China's domestic consumption has been a concern since the property crisis unfolded. Nevertheless, China's vast consumer base remains a formidable force, with immense potential. For many foreign investors, consumer brands offer a more accessible entry point than industrial or B2B companies, where touchpoints and information are often limited. With many consumer brand stocks taking a hit, they are now trading at attractive prices.

In this post, we explore one of China’s most successful consumer fashion brands—Bosideng. Known for its premium down jackets, Bosideng competes with global players like Moncler and Canada Goose.

According to the China National Garment Association, the down jacket market reached approximately 169.2 billion yuan in 2022, underscoring the market's size. Bosideng's revenue for the same year was around 20 billion yuan, giving it a significant market share of over 10%.

Moncler and Canada Goose also maintain a strong presence in China. Moncler generated close to 10 billion yuan in Asia in FY23 (though they do not break down China revenue specifically), while Canada Goose reported over 2 billion yuan in revenue from China in FY24. Bosideng, however, outpaced both, generating 22 billion yuan in FY24 from China alone, making it the largest down jacket brand in the country, with revenues more than double those of its closest competitor, Moncler.

While Bosideng has diversified into other categories, such as ladieswear and general apparel, down jackets still represent 84% of its total revenue—an increase from 81% a year prior, reflecting continued success in its core business.

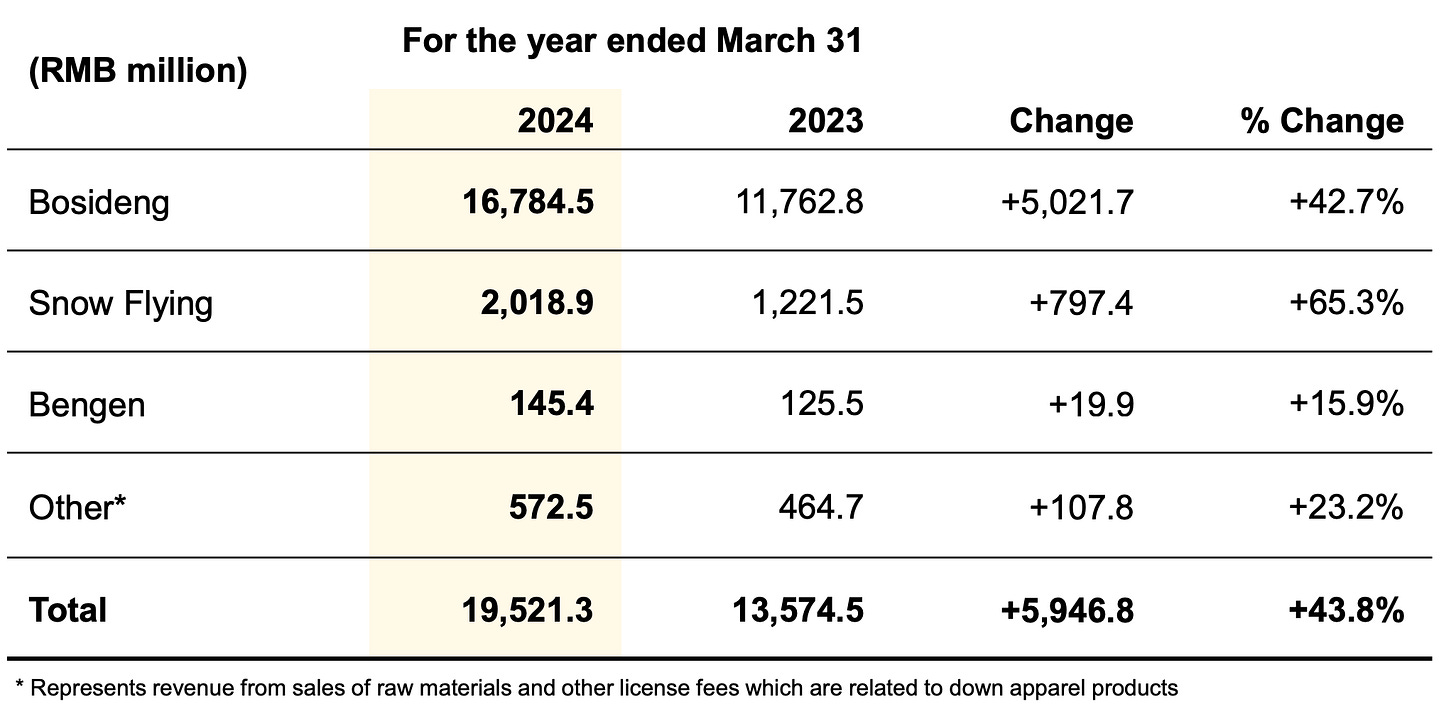

Within its down apparel segment, Bosideng employs a multi-brand approach. In addition to its main brand, it operates Snow Flying and Bengen. The main brand remains the primary driver, accounting for 86% of revenue, with sales growing by 42.7% year-over-year. Snow Flying also performed impressively, with a growth rate of 65.3%. Overall, Bosideng’s down apparel revenue grew by 43.8%, a robust performance.

Canada Goose, meanwhile, achieved a 47% increase in revenue from Greater China, marking the highest growth rate in any of its regions.

Moncler also recorded a solid 25% growth in Asian sales, again the highest across its regions.

This strong performance in down jacket sales indicates a growing preference among Chinese consumers for premium jackets that offer durability and convey status. Interestingly, this trend stands in contrast to China’s overall consumption decline, with luxury brands like LVMH, Kering, and Estée Lauder reporting slumps in China sales, underscoring the unique appeal of down jackets.

Bosideng’s FY24 performance further underscores its strength, with revenue up 38.4%, net income rising 43.7%, and dividends increasing by 38.9%—a remarkable showing amid China's sluggish economic backdrop.