Finally, Hongkong Land Plan to Unlock Its True Value

Hongkong Land released a long-awaited strategy update yesterday, which many investors have been eager to see. Hongkong Land is a premier real estate company with a high-quality property portfolio and blue-chip status as a component of the Straits Times Index. Despite its stature, the share price has been disappointing; even with a strong dividend yield above 5%, it hasn’t offset the capital loss over the past decade. In fact, an investor would have still lost 5.58% after holding Hongkong Land for ten years.

Its Hong Kong investment properties are located in the heart of Hong Kong’s CBD, near Central and Hong Kong MTR stations, some of the city's most prestigious areas.

Yet despite owning these prime assets, Hongkong Land’s share price remains stagnant. With the latest book value per share around US$13.82, it consistently trades below US$6 – meaning its properties are effectively selling at half their valuation.

This brings us to the long-overdue strategy shift that management has undertaken to unlock value.

Investment, not development

Hongkong Land is pivoting to focus on property investment over development. Management aims to generate recurring income and plans to exit the build-to-sell segment, which is largely residential. The company holds numerous residential development projects across Asia, including in China, Singapore, Indonesia, Thailand, Malaysia, Cambodia, and the Philippines. These projects are managed through subsidiaries like MCL Land in Singapore and joint ventures with partners such as Longfor.

The company estimates that selling off its build-to-sell segment could generate US$6 billion, representing about 20% of its net asset value and around 70% of its market cap.

Development projects carry higher risk due to factors such as land bidding, construction, and government regulations. For instance, China’s clampdown on property speculation has made it harder to sell residential units, contributing to Hongkong Land’s declining share price over the last two years.

Additionally, revenue from development projects is lumpy. It’s generated in phases and ceases once a project is complete, while the pressure to maintain continuous projects to secure revenue also increases risk. This is why many developers partner with others to limit exposure in each project.

Real estate is inherently cyclical, with alternating boom and bust periods lasting several years. Selling units at favorable prices during downturns can be challenging, adding another layer of complexity to development.

In contrast, investment properties offer regular, recurring income. This income stream is more predictable, and management has greater control to enhance property value over time. Shifting focus solely to investment properties could unlock significant value for Hongkong Land, helping it avoid the development discount it currently faces.

A REIT Spin-off?

Hongkong Land is also open to packaging some properties into REITs or private funds. Given its large portfolio, we believe pursuing the REIT route would be ideal.

By setting up a REIT, Hongkong Land could sell a portion of its properties while retaining a majority stake, much like other sponsors such as CapitaLand. This approach would allow the company to free up capital while still controlling the properties.

As of 31 Dec 2023, Hongkong Land’s investment portfolio is worth US$35.97 billion, with properties across several key cities.

The recent strategy update indicated that recycling some of these investment properties could generate around US$4 billion, which, is about 10% of the portfolio value.

However, Hongkong Land hasn’t provided a valuation breakdown for each property, so any guesswork on potential REIT contributions remains speculative. With only US$4 billion in estimated proceeds, it’s unlikely that the entire HK CBD crown jewel properties would be included.

The Singapore portfolio, including MBFC and One Raffles Quay, is prestigious, though Hongkong Land only has a 33% stake in these assets. Due to joint ownership, including them in a REIT would require approval from other stakeholders, making it complex. The same issue arises for properties in Jakarta, Bangkok, Macau, and Beijing.

Spinning off fully owned properties like One Raffles Link in Singapore and Exchange Square in Phnom Penh may be feasible, but alone, they may not be compelling enough for a REIT. However, combining them with a prized Hong Kong asset like Exchange Square, with its extensive office and retail space, could be viable. While this may not yield the full US$4 billion initially, it could lay the groundwork for further property injections into the REIT over a 10-year horizon.

Building a US$100 Billion Property Company

Hongkong Land aims to expand its property portfolio from US$40 billion to US$100 billion by 2035, positioning itself similarly to CapitaLand Investment, which has a current AUM of S$134 billion (US$101 billion). While Hongkong Land trades at 0.3x book value, CapitaLand Investment trades at 1x, highlighting potential for revaluation if Hongkong Land successfully pivots to an investment holding company model.

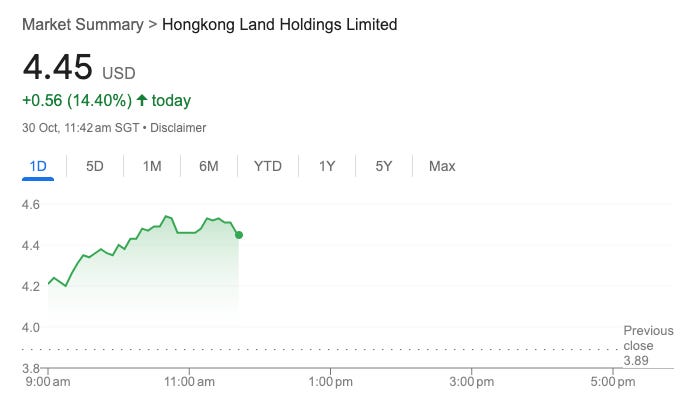

Following this strategy update, Hongkong Land’s share price surged over 10%. Yet, even after this jump, the stock still trades at less than half its net asset value, suggesting a significant discount remains.

Ultimately, whether the share price can sustain its upward trajectory will depend heavily on how well management executes this strategy. While investors have bought into the vision, concrete actions and results will need to follow in the coming years. Nevertheless, this is a promising start.