What happened in China this week:

Trump’s Tariffs and China’s Retaliation — Relationship Hits New Low 撕破脸了

Biggest Losers and Resilient Chinese Stocks Amidst Tariff Madness

China Bank Earnings: Margin Pressure and Capital Raising

Tencent Invests $1.25 Billion in Ubisoft Subsidiary

Huawei Revenue Surges 38% While Earnings Fell 28%

#1 Trump’s Tariffs and China’s Retaliation — Relationship Hits New Low 撕破脸了

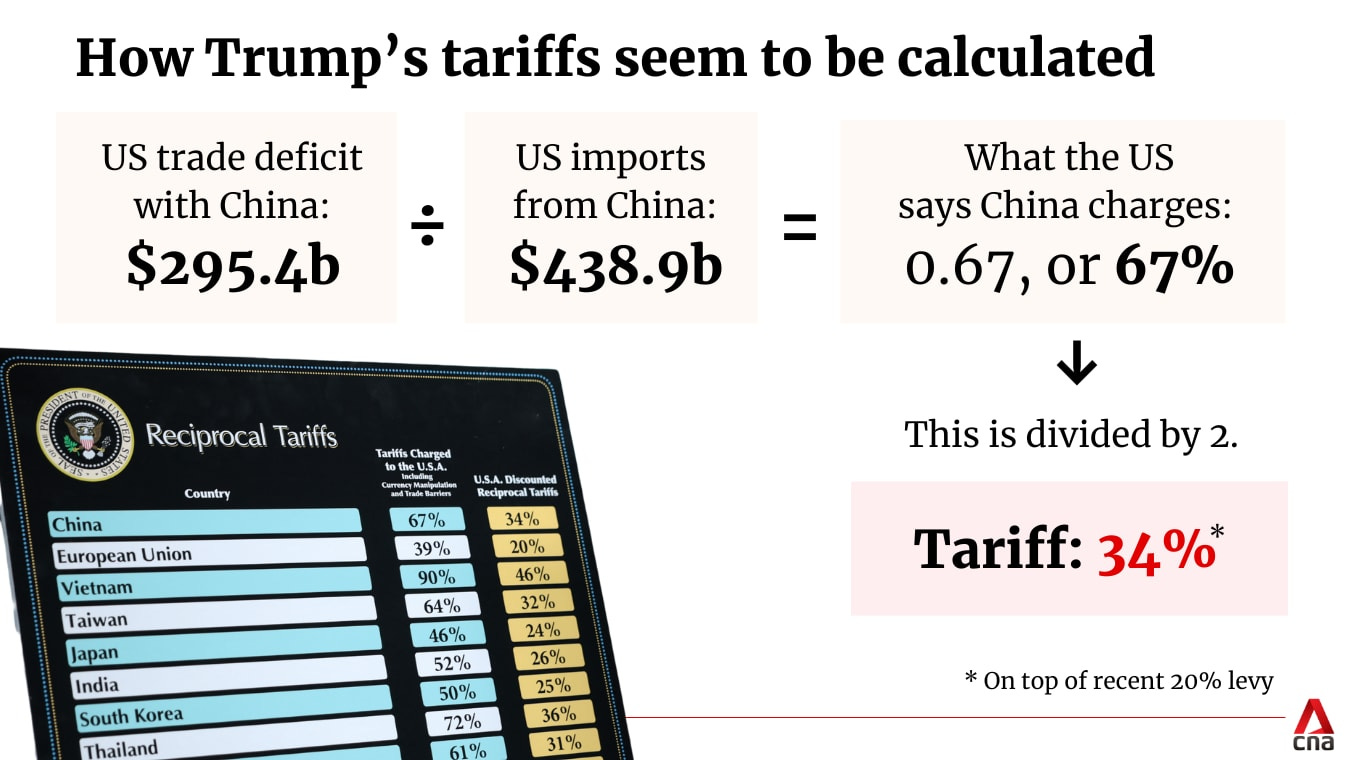

President Donald Trump has announced sweeping new “reciprocal tariffs” on over 180 countries and territories—including the EU. These new rates, published in charts by the White House, are said to reflect not just tariffs but also currency manipulation and trade barriers imposed on the U.S.

How are these tariffs calculated? Not based on the actual duties imposed by other countries on U.S. goods—but on the size of the U.S. trade deficit with each of them. In other words, if the U.S. buys more from a country than it sells to them, it gets penalized. It’s no surprise the rest of the world is furious—this logic defies standard trade norms.

For China, the new 34% tariff will be added on top of existing duties, bringing the total to a staggering 54%, the highest among all targeted countries.

This is clearly a negotiation tactic by Trump—using tariffs as leverage to secure better trade terms. But with China, the U.S.'s largest trading partner, it's backfiring badly. Beijing has responded in kind, slapping a 34% tariff on all U.S. exports. China isn’t backing down or negotiating. At the same time, Trump extended the TikTok ban by another 75 days, as Beijing refuses to approve a forced sale of the app. The timing of this new tariff clash only underscores how far relations have deteriorated.

While the tariffs will hurt China—given the U.S. imports nearly half a trillion dollars’ worth of Chinese goods annually—Beijing is already adjusting. Production will likely be cut, and new trading alliances explored. In fact, China, Japan, and South Korea are already in discussions to reshape regional trade ties. Japan and South Korea want to import more semiconductor raw materials from China, while China is looking to buy finished chip products from both countries.

This could be China’s moment to lead—stepping onto the global stage and building trade alliances without the U.S. The rest of the world doesn’t need to sit on the sidelines. They can—and perhaps should—move forward with freer trade among themselves. A retreat from globalization and the rewiring of global supply chains may be painful, but it’s starting to look like an inevitable path forward.