The recent China-HK stock rally has encouraged more investors to look at China stocks once more. Besides the Chinese tech giants, China stocks are also known to be great dividend payers, especially in mature industries such as banking and energy. Additionally, China’s withholding tax of 10% is more palatable than the US 30% tax for dividend investors.

In this post, we are doing something for dividend investors by turning our attention to the A-share market, specifically the CSI 300 Index, which comprises stocks listed on the Shanghai and Shenzhen stock exchanges. Since most tech stocks are listed in HK or the US markets, A-shares are more suitable for dividend plays.

We sought the highest-yielding dividend stocks among the 300-constituent index that pay a minimum of 5% net dividend yield. Considering the 10% tax, we aimed for stocks with at least a 5.6% gross dividend yield to achieve around 5% net yield. Out of the 300 stocks, we identified 34 that met the criteria, accounting for 11% of the index. On average, these stocks deliver a 7.5% gross dividend yield.

Looking at the industry breakdown, banks and coal companies dominate the high-dividend segment—not surprising given China’s massive economy, the profitability of its banks, and its reliance on coal for energy.

Banking Sector

Within the banking sector, we still find the Big Four—ICBC, Bank of China, China Construction Bank, and Agricultural Bank of China—among the top dividend payers, averaging around a 6% yield. Beyond the Big Four, smaller banks tend to offer higher yields, in the 7-8% range. This reflects their perceived higher risk, as investors demand greater compensation for potential instability.

A key observation is that year-to-date (as of 17 March 2025), most of these bank stocks have declined, yet they have generally performed well over a five-year and one-year window. This suggests that Chinese bank stocks offer strong dividend yields with potential capital gains over the long term, despite short-term market turbulence.

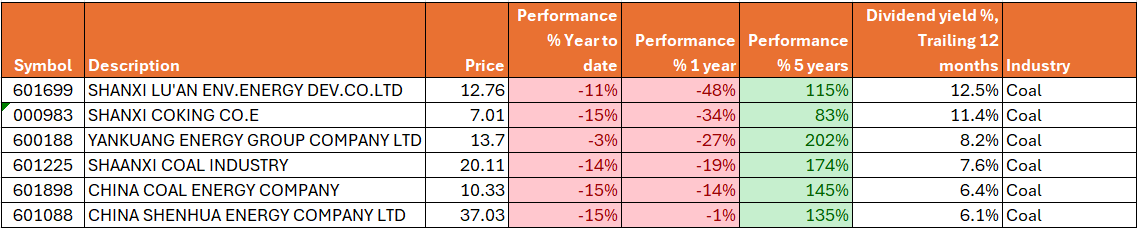

Coal Sector

The coal sector features six stocks that made it to the high-dividend list. The top two, Shanxi Lu’An Env Energy Dev and Shanxi Coking Co, offer over 10% dividend yields. However, this is largely due to their share prices plunging significantly over the past year.

There is a clear explanation—Shanxi province accounts for approximately 29% of China's coal output, making it one of the largest coal-producing regions. In early 2024, Shanxi initiated voluntary production reductions—the first in seven years—to address an oversupplied coal market, exacerbated by weakened demand from property, steel, and cement industries. This highlights the cyclical nature of coal stocks, requiring investors to endure greater volatility. Additionally, coal stock dividends may fluctuate more than those of banks, making them less stable over time.

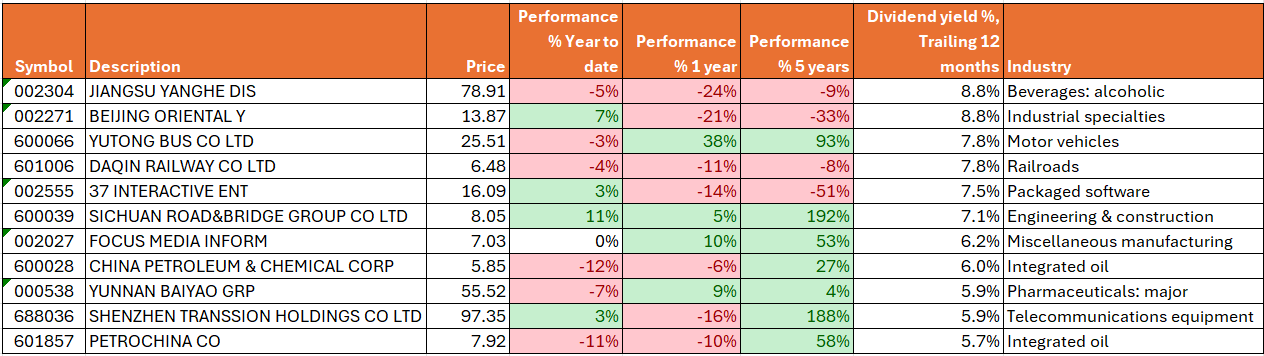

Other Industries

Apart from banks and coal, there are several high-dividend payers in other industries. Notable names include PetroChina (601857) and China Sinopec (600028). Other interesting companies include:

Yanghe (002304) – A major baijiu brand.

Yutong Bus (600066) – The largest bus manufacturer in China.

Yunnan Baiyao (000538) – A well-known traditional Chinese medicine brand.

Transsion (688036) – At one point, the most popular smartphone brand in Africa.

Depending on your familiarity with the China market, some of these names may still sound foreign, despite offering attractive yields to dividend investors.

China A-Share Dividend ETF

If you are uncomfortable buying individual A-shares, an alternative is gaining exposure through ETFs. Recently, the Lion-China Merchants CSI Dividend Index ETF is open for subscription. This ETF automatically invests in the top 100 dividend stocks within the CSI index, considering not just yield but also cash flow and the sustainability of payouts.

For more details, check out our post on this ETF.

Thanks Alvin, great work.

I have just returned from China (for the 5th time in a couple of years) and I am still amazed by the country and its people.

For those China investment doubters I say "go and have a look." It will rock your socks off!

Jeff