The May report is now available, and you can choose to download the PDF version at the end of this post or conveniently read it on Substack.

Report outline

Retaliation and Self-sufficiency: Alternate G-7, Banning Micron, Targeting Consulting Firms and Launch of C919

China’s Economy: Indicators for PMI, Inflation and Youth Unemployment

China’s Stock Market: MSCI China, CSI 300 and HSI Chart Reading

Company Review: BYD, Li Auto, Tencent, Alibaba, Huya and Douyu

Investment Idea: A H-share that is cheaper and yielding higher at 8.6% than the A-share equivalent

1. Retaliation and Self-sufficiency

Alternate G-7

The G7 summit began on May 19, 2023, and although China is not a part of the G7, the main focus of the discussions revolved around China. The primary message conveyed was the need to ‘de-risk’ from China, as the G7 countries reached a consensus to reduce their reliance on China, aiming to avoid vulnerability in the event of deteriorating geopolitical relations.

Coinciding with the G7 summit, China chose to inaugurate the China-Central Asia Summit, which occurred just one day apart. This action is widely perceived as intentional and a display of defiance towards the political alliance. Chinese President Xi Jinping joined leaders from five Central Asian countries, namely Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan, and Uzbekistan.

China is actively cultivating relationships with its neighboring countries. It has already established strong connections with Russia and is now making notable advancements in Central Asia. It holds great significance for China to establish friendly alliances in the region, not solely for trade purposes but also for defense and security considerations. Having a friend along the border reduces the number of potential adversaries and contributes to China's overall stability.

Furthermore, Central Asia holds significant importance for China as a vital source of energy and a crucial corridor to Europe. Simultaneously, Central Asia relies on China's substantial foreign investments and export goods. As a result, there exists a mutual benefit between China and Central Asia, where both parties can gain advantages from their symbiotic relationship.

China has also played a mediation role by facilitating peace talks between Saudi Arabia and Iran, resulting in the reestablishment of diplomatic relations between the two nations. China has also been actively investing in infrastructure projects in Africa. Furthermore, China has developed warm relations with countries in South America. It appears that China's strategic approach involves fostering friendships with countries where the United States has shown limited interest. So far, China's strategy has been successful, and China definitely needs more friends in the world stage.

Banning Micron

China has recently imposed restrictions on operators of critical infrastructure, prohibiting them from purchasing chips from Micron. However, it is important to note that this restriction does not constitute a complete ban on Micron, as other private companies and less sensitive state-owned enterprises can still engage in business transactions with them.

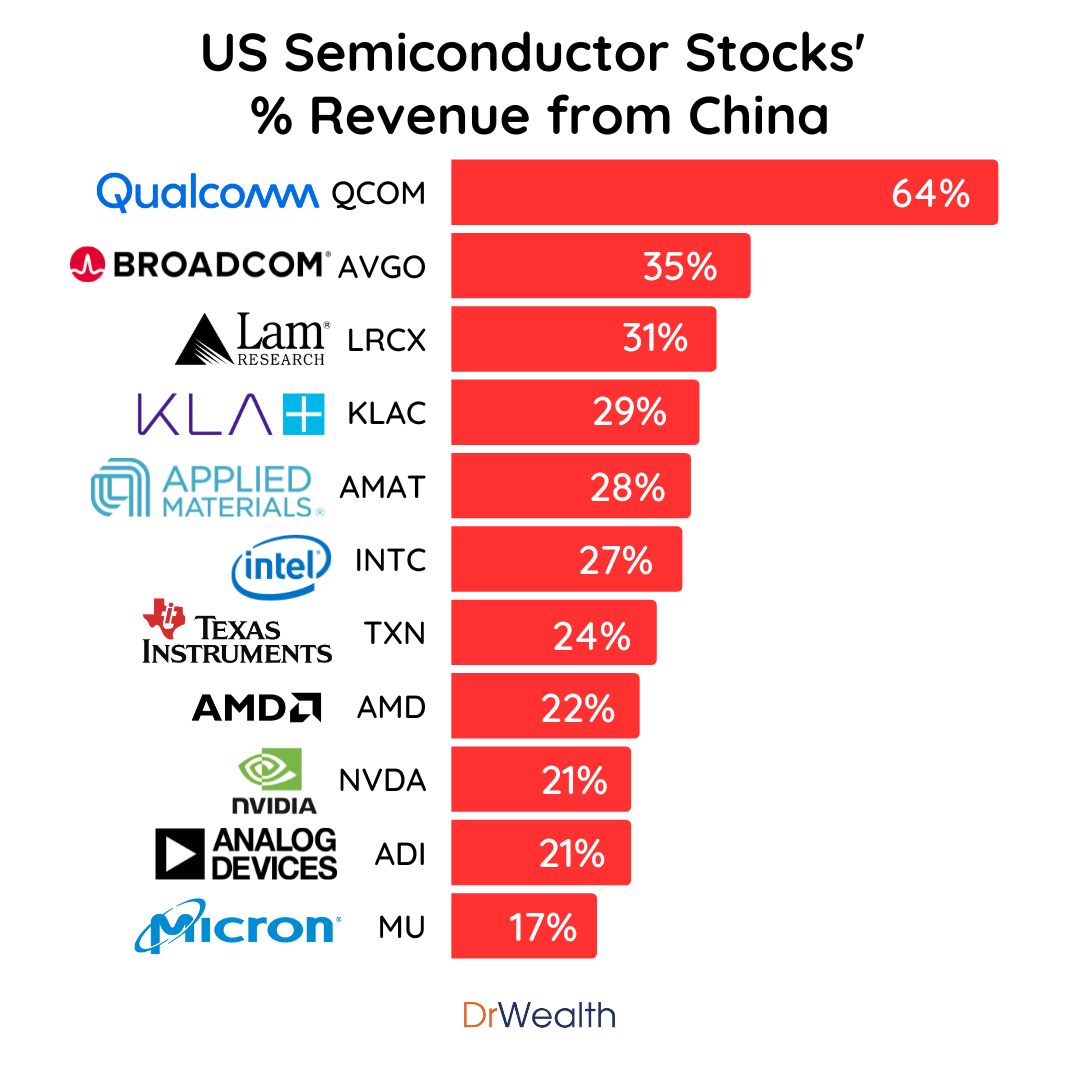

Apart from Micron, numerous chip companies headquartered in the United States also possess substantial market exposure in China.

So far, the policy responses in the chip war have been calculated and measured. The United States has not imposed a complete ban on semiconductor access to China, but rather restricted the export of advanced chips. This approach likely stems from the desire to allow American companies to continue profiting from the largest chip market, China, while limiting China's access to high-end chips in order to impede its progress.

Likewise, China has not banned all sales of Micron products within its borders, but has limited it to infrastructure companies. It is probable that China still relies on foreign technology and understands that banning more US companies would be detrimental to its own interests. Additionally, there may be readily available alternatives to Micron, such as Samsung Electronics and SK Hynix, making the impact of the ban less severe.

Another factor to consider is that China may not have reached the scale or technological capability necessary to replace the supply provided by US companies. Therefore, China will likely continue relying on these companies while it scales up its own production and improves its technology. However, as China progresses and expands its capabilities, the likelihood of it seeking to remove US companies from its supply chain in the future increases. Until then, further bans are likely to remain targeted and inconsequential to China.

Targeting Consulting Firms

We have reached a juncture where it seems unlikely for the relationship between the United States and China to be amicable again. At present, the absence of any further escalation in geopolitical tensions is already viewed as a positive development.

Recently, China has responded with a series of retaliatory measures against the US. On the grounds of espionage concerns, China has launched investigations into foreign consulting firms, leading to significant repercussions for certain entities. One such example is Mintz Group, which faced severe consequences, including the arrest of five employees and the forced closure of their branch. Furthermore, Capvision's offices in Shanghai, Beijing, Suzhou, and Shenzhen were subjected to raids as well.

In addition, Chinese authorities paid a visit to the Shanghai offices of Bain & Company, a notable consultancy firm from the United States, and proceeded to question their employees.

According to a report aired on CCTV, there has been an increasing level of suspicion towards both foreign and domestic companies involved in the due diligence and business research industry. The report highlighted concerns that certain consulting firms were prioritizing market share and profit at the expense of national security. It suggested that these firms were potentially becoming "accomplices for overseas espionage, bribery, and the extraction of national secrets and intelligence."

The report lacks specific examples of wrongdoing that would justify the raids on consulting firms, leaving the rules and justifications ambiguous. China has not been transparent about these actions, and this lack of transparency undermines trust. It is possible that espionage has occurred, but the optics of this event further erode confidence in conducting business in China. Consulting firms play a crucial role in enhancing understanding of China for foreign firms seeking to invest in this market.

While China claims to welcome foreign investment as long as firms adhere to its laws, these recent developments do not contribute to restoring business confidence or attracting foreign investment.

China launches its own commercial jet

After being beset by delays during its 16-year development program, China's domestically-produced C919 passenger jet finally completed its highly anticipated inaugural commercial flight on May 28, 2023. The C919 took off at 10:32 am from Shanghai Hongqiao International Airport and it landed at Beijing Capital Airport 2 hours later, where it received a ceremonial water cannon salute.

This event signifies a major achievement for China and represents another stride toward self-reliance by introducing an alternative option for commercial airliners, thereby challenging the longstanding duopoly of Boeing and Airbus. The C919 jet will directly competes with the Boeing 737 and Airbus A320 families.

However, despite its notable progress, the 164-seater C919 still heavily depends on Western components, including engines and avionics. Notably, the engines used in the aircraft are sourced from CFM International LEAP, a joint venture equally owned by American company GE Aviation and French company Safran Aircraft Engines. Additionally, certain systems are developed through joint ventures with foreign companies situated in China, such as Thales for the In-Flight Entertainment (IFE) system and Honeywell for the flight controls.

The primary demand for the C919 aircraft is expected to come from domestic airlines initially. Comac, with its goal of producing 150 planes annually within five years, has already secured over 1,200 orders for the C919. However, the prospects for the international market are uncertain due to the lack of certification by European and US regulators, which is unlikely to occur given the ongoing geopolitical tensions.

For instance, the C919's predecessor, the ARJ21, is a 90-seat short-haul aircraft that commenced commercial operations in 2016. The only international customer was TransNusa in Indonesia.

While the immediate ramp-up of demand for the C919 may not be feasible, the rapid growth in China's aviation industry has prompted even state-backed airlines, including China Eastern, to order nearly 300 Airbus planes last year to meet the increasing demand. This serves as a significant milestone; however, it also indicates that China's aviation sector is not yet completely self-reliant.