Here’s what happened in Growth Dragons this week:

China Passive Aggressive With Apple

HKEX (SEHK:388): Strong Earnings But Hurt by New Policies

Kweichow Moutai (SSE:600519): Slowing Growth But Still One of the Best Growth Stocks

New Oriental (NYSE:EDU): Surprised with Education Revenue Growth

#1 China Passive Aggressive With Apple

For many years, Apple had relied on China for manufacturing its products. However, in recent times, Apple sought to diversify its production away from China and, with the assistance of Foxconn, established manufacturing facilities in India.

This move did not sit well with China, as it implied potential business loss and job displacement. Consequently, China took an indirect approach to communicate its displeasure, as direct confrontation is never their style.

China has implemented a policy restricting government officials from using iPhones and introduced a new regulation demanding proof of a Chinese government license for new apps before they can be released on the China App Store.

The Chinese government extended its scrutiny to Apple's key supplier, Foxconn, initiating an investigation related to possible tax and land-related matters.

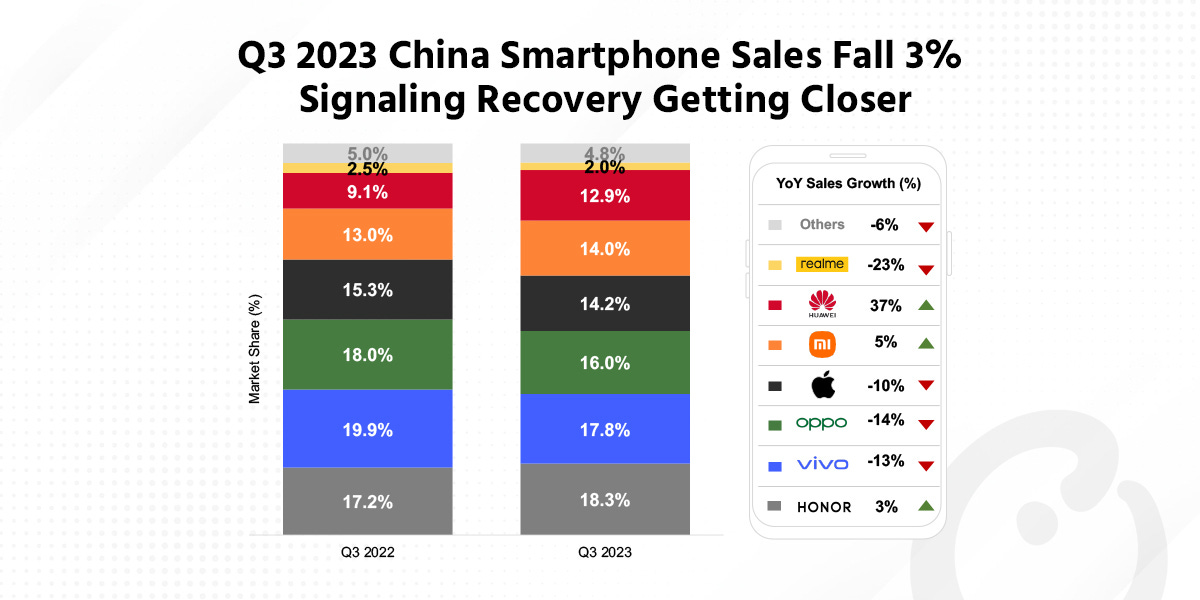

Furthermore, the resurgence of Huawei in the market has had a noticeable impact on Apple's year-over-year sales, which have declined by 10% compared to the previous year, while Huawei has experienced a remarkable 37% growth.

To address the situation, Apple's CEO, Tim Cook, made a personal trip to China in order to mend relations with Vice Premier Ding Xuexiang and Jin Zhuanglong, who leads the Ministry of Industry and Information Technology. During his visit, Cook also committed to continuing investments in high-end manufacturing within China and engaged in photo ops at the Luxshare Precision (SSE:002475) factory. He shared some of these photos on his Weibo account.

In today's business landscape, it's evident that CEOs face increased challenges due to geopolitical sensitivities. They are required to possess not only business acumen but also diplomatic skills to effectively navigate the complex relationship between the United States and China, particularly if they aim to profit from both markets.