Here’s what happened in Growth Dragons this week:

China's Manufacturing Experiences Further Deceleration, Prompting Additional Government Stimulus

Why China Banks are not Doing as Well as Their US Counterparts

Midea Reports Modest Growth in Q3 and Continues to Trade below its Fair Value

Ping An Insurance Delivers Results in Line with Expectations, with the Stock Significantly Undervalued

The Sun is not Shining for Solar Companies

#1 China's Manufacturing Experiences Further Deceleration, Prompting Additional Government Stimulus

In October, China's official Purchasing Managers' Index (PMI) dropped from 50.2 to 49.5, signifying a contraction in the world's second largest economy’s manufacturing sector despite relatively stable third-quarter GDP growth.

This decline in producer confidence, the first since July, can be attributed to multiple factors.

Firstly, the export sector has been severely weakened due to trade sanctions and investigations into electric vehicles (EVs) imposed on China. These protectionist measures have significant repercussions for Chinese producers, limiting their access to raw materials and intermediaries, ultimately affecting product quality. This is evident in the four-month decline in new export orders, a consequence of the West's decoupling strategy against China.

Secondly, the rapid increase in unemployment in the manufacturing industry since May has reduced consumers' purchasing power.

In response to these challenges, the Chinese government has outlined several macro strategies to boost confidence and stimulate the economy. President Xi Jinping emphasized these strategies during the Financial policy meeting held on Monday and Tuesday.

The focus will be on mitigating risks associated with local governments and property businesses through central bank finance and debt restructuring. The meeting outlined a reform agenda, emphasizing consolidated central government control to prevent corruption and promoting high-end manufacturing for innovation and technology, aiming to decouple from the property sector.

We believe that policies require time to yield results, and the optimal outcome is achieved when China regains its economic growth rate and maintains it over an extended period.

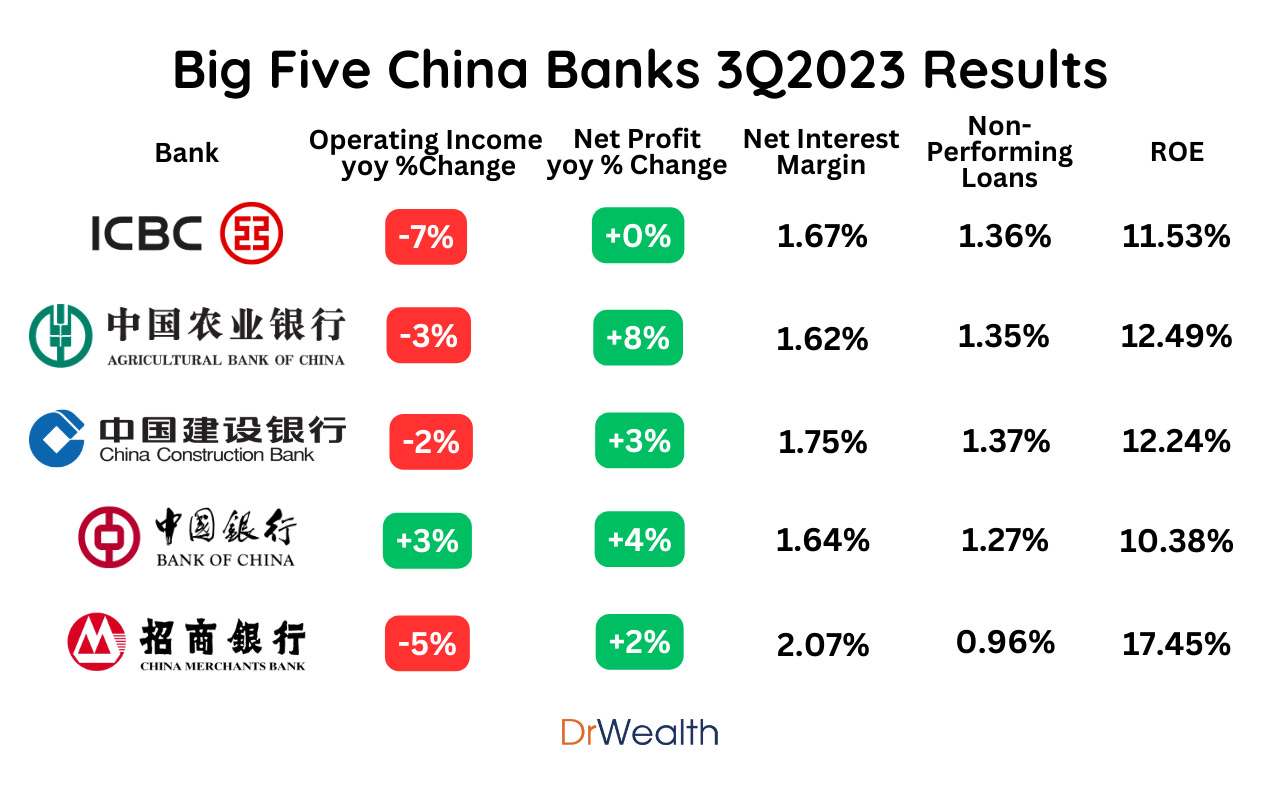

#2 Why China Banks are not Doing as Well as Their US Counterparts

In China, the banking sector grapples with challenges arising from lower interest rates, making it challenging for Chinese banks to absorb high loan payments from businesses as profits. Consequently, Chinese banks are not expected to achieve the same level of performance as their counterparts in the US which are enjoying higher interest rates. Recently, there have been indications that the Chinese government has directed state-owned banks to extend existing local government debt through longer-term loans at reduced interest rates, aiming to mitigate debt risks.

As a result, Chinese banks are anticipated to face stagnant earnings and profits in the near term due to delayed loan maturity and lower interest rates compared to other countries. Notably, all four of China's largest banks (Bank of China, Industrial and commercial Bank of China, the Agricultural Bank of China and the China Construction Bank) experienced shrinking margins in Q3.