decline in wealth, with a decrease of $11.4 billion. Despite CATL's dominant market position, the EV sector is currently experiencing slowing growth. Furthermore, BYD, which produces its own batteries, has become the top-selling EV brand globally, highlighting the intensified competition in the EV market. Additionally, the share price of CATL had increased significantly, which made a correction to be expected.

The decline in the wealth of He Xiangjian and Lee Shau Kee can be attributed to the downturn in the property sector. As a result of the property market meltdown in China, many stocks related to the sector, such as Henderson Land and Midea Real Estate, have seen significant drops in their value. Additionally, as Midea is a home appliances company, a decline in property demand would likely result in decreased demand for home appliances, thus impacting the company's earnings and stock price.

Robin Zeng, CATL (SZSE:300750) -$11.4b

Zhang Yiming, Bytedance -$5b

He Xiangjian, Midea (SZSE:000333) + Midea Real Estate (SEHK:3990) -$4.9b

Lee Shau Kee, Henderson Land (SEHK:0012) -$3.1b

Ma Huateng, Tencent (SEHK:0700) -$1.9b

In’s and Out’s

Colin Zheng and Jack Ma have both reclaimed their positions in the top 10, after dropping out of the ranking last year. This could potentially signal better times ahead for their respective e-commerce companies, Pinduoduo and Alibaba.

On the other hand, Wang Wei, founder of S.F. Holding (SZSE:002352), a logistics company, and Qin Yingling, Chairman of Muyuan Foods (SZSE:002714), operator of the world's largest pig farm, have been dropped from the top 10.

So what?

The richest individuals and their companies are a reflection of the most important drivers of economy. The changes to their wealth would tell us the ebbs and flows in the economy. Hence, knowing them and their companies would give us a better feel about the business landscape and the sectors they are in.

I have done a separate post on the world’s richest and we can derive a Forbes Richest investment strategy by investing in the stocks owned by these individuals, we can potentially benefit from their success and potentially grow our own wealth as well.