A common question among investors is whether to choose A-shares or H-shares when investing in a Chinese company that has listings in both markets.

Although both share classes represent the same company, there are some differences that investors may want to consider.

HKD’s future

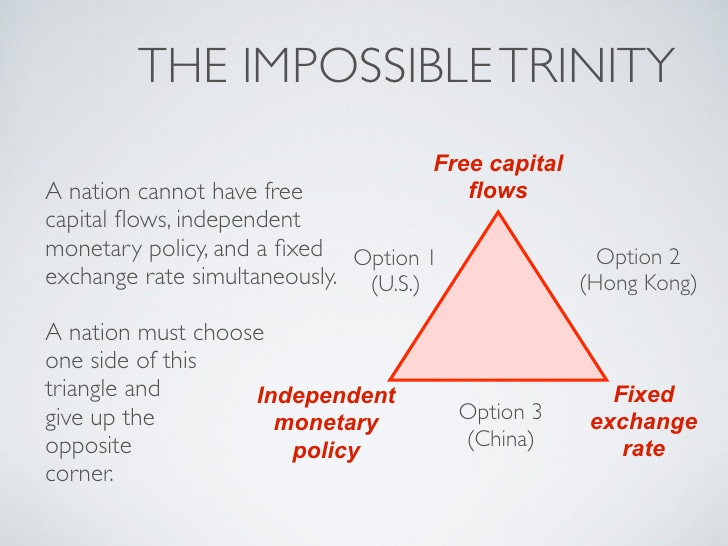

First, we have to understand the concept of the impossible trinity in economics.

According to this theory, each country can only control two out of the three following aspects: its exchange rate, its monetary policy, and the free flow of capital.

For example, the United States controls its monetary policy and allows for free capital flows, but it cannot control its exchange rate.

Hong Kong, on the other hand, also allows for free capital flows but pegs the HKD to the USD, meaning it cannot control its monetary policy.

Lastly, China controls both its exchange rate and monetary policy, but it cannot allow for the free flow of capital.

What’s the big deal you might ask.

Hong Kong's economy is heavily interlinked with Mainland China's, but its monetary policy is tied to the US dollar, creating a potential source of tension that could put pressure on the HKD-USD peg.

For instance, if China's economy slows down, the People's Bank of China (PBOC) may cut interest rates to stimulate growth. However, Hong Kong cannot follow suit, and if the US raises its interest rates and the USD appreciates, Hong Kong would have to buy more HKD to strengthen it and defend the peg. This tightening of monetary policy could exacerbate Hong Kong's economic slowdown.

As a result, this dissonance could work against Hong Kong's interests, potentially leading to a depegging that could result in significant forex losses, even for investors who hold stocks denominated in HKD. While the Hong Kong Monetary Authority has emphasized the strength of its reserves, there remains a risk that the peg may not hold.

In the long run, it may make more sense for Hong Kong to peg its currency to the RMB, especially if the RMB becomes a major international trading currency. In the meantime, investing in A-shares could be a way to avoid the risks associated with a potential depegging of the HKD.

Note: There are more China companies listing H-shares denominated in RMB. They might become more attractive to foreign investors who do not want HKD exposure.

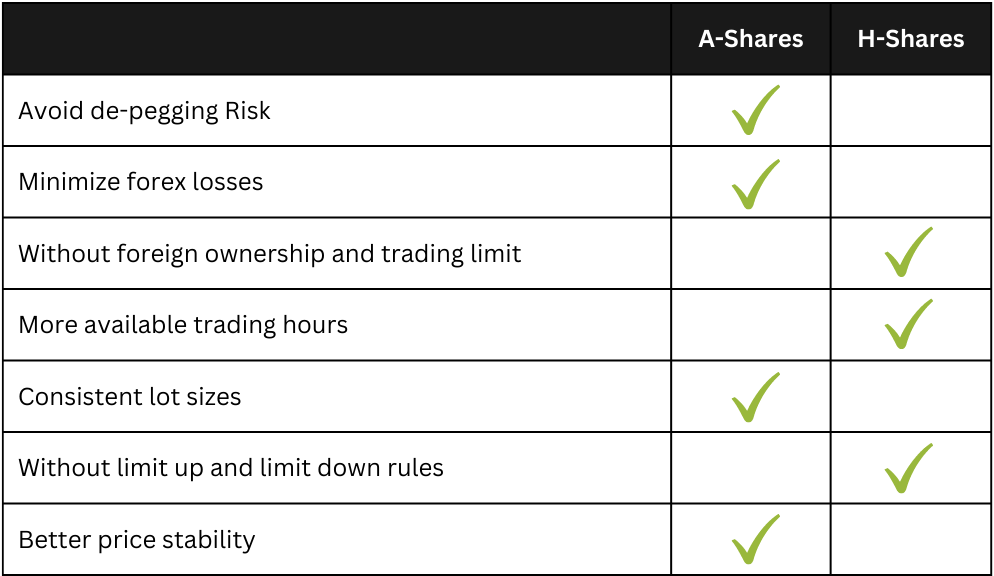

Verdict: 1 point for A-shares

Forex

The majority of Chinese companies are headquartered in China and earn their revenues in RMB. Hence, there may be translation losses when RMB is converted to HKD for H-share prices.

To minimize the impact of forex differences, investors may want to consider investing in A-shares, which are priced in RMB and have their financials reported in RMB as well. This would help mitigate the impact of currency fluctuations on investment returns.

Verdict: 1 point for A-shares

Foreign ownership and trading limit

A-shares have a foreign ownership limit of 30%, which means that foreign investors may not be able to buy certain A-shares if the limit has been reached. This can result in missed investment opportunities for those who intend to invest in specific companies.

In addition, there is a volume limit for foreign investors purchasing A-shares, which is currently set at RMB 52 billion for both the Shanghai and Shenzhen Stock Exchanges. While this limit has never been reached, it is worth noting that it could become a limiting factor in the future.

H-shares, on the other hand, do not have these limitations and are open to foreign investors without any restrictions.

Verdict: 1 point for H-shares

Market opening hours

Investors who are interested in trading A-shares will need to take into account that the Shanghai and Shenzhen Stock Exchanges and the Stock Exchange of Hong Kong have different trading hours.

This means that for foreign investors, both markets would need to be open at the same time in order to trade A-shares. If either market is closed, investors would not be able to buy or sell A-shares.

In contrast, trading H-shares only requires the Hong Kong market to be open, which can make it more convenient for investors who prefer to trade during Hong Kong market hours.

Verdict: 1 point for H-shares

Lot sizes

Investors who trade A-shares should note that the lot size is fixed at 100 shares per lot for both the Shanghai and Shenzhen exchanges. This means that the minimum amount of shares that can be bought or sold is 100, and any additional shares would need to be purchased in multiples of 100.

In contrast, the Hong Kong market does not have a fixed lot size, which can lead to more variability in the amount of shares that can be traded. This can be confusing for investors, who need to check the lot size for each individual stock they wish to trade. Additionally, the lot sizes in Hong Kong can be very large, which may not be convenient for investors who want to size their positions according to their desired investment amount.

Verdict: 1 point for A-shares

Limit up and limit down

It's important for investors who trade A-shares to be aware of the limit up and limit down rules in the Chinese markets. These rules stipulate that if a stock's price rises or falls by 10% or more, trading in the stock will be halted for the rest of the day, and resume the next trading day.

While these rules serve a similar purpose as circuit breakers in futures markets, they may limit an investor's ability to trade in a stock that has reached a limit up or limit down level. This can be frustrating for investors who are trying to take advantage of market movements, but it's important to remember that these rules are designed to prevent excessive volatility and ensure that trading prices remain within reasonable levels.

Verdict: 1 point for H-shares

A-H Premium

A-Shares tend to trade at a higher price than their equivalent H-Shares, even after accounting for forex differences. This is known as the A-H premium.

This is due to the fact that A-Shares are primarily bought by Chinese investors, who may have higher confidence in Chinese companies due to familiarity with them.

On the other hand, H-Shares are held by foreign investors, who may sell off their shares during periods of high volatility or uncertainty. This has led to the A-H premium spiking during times when China stocks are down.

Hence, A-shares may offer more stability compared to H-shares. Investors who buy A-shares at a premium are able to sell their A-shares at a premium in the future.

Similarly, investors who purchase H-shares may be able to buy them at a lower cost, but they may also have to sell them at a lower price in the future. Hence, it doesn’t mean that H-shares offer a better value because it is ‘cheaper’.

It is important to note that the A-H premium is not a static phenomenon and can fluctuate over time. Additionally, it isn’t an indicator of future price movements.

The A-H premium index is published by Hang Seng to identify whether an A-H premium exists. If the index is above 100, it means that A-shares are trading at a premium compared to H-shares. In the chart below, you can see that the premium existed for the past 5 years.

Verdict: 1 point for A-shares

Conclusion

Both A-shares and H-shares have their own advantages and disadvantages, and the decision of which depends on the factors that are more important to you.

Some may prioritize ease of access, while others may prioritize minimal forex fluctuations.

Thanks

Is it better to settle H shares in SG$ or HK$ to mitigate lower forex losses ? Thanks