Anta's Multi-Brand Success and Amer Sports' IPO

Which is the second-largest sportswear brand in China?

Many would think of Nike or Adidas.

However, as of 2022, Anta has overtaken Adidas to become the second-largest sportswear brand in China, achieving nearly double the sales of Adidas!

It achieved this through a multi-brand approach.

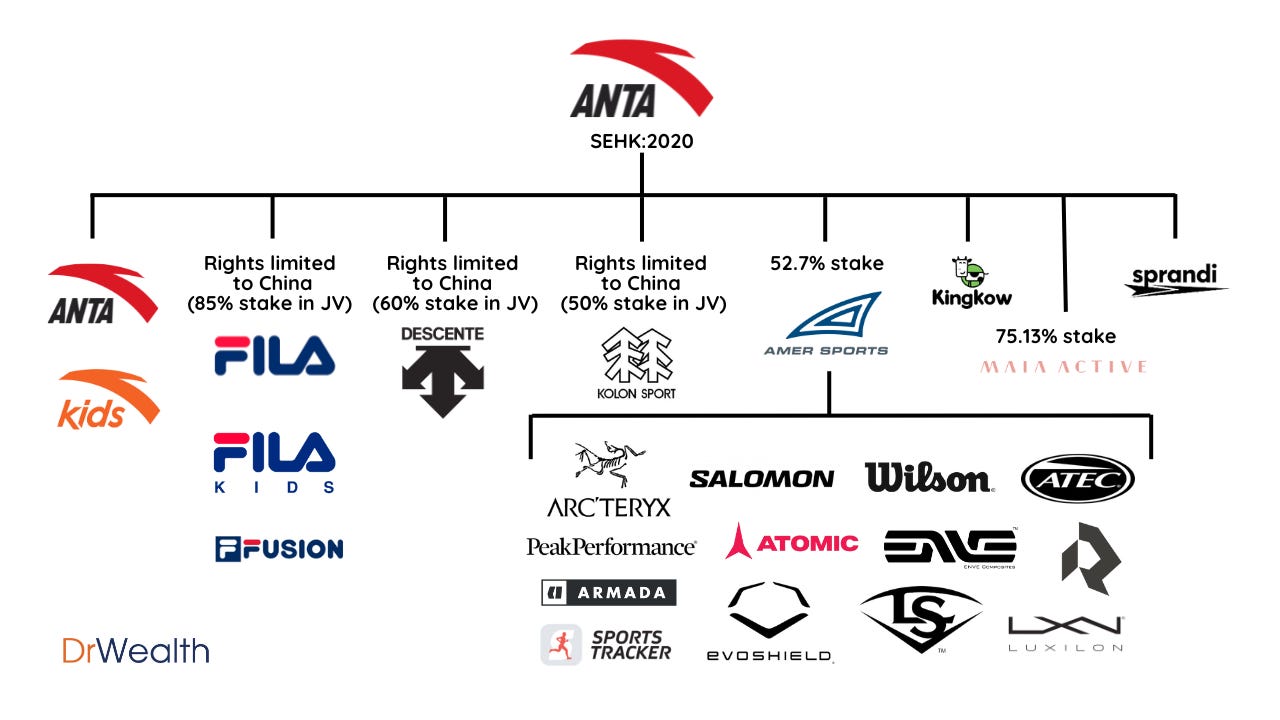

First and foremost, Anta, including Anta Kids, is the flagship brand, contributing 47.8% of the total revenue in the first six months of 2023. Anta positions itself as a mass-market sportswear brand catering to running, cross-training, and basketball.

Next comes Fila, of which Anta owns the rights in China, Hong Kong, and Macau, while the main Fila brand is owned by Fila Korea. Despite this, Fila in China, encompassing Fila Kids and Fila Fusion, accounted for 41.3% of Anta’s total revenue. Fila is positioned as athleisure fashion wear, targeting a less sports-intensive audience, and is priced higher than Anta products.

Other brands like Descente, Kolon Sport, KingKow, and Sprandi contributed just 10.9% in the first half of FY23. Descente, a Japanese brand specializing in skiing, cross-training, and running, partnered with Anta in a joint venture, with Anta holding a 60% stake, to market in China. Kolon Sport, a Korean outdoor brand, also partnered with Anta in a joint venture, where Anta holds a 50% stake for distribution in China.

This illustrates a typical ‘gatekeeper’ strategy. Recognizing China's vast market, foreign sports brands seeking entry can partner with Anta, leveraging its status as a home-grown Chinese enterprise and its extensive retail distribution network within the country.

Maia Active, often likened to a Lululemon clone, has not yet reported its financial contribution to Anta since it was acquired in December 2023.

In the case of Amer Sports, it is not included in Anta’s revenue reporting because Anta treats it as an investment. Amer Sports' revenue surpassed that of Fila in the first half of 2023.

Amer Sports is currently pursuing a listing in the US, which could potentially value the company at $10 billion. The Anta-led consortium acquired Amer for just $5.2 billion in 2018, effectively doubling their investment in five years.

Although the precise shareholding remains uncertain, as it depends on the amount raised through the listing, Anta is likely to remain the largest shareholder of Amer post-listing.

This listing could enhance Anta's global visibility and brand awareness, yet it is not expected to directly impact the operations of either Anta or Amer. This strategy represents one way Chinese companies can bolster their international branding.

Like many other Chinese stocks, Anta is considered undervalued. When comparing Anta and Li Ning to global giants like Nike and Adidas, it's evident that the US company is traded at a higher multiple. While Nike’s premium pricing is justifiable due to its market leadership, there is also a case for Anta and Li Ning to command a premium as faster-growing stocks. However, this hasn’t been the case so far.

We estimate Anta’s fair value to be around HK$99, indicating that its current share price of HK$71 is indeed undervalued.

However, investors should temper their optimism regarding a potential rebound in Anta’s share price solely attributed to Amer’s IPO. A broader improvement in sentiment towards Chinese stocks is necessary to facilitate a significant boost in its share price. Without this change in market sentiment, Anta’s share price may remain low for an extended period, despite positive developments.