Growth Dragons Weekly: China GDP Growth Misses Target While Third Plenum Underwhelms

What happened in China this week:

China GDP Growth Misses Target While Third Plenum Underwhelms

Douyin and Kuaishou Continue to Eat Into the Ecommerce Market Share

China Merchant Bank Acquires Long-Desired Trust License

Ping An Issues Convertible Bonds at 0.875% Coupon and 21% Premium Over Its Share Price

BYD Wants to Win it All - EV, Battery and Autonomous Driving

#1 China GDP Growth Misses Target While Third Plenum Underwhelms

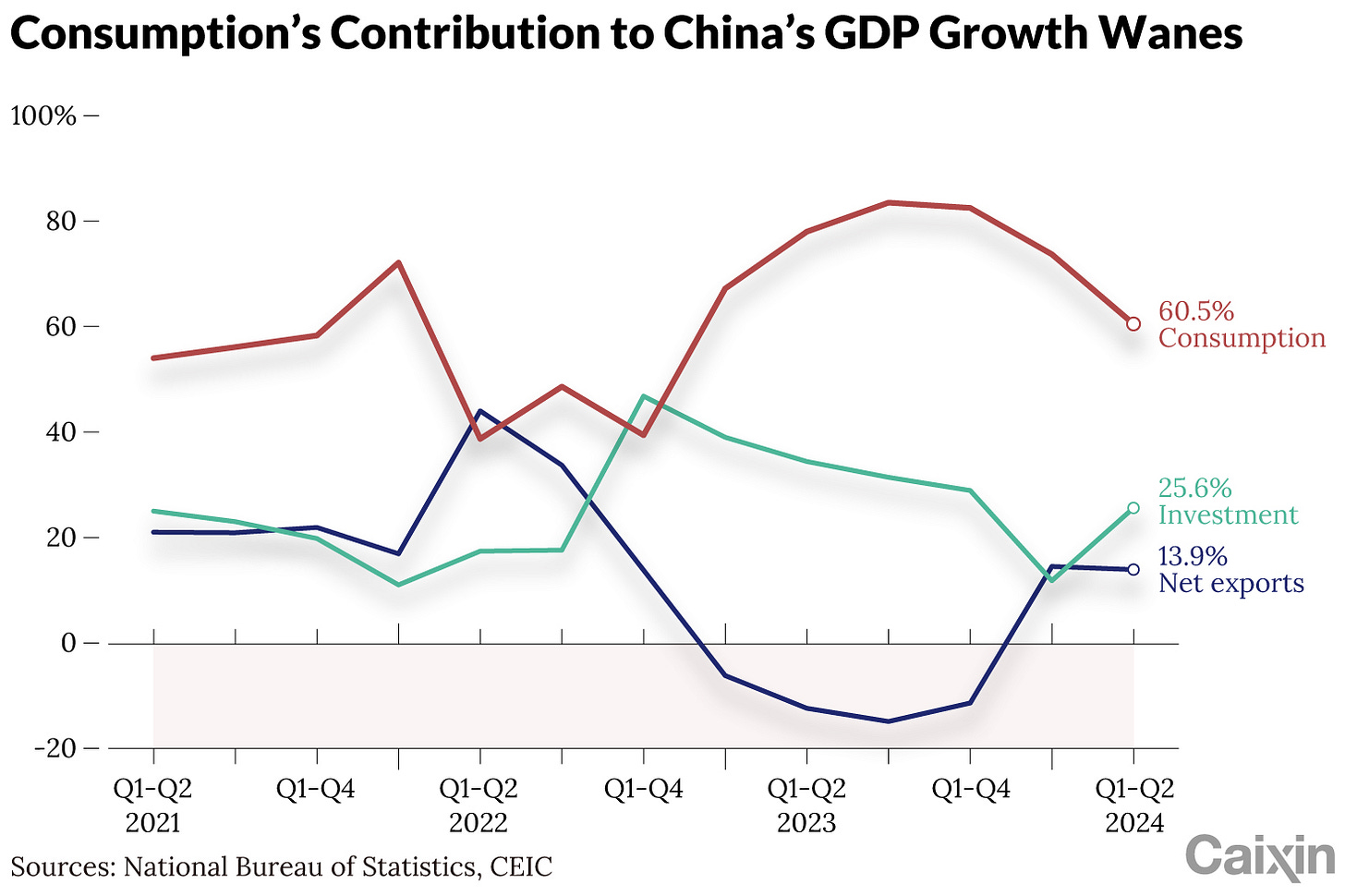

China’s economy grew by 4.7% from April to June, missing the analyst target of 5.1% and China’s own 5% target. This was the slowest growth rate since Q1 2023. The main reason for the slow growth is attributed to a drop in consumption.

Prices of tobacco and alcohol dropped by 1.4%, while fresh food and vegetable prices decreased by 7.8% and 2.7%, respectively. Agriculture and meat production data showed a year-on-year increase of 4% and 0.6% for the first half of the year. However, the number of pigs slaughtered fell by 3.1%, indicating a reluctance among consumers to increase spending on pork. This data aligns with China’s H1 CPI data, which only grew by 0.1% year-on-year. The significant role of consumption in China’s GDP growth creates strong deflationary pressure as the prices of these necessities fall year-on-year.

Employment and household income data provide some optimism for possible improvement in H2 2024. Employment remained stable, and urban unemployment declined by 0.1 percentage points to 5.1%. Nationwide per capita real growth of household income was 5.3%, much higher than the country’s economic growth. Youth unemployment, which was a glaring problem at 21.3% in June last year, saw substantial improvement, declining to 13.2%. The stability in employment and strong income suggest that China has the capacity to spend, but there is a lack of propensity to do so.

Industrial production and the service sector continued to grow at a fast pace. The total value added by industrial enterprises above a designated size grew by 6% year-on-year in H1 2024, with high-tech manufacturing growing the most at 8.7%. The production of 3D printing devices, new-energy automobiles, and integrated circuits increased by 51.6%, 34.3%, and 28.9%, respectively. However, a weak sign in the industrial sector is that these enterprises only recorded a 3.4% growth in total profits, as weak consumption squeezed their margins. The high production momentum will likely need continuous government investments.

International trade continues to benefit China, with the total value of imports and exports of goods increasing by 6.1% year-on-year. Imports and exports of private enterprises increased by 11.2%, accounting for 55% of the total value, suggesting stronger PMI data for Caixin compared to the Chinese national data, which focuses on large domestic institutions. However, this could be a temporary spike as Chinese companies rush to avoid tariffs imposed on China, potentially leading to a drop in exports once the tariffs are enforced.

The China property sector remains a drag. While large cities like Beijing, Shanghai, Nanjing, and Hangzhou reported price increases between May and June this year for resale, the rest of the markets recorded a fall. The aggregate price of new homes across 70 cities on the mainland fell by 0.7% in June from a month earlier. The momentum of price decline has slowed but is not over yet. The beleaguered property sector, once a major contributor to GDP growth, now acts as a drag. The lower wealth effect makes the Chinese more prudent, spending less to stimulate the economy, and sends a poor image to foreign investors, discouraging investment in China. This issue may take years to resolve.

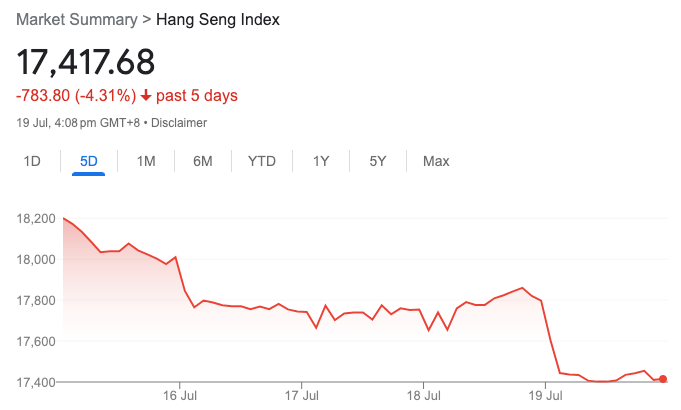

While the GDP results were disappointing, many hoped that the third plenum this week would deliver more stimulus policies. However, the third plenum communiqué reiterated the same directions as before, such as deepening reforms, modernizing China, and pursuing high-quality development. This likely disappointed investors.

The Hang Seng Index declined by 4% over the past week.

On the other hand, the CSI 300 fared better with a 2% gain, possibly due to the Chinese National Team buying up ETFs to support stock prices. The Huatai-PineBridge CSI 300 ETF recorded 2.9 billion yuan inflows on Tuesday, with an average daily inflow of 712 million yuan for the year. Many other ETFs tracking the CSI 300 index also recorded increased money inflow, according to the South China Morning Post.

We believe that the worst in the China stock markets is over, but the recovery will not be smooth. We will still experience significant volatility, and expectations often exceed what reality delivers. All China stock investors can do is be patient.