14 China Stocks Most Impacted by U.S. Tariff

Last weekend, Trump imposed tariffs on China, Canada, and Mexico. Specifically, he added a 10% tariff on all Chinese goods entering the United States. This move was largely anticipated by the market since his election. In response, China retaliated with tariffs on a range of U.S. exports.

Unlike the ongoing negotiations with Canada and Mexico, we don’t expect the U.S. to roll back its tariffs on China, given Beijing’s decision to push back. However, both sides have hinted at potential negotiations in the coming days. While these discussions have yet to materialize, we will focus on some Chinese companies that are likely to be impacted by the tariffs.

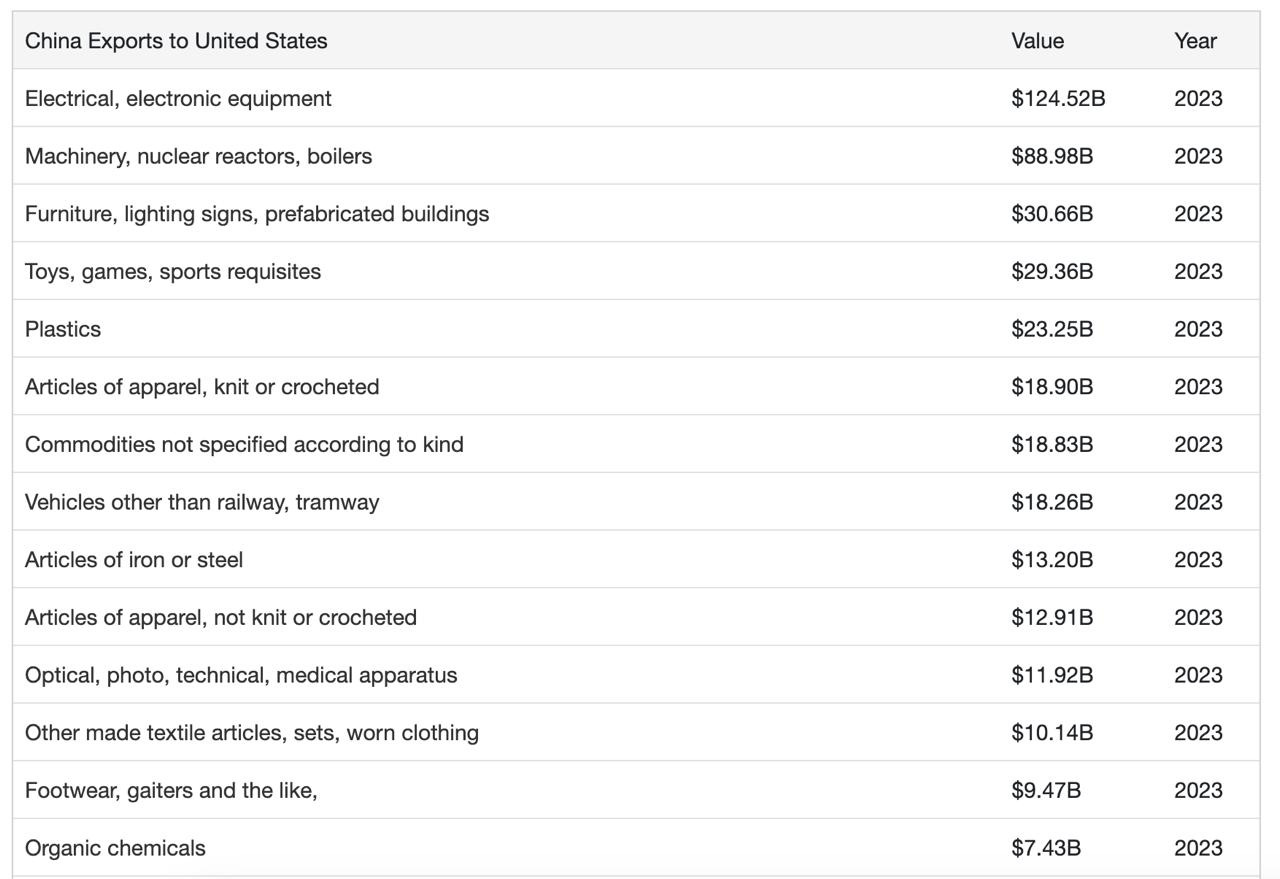

The table below highlights the top exported products to the U.S., along with companies operating in these industries that we believe will be impacted by protectionist measures.

However, in an increasingly interconnected world, tariffs are rarely effective in completely blocking access to a target market. For instance, EV makers like BYD did not see a decline in stock price despite high tariffs, as their U.S.-based factories shield them from protectionist policies. A careful analysis is essential to determine which businesses will be significantly affected.

#1 Goodbaby (SEHK:1086)

Goodbaby is a leading Chinese manufacturer of baby and children’s products, including strollers, car seats, and apparel. The company positions itself as a global leader in the durable juvenile products industry.

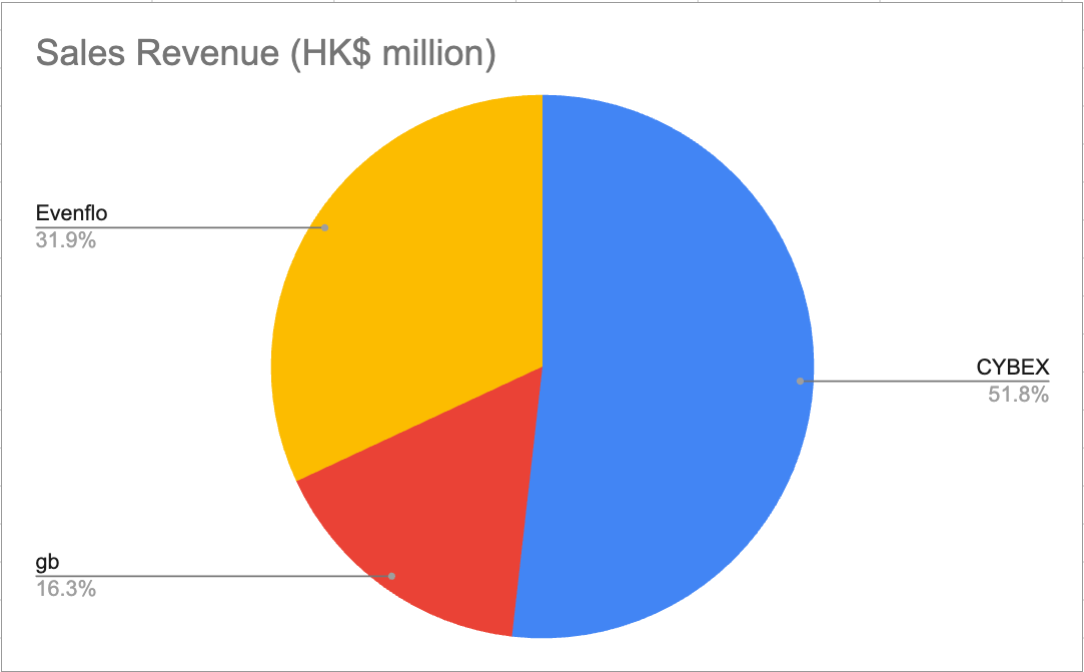

It owns brands such as gb, Cybex, and Evenflo, with its key markets in Germany, the U.S., and China. Below is a breakdown of sales for these three main brands under Goodbaby.

Evenflo primarily operates in North America, where it is a leading brand in the U.S. The company has production bases in both the U.S. and Mexico, which the former helps shield it from potential tariffs. However, we believe that the majority of production still takes place in China due to lower costs.

Additionally, CYBEX, which specializes in premium strollers, car seats, and baby gear, also has a presence in the U.S. market, selling primarily through online retailers such as Amazon, BuyBuyBaby, Nordstrom, and other specialty baby stores. Given these factors, we expect Goodbaby’s sales to experience some impact from the tariffs.

#2 Samsonite (SEHK:1910)

Samsonite is a global leader in travel luggage and bags. Originally founded in the U.S., the company is now headquartered in Luxembourg. It owns several well-known brands, including Tumi, American Tourister, and Hartmann. The U.S. remains a key market, accounting for 34.4% of total sales, with 95% of North American sales coming from the U.S. as of its H1 2024 report.

Brand Performance in North America (H1 2024):

Samsonite: Net sales of $300.9 million (49.5% of the region's total).

Tumi: Net sales of $231.9 million (38.1% of the region's total).

American Tourister: Net sales of $43.3 million (7.1% of the region's total).

Other Brands: Net sales of $32.3 million (5.3% of the region's total).

In its earnings report, Samsonite noted that “the geographic location of the Group’s net sales generally reflects the country/territory from which its products were sold and does not necessarily indicate the country/territory in which its end customers were actually located.” This suggests that while sales are recorded in the U.S., the products themselves may be manufactured elsewhere.

Although the company does not disclose the exact proportion of its products produced in the U.S., we anticipate that a significant portion is exported from China. Additionally, Samsonite is increasing its direct-to-consumer (DTC) e-commerce sales, which could further involve international trade, as products designed in other countries are also listed in the U.S. market. Given these factors, the company may face some impact from tariffs on imported goods.

#3 Techtronic (SEHK:669)

Techtronic is a Hong Kong-based manufacturer of power tools and home improvement equipment, owning well-known brands such as Milwaukee, Ryobi, and Hoover. The company generates the majority of its sales in North America, while most of its manufacturing takes place in China and Vietnam.

Given this production setup, a significant portion of its products is exported to North America, making them subject to U.S. tariffs. This exposure to protectionist measures could impact Techtronic’s cost structure and profitability, depending on its ability to pass costs to consumers or shift production to other regions.