China remains the factory of the world, with its production strength undiminished despite the ongoing trade war. As such, there is significant room for automation and innovation to make its manufacturing more efficient and future-proof.

Baosight (SSE: 600845), a Chinese software company specializing in industrial digital transformation and automation, is well-positioned to benefit from this trend.

It is likely that readers are more familiar with Siemens and Baosight operates in a similar domain. Siemens, the world’s largest industrial automation company, provides solutions across industries such as energy, food and beverage, automotive, and pharmaceuticals. For FY24 (ending September 30, 2024), Siemens reported revenue of €75.93 billion. In comparison, Baosight's revenue for the same period was only €1.8 billion. Even Siemens' China revenue, at €8.08 billion, is over four times Baosight's total revenue. It’s important to note, however, that Siemens’ broader business portfolio, which includes healthcare, skews this comparison. Still, Siemens generates its largest revenues from its industrial business segment.

Geopolitical tensions have led to increased resistance against foreign businesses in China, creating opportunities for domestic companies. In recent years, Siemens has divested its wiring accessories and trench businesses in China. Moreover, Siemens’ China revenue declined by 8% year-on-year in FY24, though this cannot be entirely attributed to geopolitics. Baosight also reported a 3% year-on-year revenue decline during the same period, reflecting sluggish economic growth in China. Meanwhile, another Chinese industrial automation company, Shenzhen Inovance (SZSE: 300124), achieved a 33% revenue growth over the same timeframe. However, since Inovance is not available via Stock Connect, Baosight becomes an accessible option for foreign investors.

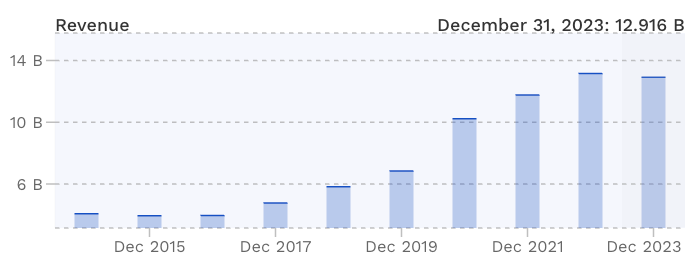

Despite the recent slowdown, Baosight has grown its revenue at a 10-year CAGR of 14%, outpacing China's GDP growth.

Its earnings have grown even faster, at a 21% CAGR, highlighting economies of scale.

The company boasts solid financials, with a 19% net profit margin, a high return on equity (ROE) of 24%, and return on assets (ROA) of 12%. These figures underline its profitability, allowing for consistent dividend growth. Though not a high-yield dividend stock, its latest yield of 3.6% reflects its quality as a dividend grower.

Baosight's stock has demonstrated resilience in China's challenging market conditions. Over the past decade, it has delivered a total return of 397%, including dividends. Even in the last five years, during which the MSCI China Index posted negative returns, Baosight's stock gained 112%.