Here’s what happened in Growth Dragons this week:

China Finally Believe the Stock Market is Worth Saving

Jack Ma and Joe Tsai Invest $202m in Alibaba Shares: Sign of a Turnaround?

New Oriental Education Power On, 7x Returns From the Low

JD.com Giving Hong Bao at 2024 Spring Gala

#1 China Finally Believe the Stock Market is Worth Saving

Many investors, accustomed to the Fed 'saving' the US stock market through rate cuts, extend this expectation to China's PBOC. Unfortunately, this has become a major source of frustration, as stimulus from China has been limited to a few 0.25% reserve requirement ratio (RRR) cuts. Consequently, many disillusioned investors have abandoned the Chinese stock market.

Several reasons might explain why China is not heavily leaning on stimulus this time. This crisis stems from a crash in the debt-laden property market, with a significant amount of bad debt to unwind. Hence, why should banks be permitted to increase lending, adding to the debt pile? Moreover, rate cuts would further depreciate the yuan, increasing the cost of USD-denominated loans for troubled developers.

However, when faced with a similar property crisis in 2008, then-Fed Chair Ben Bernanke released liquidity into the system through quantitative easing. Despite heavy criticism at the time, this strategy ultimately contributed to the recovery of the US economy and stock market.

Beyond these reasons, I suspect China's reluctance to follow the US playbook stems from a disdain for ultra-loose monetary policies and government-incurred debt to stimulate the economy and markets. The Chinese, traditionally more conservative, may view such strategies as risky, with unforeseen consequences.

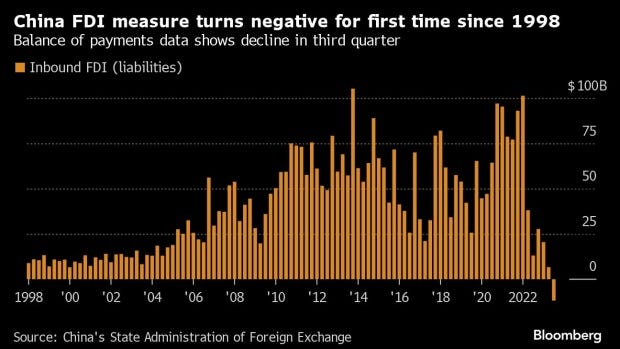

Yet, the plummeting Chinese stock market has tarnished China's image, portraying it as uninvestable. This perception could deter foreign direct investments and accelerate capital outflows. Domestic consumption alone is unlikely to sufficiently power China's economic growth in the short term. Therefore, revitalizing the stock market is essential for China's economic recovery.

Recently, China's Premier Li Qiang ordered the stabilization of the stock market, and swift actions followed. China is preparing a 2 trillion yuan rescue package to purchase Chinese stocks, supplemented by another 300 billion yuan from China Securities Finance Corp or Central Huijin Investment.

The central bank announced a 50 basis-point (0.5%) reduction in the reserve requirement ratio (RRR) for domestic banks, potentially injecting approximately 1 trillion yuan (US $141 billion) into the financial system.

The market has responded positively, with the Hang Seng Index gaining 3.6% to 15,899.87 on Wednesday. Major lenders like ICBC, China Construction Bank, and HSBC saw increases in share prices. Foreign fund managers, including abrdn, have lauded these stabilizing measures as "steps in the right direction", a vital confidence boost needed to attract foreign investment.

Is this enough? While a good start, investors may anticipate further stimulus to sustain momentum. The previous growth model based on property and exports is no longer viable. China must find new growth engines, and while structural changes will take time, addressing the stock market crisis is urgent. Without action, China risks depleting its foreign capital and jeopardizing its reform plans.

However, a notable departure from past practices is the public declaration by the Premier, the second most powerful figure in China, to rescue the stock market. It's rare to recall anyone in such a high position of power making a similar remark. Given China's top-down management style, it's crucial that the directive to save the stock market comes from the top echelon. This resolve at the highest level could be the crucial factor that makes a difference this time.