There has been a wave of M&A activities among security brokers in China. The country aims to have 10 high-calibre brokerages by 2029, nurture two to three firms to a global scale by 2035, and make its capital markets globally influential by 2050.

We have highlighted this several times: China’s stock markets require foreign funds to support their rise because they lack the deep liquidity that the US markets possess. Now, China wants to change this and has made it a national target. This is a positive sign because, historically, China has focused more on the real economy than the speculative stock market. However, politicians seem to have awakened to the idea that having a strong and bullish stock market is equally important, ensuring it is not at the mercy of foreign fund flows. As with many targets in China, they achieve them as long as they commit their minds and resources. Therefore, it is possible that China could enjoy a vibrant stock market that rivals the US in the future.

Rosy projections aside, for now, there could be some M&A opportunities worth exploring. The securities industry is likely undergoing a consolidation phase, and if we can identify some of these target companies before they are acquired, we may secure offers higher than the prevailing prices, resulting in substantial gains.

In April, Guolian Securities (SSE:601456) announced a plan to buy out its smaller rival, Minsheng. Guolian will issue 11.31 yuan per share to acquire the entire stake of Minsheng. This merger is likely to occur, pushing Guolian Securities into the top 20 brokers in the nation, significantly improving its risk-bearing potential and revenue channels.

In May, Zheshang Securities (SSE:601878) made a bid for a 15% stake in Guodu Securities.

Recently, rumors have surfaced about a possible merger between Guotai Junan (SEHK:1788, SSE:601211) and Haitong Securities (SEHK:6837, SSE:600837). Both firms engage in investment banking and other financial services, primarily focusing on the Chinese capital markets. While sources familiar with the matter have mentioned that there are currently no plans for such a move, we believe there are promising M&A opportunities in this industry, and a significant merger could occur in the near future.

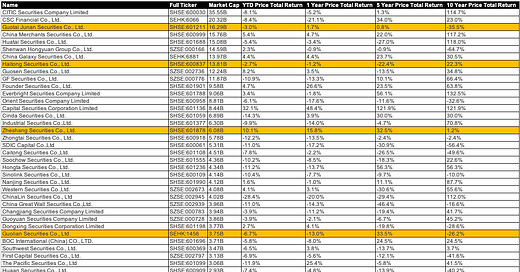

We have compiled a list of China-listed stock brokers, and you can download the spreadsheet for more details:

We have excluded those involved in investment banking or that only offer futures trading. We have also removed those that foreign investors can’t buy, such as those listed on the ChiNEXT board. Despite these exclusions, we still ended up with almost 100 stock brokers.

We noticed that M&A activities are happening among larger companies rather than smaller ones. So, if we set a market cap cutoff of at least USD $1 billion, the list shortens to 47 companies.

We need to narrow down the options further. Some considerations that could lead to an acquisition target include the business not doing well, which might make the management more willing to consider a sale. Additionally, the valuation should be low to make the price tag attractive. Lastly, there could be strategic impetus, such as entering a particular market segment that the acquirer does not currently have. The first two considerations are easier to assess using financial ratios, but the final one is more challenging as it requires a deep strategic study.

Out of the billion-dollar market cap stock brokers, only four experienced a loss in the trailing twelve months, with Haitong being one of the acquisition targets. Besides Haitong, the other one trading below its book value is Tianfeng Securities.

But we doubt investors gain any confidence in buying such companies with poor fundamentals. Moreover, acquisitions may or may not happen, and this is just a rough guess at best.

If we invert the thinking and buy those that are fundamentally stronger, it means that even if acquisitions don’t happen, these stocks may still perform better than the underperforming ones. It also means that because they are stronger, they may become the acquirers themselves.

So, we screened for positive net profit margins and a minimum 4% dividend yield among companies with more than a USD $1 billion market cap. We ended up with the screen results.

Out of these, China Galaxy Securities looks cheapest as it has the lowest Price/Book ratio and the highest dividend yield. Its dividend payment has been consistent. Although dividends were cut in the past two years, it still maintained a reasonable yield. Let’s not forget that the Chinese stock markets were terrible for business in the past three years.

China Galaxy Securities is also one of the Chinese broking houses that have expanded beyond China. It acquired CIMB Securities last year and now has a footprint in Southeast Asia.

Overall, we believe the consolidation within the Chinese securities industry is timely and necessary. Chinese securities firms need to grow bigger and stronger to instill confidence among investors and to marshal the resources required to compete effectively against their US counterparts. This consolidation will not only enhance the competitive edge of Chinese firms on the global stage but also contribute significantly to the development of a vibrant domestic capital market.

While we want to capitalize on the M&A activities, unfortunately, the potential targets presented to us have poor business fundamentals that would be risky for us to invest in. Although the fundamentally stronger ones are less likely to be acquired, we tend to lean on them more since guessing acquisition targets isn’t a high accuracy game. If one ends up with no acquisition in play, at least the fundamentals are strong, and it pays good dividends.