Grow Dragons Weekly: Cainiao IPO + Alipay+ Midea IPO + Moutai x Dove + Healthcare Stocks

In Growth Dragons this week:

Alibaba = Cainiao IPO + Ant Group Opens Up + $2B investment in Trendyol

Midea’s Blockbuster IPO in 2024

Lifting Foreign Ownership Limit On China A-Shares?

Moutai x Dove = Sold Out Chocolate

Buying Opportunity For Healthcare Stocks

Alibaba = Cainiao IPO + Ant Group Opens Up + $2B investment in Trendyol

Alibaba has a few noteworthy developments to discuss.

Firstly, there have been plans to separate Alibaba's subsidiaries into independent listings ever since the Group was divided into six distinct companies. However, we didn't anticipate these listings happening so soon, considering the unfavorable market sentiment. This delay was one of the main reasons behind Alibaba postponing the IPO of HippoFresh. Therefore, it was surprising to hear that Cainiao is preparing to file its Hong Kong IPO next week.

Cainiao aims to generate a minimum of $1 billion through this share offering, making it the largest Hong Kong IPO since China Tourism Group Duty Free's $2.3 billion raise in August 2022.

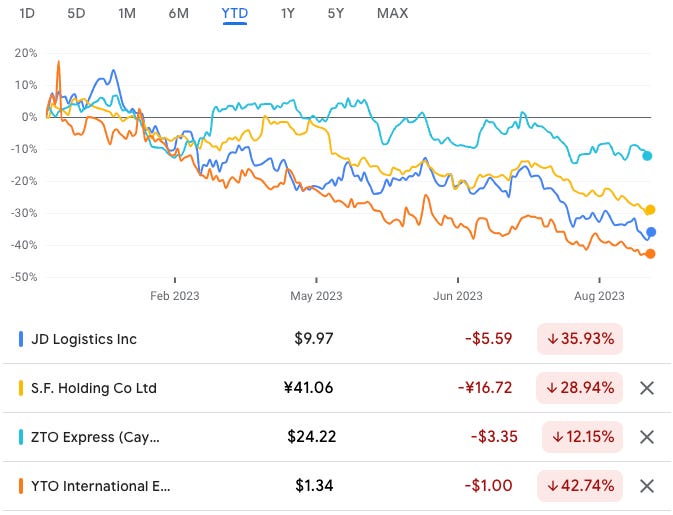

However, we hold a cautious outlook on these listings, especially considering the poor performance of other publicly traded logistics firms. For Alibaba shareholders, there is a possibility of receiving Cainiao shares as a dividend-in-specie. If this happens, we would prefer to sell Cainiao shares rather than hold onto them.

Next, we have Ant Group's associated company, Ant Group.

Ant Group has recently partnered with seven new entities in its Alipay+ collaborations:

mPay (Macau)

HiPay (Mongolia)

Changi Pay (Singapore)

OCBC e-wallets (Singapore)

Naver Pay (South Korea)

Toss Pay (South Korea)

TrueMoney (Thailand)

In addition to AlipayHK, Malaysia's Touch 'n Go e-wallet, and South Korea's Kakao Pay, Alipay+ now supports a total of ten different Asian e-wallets and payment applications in mainland China.

This payment option eliminates the necessity for users to download more payment apps. Travelers to mainland China can utilize their local payment apps to make payments at Alipay+ QR-enabled merchants, making it convenient for tourists to conduct transactions in China's predominantly cashless society. It is also a boon for Ant Group as it expands Alipay’s adoption.

Finally, Alibaba is capitalizing on its current momentum to expand its e-commerce presence beyond China. The company has recently unveiled a substantial $2 billion investment in its Turkish subsidiary, Trendyol. This marks the largest sum Alibaba has ever committed to Trendyol, following previous investments of $728 million and an additional $350 million on two separate occasions.

The decision by Alibaba to bolster its investment in Trendyol follows the noteworthy achievement of the Turkish platform, which recorded an operating profit for the first time during the second quarter. Over the period from April 1, 2022, to March 31, 2023, Trendyol witnessed a remarkable 47 percent year-on-year increase in order growth, accompanied by a substantial 110 percent surge in gross merchandise volume when measured in local currency. Given the impressive growth demonstrated by Trendyol, it is clearly a strategic move for Alibaba to provide further support and resources to this venture.