The proliferation of AI leads to higher demand for raw metal which includes copper. Morgan Stanley mentioned that the data centers required to be built for AI would provide a CAGR of 18% for electricity consumption from 2024-2027. This may result in a CAGR of 26% for copper since it is used to conduct electricity and in other parts of the infrastructure. AI is not the only development that will push demand for copper higher, new products like EVs, will also require more copper for production.

On the supply side, Goldman Sachs estimates that there will be supply constraints this year.

Sossego, a copper mine under Vale, was ordered to halt operations by the Brazil Court due to suspected environmental pollution.

Zambia, Africa’s second largest copper producer, may reduce electricity usage due to drought which will reduce the amount of copper to be produced.

Next, Chile’s copper productions such as Codelco will also reduce due to accidents and environmental considerations.

Furthermore, the London Metal exchange and Chicago Mercantile Exchange were banned from accepting new aluminum, copper and nickel produced by Russia to reduce its profits to fund its war efforts against Ukraine. This is extremely critical as 62% of the proportion of available copper stocks are Russian made as of March 2024.

There are many other mine shutdowns and incoming export bans such as from Indonesia.

The effects of these supply reductions are magnificent when they are considered together. Goldman Sachs strategist Snowdon forecasts that copper prices could reach US$15,000 per ton (~US$10k per ton at the time of writing.)

China uses the largest amount of copper for its various production. As China becomes the main market and driver for EV and new energy products like Photovoltaic technologies etc., China will continue to be a leading consumer of copper.

China’s increasing investment on semiconductor chips and AI to catch up to the west and achieve self sustainability will also drive its demand.

Overall, China has the largest demand for mineral products across the world but it has scarce base metal resources which gives rise to higher demand over supply. This will result in a positive business outlook for base metal mining China businesses as they will always have strong demand.

2 China Copper Stocks to Benefit

#1 Zijin Mining 紫金矿业 (SSE:601899 / SEHK:2899)

Zijin Mining Group specializes in mining metals like copper, gold, silver, etc. It has 15 mining projects in China, copper is its main production and total exploration of copper amounts to 74 million tons. It is the only mining business in Asia that explored more than a million tons of copper in a year, its total production ranks at number 5 globally. It is ranked 373 in Fortune Global 500.

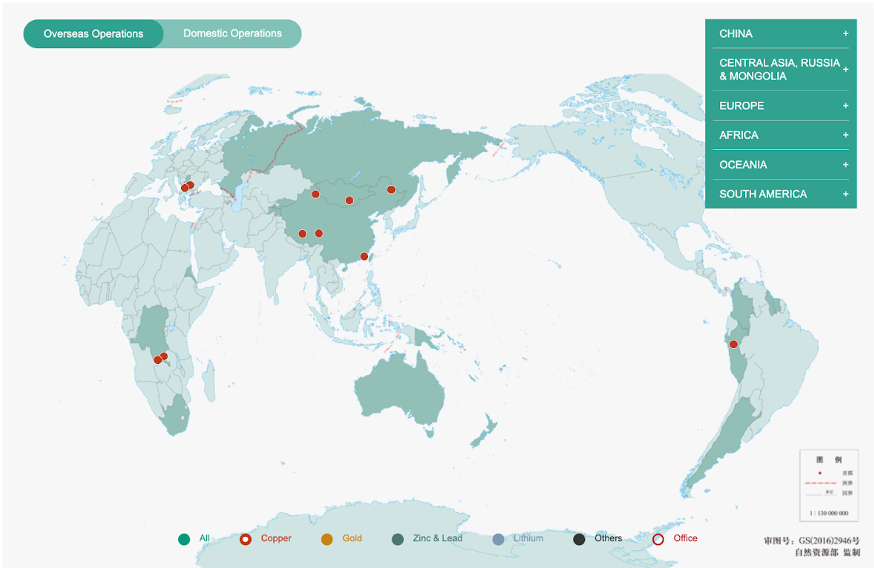

The picture below represents the copper operations of Zijin across the globe. It aims to continue to grow its copper productions and rank at least 3-5 globally. The production is also focused on decarbonising. Its forecasted CAGR for copper production is 11% to 2025.

It recorded revenue growth of 8.5% to 293 billion yuan and net profit growth of 5% to 21 billion yuan. Its asset liability ratio is about 60% and gross profit margin is 15.8%.

The amount of copper that is in its reserves is ranked 1st in China and 8th in the world. This means that if China businesses were to benefit from the high copper prices, Zijin Mining would be one of them. Most of the copper resources that Zijin uses comes from overseas mines. Apart from copper mines, its gold mines are world class as well with Porgera Gold Mine in Papua New Guinea - world’s top 10 gold mines, resuming production. This provides another source of income apart from Copper.

The image above highlights six of the fifteen key projects currently being explored by the company, seven of which produce copper. This business is unique not only because of its focus on mining but also due to its establishment of the Zijin School of Geology and Mining, which cultivates talent to boost the company's productive capacity. Additionally, the company has a research institute and collaborates with Sino Resources to enhance its production capabilities.

#2 CMOC 洛阳钼业 (SSE:603993 / SEHK:3993)

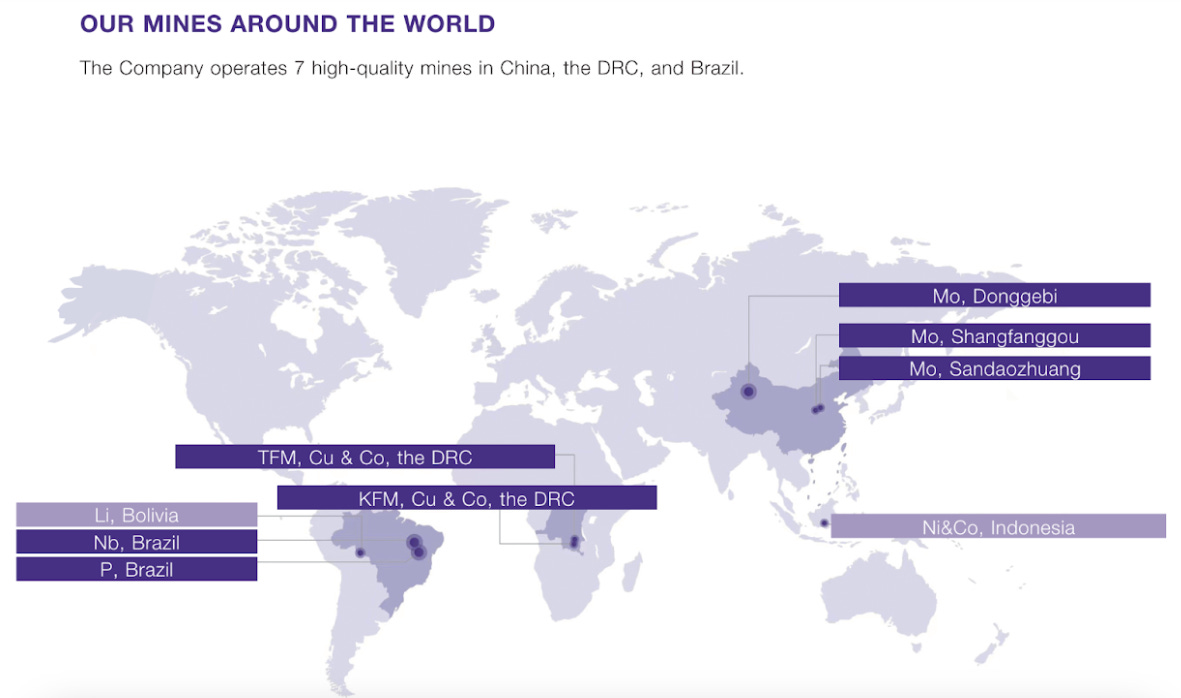

China Molybdenum Company (CMOC) Group focuses on mining, excavation, processing and trading of metal. It is globally known for its copper, molybdenum, tungsten and niobium producers. It is the world’s largest cobalt producer and also engages in producing phosphate fertilizer in Brazil. Its copper production is also approaching top 10 in the world.

Its biggest mining projects are Tenke Fungurume Mining (TFM) and CMOC Kisanfu Mining (KFM) which have yearly copper production capacity of 450,000 tons and 90,000 tons respectively. The Group has mentioned its development for next phase exploration of these projects. The company’s mineral product resources remain in a global leading position.

It does not only foray in the copper products but also engages in transaction of cobalt, molybdenum - a strategic resource for the military and China is the biggest producer of it.

The asset liability ratio is about 58.5% and gross profit margin is 9.7%. Last but not least, CATL - World’s largest EV battery producer, is a major shareholder of this company for its lithium mines. This suggests the maturity of the production lines of this corporation and its economic resilience from a product mix. Thus, it provides a strategic investment option due to its leading position in copper production and its production of molybdenum will ensure the business’s resilience in China.

Which is a better stock to buy?

The United States Geological Survey (USGS) estimated 2023 global copper production at around 22 million tons and Goldman Sachs estimated a 23 million tons production in 2024.

CMOC Group and Zijin Mining could account for up to 25% of global copper production, following their respective production increases of 150,000 tons and 10,000 tons. These increments rank them among the top two copper producers worldwide.

The image below shows the copper reserves of some of the businesses relevant to the copper industry as of 2022. It shows that Zijin Mining and CMOC Group are the clear leaders in copper resources yet to be mined and Zijin Mining has the upper hand.

The current PE ratio of Zijin Mining suggests it is overvalued, with a PE ratio of 19.0x compared to its five-year average of 16.4x. Conversely, CMOC Group appears to be undervalued, as its PE ratio is 14.6x, below its five-year average of 18.9x. Relatively, CMOC is the more worthwhile play here.

Zijin Mining dividend history:

CMOC Group dividend history:

Both businesses are increasing their dividends since 2019, suggesting increasing profitability due to the rise in demand for metals.

Both businesses have reported a drop in cash reserves for the year of 2023 which was the cause of the drop in current assets for both companies year on year. This fall in cash reserves are largely due to capital expenditures.

For instance, Zijin Mining has acquired Zhunuo Copper Mine in Tibet and the Kharmagtai Copper and Gold Mine in Mongolia. CMOC Group also continues to develop its TFM and KFM copper mine to enter the next phase of production.

Both stocks have moved in the same direction of copper prices but with higher returns. While copper prices have risen by 19%, CMOC stock has moved 72% and Zijin Mining has moved 34%. This makes them more lucrative than investing in copper directly.

CMOC is potentially more volatile due to its smaller market capitalization, which is less than half that of Zijin Mining. Additionally, CMOC is in a stronger financial position, with current assets nearly twice its current liabilities, unlike Zijin, whose current assets are lower than its current liabilities. Despite Zijin's substantial mineral reserves, CMOC's higher cash and inventory levels could facilitate easier cash flow generation, suggesting more pronounced stock movements. Both stocks are currently in a consolidation phase, and given the potential for higher copper prices, there is a likelihood of both stocks appreciating in value.

Overall, there are too many Chinese businesses that engage in copper production, mining, smelting and trading. It is not possible to find a business that only engages in copper production without dealing with other metals. It would also be too risky to not have a product mix due to possible overproduction with lithium as an example. However, if the business does not have a strong focus on copper it may also not be able to reap the benefits of high copper prices. Zijin Mining and CMOC Group stand out with the best chance to benefit from the high prices. With the large amount of resources they possess, they have stronger price setting ability for their products.

Other China Copper businesses

中国五矿集团 (SSE:600058) Minmetals Development

China Minmetals Corporation started in 1950 was the combination of 2 Chinese businesses from the Fortune Global 500 lists which are 中国五矿 and 中冶集团. It is China’s biggest and most internationalized metal mining corporation. It is also the largest metallurgical construction and operation service provider in the world. The business recorded revenue growth of 3.5% to 930 billion yuan.

This business has over 38 mines across the world. It does not purely mine copper, some other metals that are mined for include lead, zinc, nickel, iron, etc.. Most of these productions are either ranked first or are top few in the world. The corporation encompasses the entire supply chain by providing mining, smelting, processing and trading services. It is also slowly venturing into the new energy industry like batteries which means the business’s development is in line with China’s goal of increasing focus on new productive forces.

China Minmetals Corporation consists of 8 listed China businesses. Overall, it recorded over 900 billion yuan of revenue in 2023 and was listed at position 65 in the Fortune global 500. These 8 businesses are :

China Metallurgical Group Corp (SSE 601618, HK 1618)

Minmetals Capital Company Limited (SSE 600390)

Minmetals Development Co. Ltd (SSE 600058)

China Tungsten and Hightech Materials Co Ltd (SZSE 000657)

Zhuzhou Smelter Group Co Ltd (SSE 600961)

Hunan Changyuan Lico Co Ltd (SSE 688779, uninvestable)

MMG Limited (HK 1208)

Minmetals Land Limited (HK 0230)

These businesses do not only focus on copper productions and they diversify in a variety of services. However, China Metallurgical Group Corp had signed a deal with Afghanistan to explore the second largest mine in the world, Aynak. The mine has yet to be touched ever since the signing of the deal back in 2008. If China can access this mine it will bring exponential profits for the business. The progress has been halted due to the rich historical religious sites that were discovered near the mine. However, China’s high demand for copper and the importance of Afghanistan in its “Belt and Road Initiative” may lead to the ultimate exploration of the mine.

Overall, China Minmetal Corporation is the worst performing business compared to all other copper businesses mentioned later on in terms of stock gains year to date. This is likely due to its diversification in other businesses like real estate and it has also yet to unlock the value of copper from Aynak mine. It also has a high asset liability ratio of 73.2%. This business will have much to gain if the exploration of this mine is resumed. Furthermore, we believe that investing in the business as a whole may be risky due to the real estate exposure and investors could pick to invest in individual subsidiaries that are more focused on copper production like China Metallurgical Group and MMG limited.

江西铜业 (SSE:600362) Jiangxi Copper Co Ltd

Established in 1979, JCCL is the largest copper smelting business and the largest cathode copper producer in China. It mines resources such as copper, gold, silver, zinc, etc, and provides services like finance, trade and logistics to support further mining development. It provides up to 1/7 of the cathode copper that is in the Chinese market. Cathode copper is a type of copper that has high purity and is very useful in industries like EVs. Most of the copper resources that JCCL uses come from copper mines in China. The business recorded earnings growth of 8.7% to 521 billion yuan and 8.5% rise in gross profit to only 6.5 billion yuan due to a low gross profit margin of 2.7%. It also has a high asset liability ratio of about 73%.

铜陵有色 (SZSE:000630) Tongling Nonferrous

Tongling Nonferrous was one of the first copper industrial bases built in China. It built the first copper mines, smelting plant and first mechanized open-pit copper mine. Now, it has diversified into mining for a variety of metals and provides smelting, production and trading services.

This business has 11 metal mines, 7 smelting plants and 4 metal processing plants. It mentioned on its webpage that it is enroute to achieve the decarbonization goals with its frontier technology in each discipline. Focusing on copper, it produces cathode copper and other manufactured copper products like copper flat wire, Brass rod, copper foil and many other copper products. With such a wide product variety, it helped make Tongling Nonferrous the strongest player in total import and export volume in China’s copper industry.

The business’s revenue fell by 12.81% to 137 billion yuan but net profit of shareholders fell by 35.49% to 2 billion yuan. The gross profit margin is at 7.2% and its asset liability ratio is rather favourable at 50.7%. Its copper product sales increased 13.46% year on year. This is set to increase further due to the 2023 acquisition of 70% stake of China Railway Construction Tongguan Investment Co Ltd. The core asset of this acquired business is Mirador mine in Ecuador. The mine is expected to be put into operation in June 2025 which may help boost revenue next year. The business also remains as the leading supplier of copper products for 5G technology, and is set to build more copper foil production capacity which is critical for lithium batteries used in EVs. It has an asset liability ratio of about 60%.

云南铜业 (SZSE:000878) Yunnan Copper Co

Yunnan Copper Co managed to produce record high cathode copper production of 1.38 million tons during 2023. Its revenue was 146 billion yuan and profits was 1.5 billion yuan with a cash flow CAGR of more than 10% for the last 3 years. It has managed to continue to decrease its management and financing fees by maintaining return on assets above 10% for 2 years. Its asset liability ratio also decreased for the past 3 years, at 56.43% in 2023.

西部矿业 (SSE:601168) Western Mining

Western Mining has 7 exploration rights and 15 mining rights in Qinghai, Inner Mongolia, Tibet, etc.. In 2023, copper product sales made up 67% of total sales, which grew by 11.5%. It has 6 million tons of copper. It aims to produce 0.2 million tons of copper per year. It continues to expand as it have mining rights for 双利矿业二号铁矿 from 2022 to 2041 which could produce about 0.2 million tons of copper per year. It has also acquired other mining businesses to increase its reserve resources such as 淦鑫矿业 which contains 19,000 tons of copper and 45.6 million tonnes of iron ore. Its asset liability ratio is 60.93% and gross profit margin is 18%.

大冶有色 (SEHK:661) China Daye Nonferrous Metals

Daye nonferrous metal has a similar business structure as businesses above as it engages in mining, smelting and processing of metals. It creates about 0.53 tons of cathode copper a year. Its market share in China’s cathode copper market ranks at 5th position. It hopes to produce 1 million tons of copper and record sales of at least 100 billion yuan by 2025 under “十四五”, the fourteenth 5 year plan.

Its revenue in 2023 grew by 33% to 44 billion yuan and gross profit rose by 55% to 1.8 billion yuan. The copper mined increased by 44% to 15400 tons and cathode copper increased by 30% to 620000 tons year on year. It aims to mine 19900 tons of copper and produce 870000 tons of cathode copper in 2024. Its asset liability ratio is 82% and gross profit margin is 24% which are both relatively high.

北方铜业 (SZSE:000737) North Copper co ltd

This business is a relatively smaller copper producer compared to the other businesses listed here. It is a subsidiary under ZTS non-ferrous metals Group Co Ltd. The net profit for 2023 is 382 million yuan and possesses an asset liability ratio of 73%. Its gross profit margin is 14.5%. While this business has experienced growing profits for the past 3 years, it is not the best business to invest in due to its small size. This may decrease its ability in price setting when selling its products which will affect margins. However, this does not reduce its irrelevance in the Chinese copper market as it is the largest copper mining and smelting corporation in North China.

白银有色 (SSE:601212) Baiyin Nonferrous group co ltd

Baiyin Nonferrous Group has 15 mines for metal and non-metals and also has the rights to mineral processing capacity of 16 million tons per year for multi metals. It has the capacity to produce 200000 tons of copper yearly and also produces cathode copper but has a rather small market share. Under copper smelting, this business has the only independent intellectual property rights in a particular silver copper smelting process. The business also has built a production line that is capable of processing 1.4 million tons of copper smelting annually and can recycle up to 22000 tons of copper per year. This amount of production is equivalent to a medium-sized mine.

The business reported revenue of 86 billion yuan which was a 1% drop year on year but net profit rose by 150% to 83 million yuan. It has an asset liability ratio of 63% and gross profit margin of 4.13%. This business may not be a strong competitor in the industry but its technology in recovering copper from scrap metal would be essential. However, this business does not solely focus on copper as it is currently focusing on constructing a 5000 ton per year nano zinc oxide production line.

中国有色集团 (SEHK:01258) China Nonferrous Mining Corp

China Nonferrous Mining Corp reported growth of 261 billion yuan of earnings and 27 billion yuan in net earnings. It produced 142,423 tons of cathode copper and 285,733 tons of anode. The business controls more than 7 million tons of copper resources in mines operated by the company. This ensures it will continue to gain from the rise in copper prices in the future. It has one of the lowest asset liability ratio of 34.9%. The business maintains a high gross profit margin of 24.3%. It is estimated to be able to produce 410,000 tons of anode copper and 140,000 tons of cathode copper this year. This business just got added into the Hang Seng Index which means more capital will flow into this business and render it a good candidate for investment.

China Nonferrous Mining Corp have a 33% stake in China Nonferrous (中色股份, SZSE 000758). This subsidiary reported sales growth of 27% to 9 billion yuan and net profits growth of 145% to 0.3 billion yuan and its asset liability ratio is 55.7%. While the subsidiary also produces copper, investing in the parent company may be a safer option as it has access to more resources and a much better balance sheet based on the asset liability ratio.

金川集团 (SEHK:2362) Jinchuan Group International Resources Co Ltd

Jinchuan Group International Resources is ranked 289 in the Fortune Global 500 list in 2023 and possesses copper production capacity of 1.1 million tons per year. This business has mining and excavation deals in more than 30 areas globally. It produced 62,000 tons of copper in 2023, the production is balanced and barely increased for the past 3 years. It reported 4 billion yuan of sales which was a 27% decrease in sales. This business may not be the strongest candidate for an investment. Its copper production is also not the strongest amongst the businesses.

金诚信 (SSE:603979) JCHX Mining Management Co Ltd

JCHX Mining Management reported sales growth of 38% to 7 billion yuan and growth of 68% of net profits to 1 billion yuan. It is a rather small business in terms of revenue. It does have overseas resources in places like Cordoba mine, Dikulushi, Longshi and Lubambe Copper Holdings Limited. The business does have a decent potential growth due to the vast amount of copper yet to be mined in these projects but its potential and outreach is yet to match the bigger players in the field.

楚江新财 (SZSE:002171) Anhui Truchum Advanced Materials & Technology Co Ltd

The last business that we are discussing produces a wide range of copper products. It reported revenue growth of 14% to 4.6 billion yuan and net profits growth of 294% to 0.05 billion yuan. Similarly, this is a relatively small business and may not provide as big a room to grow as compared to the big players in the field.