(This is part of a series focusing on deep value stocks that offer high dividend yields and possess good fundamentals. The current bearishness in Chinese stocks has unveiled numerous such exceptionally cheap opportunities, which we will reveal over time.)

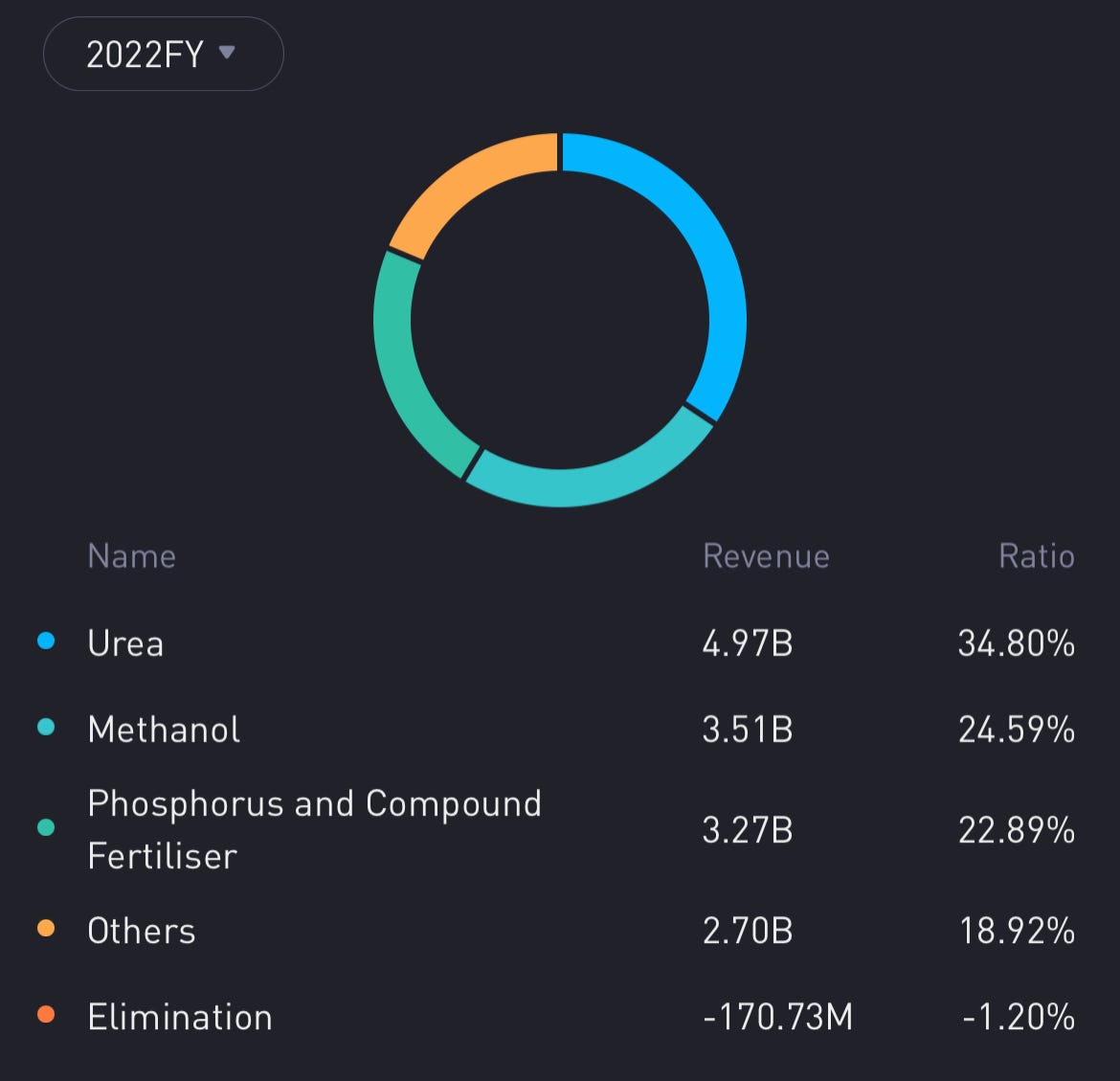

China BlueChemical (SEHK:3983) may not be a familiar name to most investors, yet it stands as one of China's largest fertilizer producers. Fertilizers, including urea, phosphorus, and other compounds, accounted for approximately 58% of its FY22 revenue. An additional 25% of the revenue was derived from methanol, which is utilized as an industrial solvent in the production of plastics, fabrics, adhesives, and more.

While the core business of China BlueChemical may not be our primary interest, it is the value of their assets that is noteworthy. The company had ¥8.9 billion in cash, surpassing its total liabilities of ¥5.7 billion in FY22. By accounting for its properties, halving the value of the remaining assets, and deducting liabilities, we arrive at a conservative value of HK$2.49 per share for BlueChemical. Below are the calculations: