Growth Dragons Weekly: China Companies Are Growing Faster Than US Companies, Really?

In Growth Dragons this week:

China Companies Are Growing Faster But Fundamentals Don’t Matter Anymore

China Wants To Stem Fund Outflows

Expanded BRICS Want To Challenge West’s Hegemony

Chinese Yuan May Weaken And Break 16-year High Against US Dollar

1. China Companies Are Growing Faster But Fundamentals Don’t Matter Anymore

Some of the companies that we have been monitoring have been reporting great results in the recent quarter. There have been no indications of growth slowing down, and consumer spending hasn't shown any decrease either.

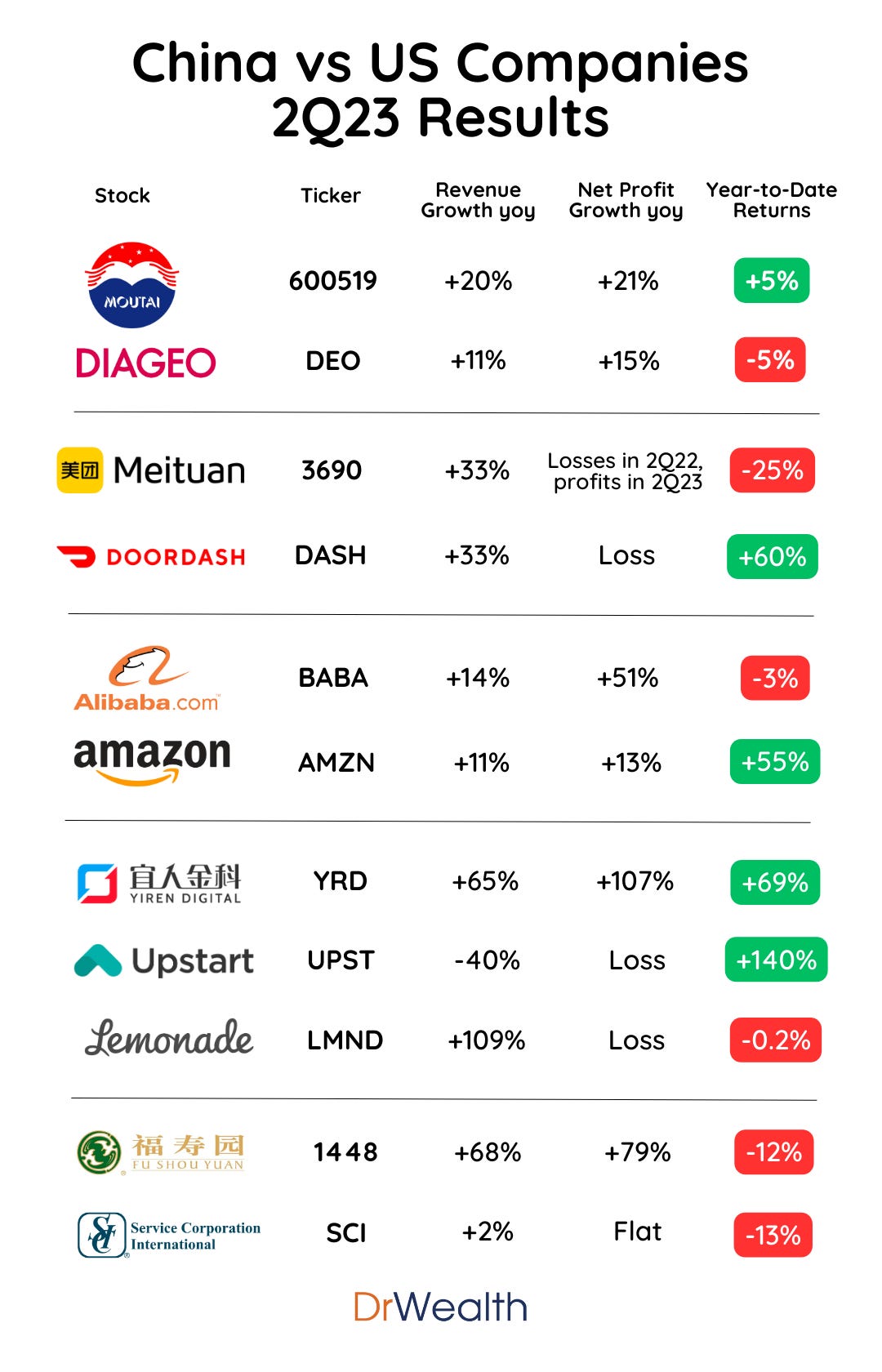

Consider Moutai (SSE:600519) as an illustration. This renowned Chinese liquor is a luxury item and hence, during a slow down and when consumers are tightening their belts, such items are usually sacrificed for other necessities. However, this was not the case. Moutai reported an impressive 20% surge in revenue and an additional 21% increase in net profit in the second quarter of 2023 compared to the previous year.

In contrast, Diageo (DEO), the Western liquor company, achieved a modest growth of 11%, with profits seeing a 15% rise in the past quarter. It is evident that Moutai is growing faster than its western counterpart, and yet some market commentators lamented about sluggish growth and deflation concerns in the Chinese market.

Meituan (SEHK:3690), the leading food delivery platform in China, disclosed a 33% surge in revenue and turned profitable in the last quarter. We can compare it to DoorDash (DASH), which is the largest food delivery platform in the US. DoorDash also generated a 33% growth in revenue but its losses continued. Yet, Meituan's share price has experienced a decline of 25% year-to-date, whereas DoorDash's share price has surged by 60%.

Drawing a comparison between Alibaba (BABA) and Amazon (AMZN) also shows the same picture. Alibaba achieved a 14% increase in revenue and a 51% growth in profits. In comparison, Amazon experienced an 11% revenue uptick and a 13% rise in profits. Despite better business performance, Alibaba's share price observed a decline of 5% year-to-date, while Amazon's share price surged by 55%.

Next, we look at Yiren Digital (YRD), an online lending and insurance company based in China. It reported a jump of 65% in its revenue and a 107% spike in profits. In the US, we can draw parallels with Upstart (UPST) and Lemonade (LMND) in the lending fintech and insurtech respectively. Upstart, unfortunately, encountered a 40% decline in revenue and is still grappling with losses. On the other hand, Lemonade reported more favorable outcomes, achieving a noteworthy 109% growth in revenue, though it still recorded losses. Yet, Upstart had the best year-to-date returns of 140% among these three stocks despite its worst business performance, while Yiren was up 69%.

Lastly, let's delve into a comparison between funeral-related stocks, Fu Shou Yuan (SEHK:1448) and Service Corporation International (SCI). Fu Shou Yuan demonstrated substantial growth with a 68% surge in revenue and a 79% increase in net profits. In contrast, SCI experienced a modest 2% growth in revenue, while its profit remained unchanged.

Some might say that China's notable growth rates are a result of a low base effect from the previous year's lockdowns, making it relatively easier for companies to exhibit high growth percentages. While this notion might hold for companies like Fu Shou Yuan, it's less applicable to tech giants such as Meituan and Alibaba. These platforms remained accessible to the Chinese population and, in fact, played a more pivotal role during the lockdowns. Similarly, even with regards to luxury brand Moutai, its ability to achieve a 17% revenue growth in FY22 contradicts the concept of a low base effect. Thus, the low base effect isn’t true for all cases.

The following image summarizes the situation.

At its core, it's evident that Chinese companies are outpacing their Western counterparts in terms of growth, and the Chinese economy is not as dire as often depicted in the media. However, the performance of their share prices has frequently lagged behind those of US stocks.

It's crucial to recognize that the US boasts the world's largest hedge funds, mutual funds, and ETFs, thus exerting significant influence over fund flows. Historically, their tendency has been to withdraw investments from Asia during times of uncertainty, leading to market declines. The ongoing geopolitical tensions provide a valid rationale for such behavior at present.

Unless the day arrives when China gains a more substantial control over global fund flows as its wealth increases, this scenario is likely to persist. So avoid China stocks if you don't have more than a decade of investing horizon.