Growth Dragons Weekly: China Loans Contract, MSCI Drops Chinese Stocks, Tencent Profit Jumps

What happened in China this week:

China Bank Loans Contract for the First Time in 19 Years

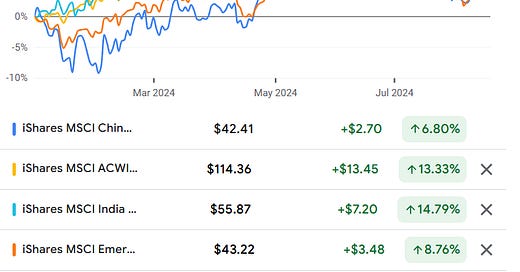

MSCI Removes 60 Chinese Stocks From its Indices

China’s Largest Real Estate Brokerage Defies Property Slowdown, Reports 20% Revenue Growth

Tencent's Remarkable 53% Surge in Profits

Alibaba Results Disappoint, But Stock Hits 1-Month High

#1 China Bank Loans Contract for the First Time in 19 Years

Despite China’s recent reduction in interest rates, bank loans to the real economy continued to contract for the first time in 19 years. This development reinforces concerns about weak domestic demand in the country and could hinder economic growth and recovery.

Yuan-denominated bank loans, excluding those extended to financial institutions, shrank by 77 billion yuan at the end of July compared to the previous month, according to data from the People’s Bank of China (PBOC). This marked the first decline since July 2005, as more debt was repaid than taken out. This is an economic phenomenon that warrants caution. When businesses prioritize paying down debt rather than borrowing to spend, it suggests a lack of confidence in the economy's consumption power. This could potentially lead to a “balance sheet recession” similar to what Japan experienced, resulting in prolonged stagnation.

It's not just businesses; Chinese households are also rushing to repay debt as investment returns fall and real borrowing costs remain elevated.

Nonfinancial companies took out just 152 billion yuan in loans in July, the smallest amount since October 2019. Meanwhile, households repaid a net 222 billion yuan worth of loans, cutting back on short-term borrowing and mortgages amid a prolonged housing downturn.

Aggregate financing, a broad measure of credit, increased by 771 billion yuan last month, according to Bloomberg calculations, falling short of the 1 trillion yuan median forecast by economists. A gauge of new loans, including borrowing by financial firms, rose by 268 billion yuan, also below the forecast of 427 billion yuan.

The overall data suggests that more robust fiscal policies may be needed, despite the PBOC’s decision to cut several interest rates in July to boost confidence and demand. Central and local governments are also accelerating bond sales in the coming months, which could help increase the flow of broader credit and offset some of the impact of sluggish borrowing demand. However, there is uncertainty about how effective this will be, as the government has channeled its funding towards high-tech and manufacturing sectors rather than the property sector. The near-term results may be limited because these advanced sectors do not have as much of a direct impact on consumer finances and daily life as the property sector does. Furthermore, the ecommerce business’s earnings are not as bearish as the media portrays as we will deliberate further in the later sections. For this reason, we are not as pessimistic about China’s economy and are excited for what’s to come for the Chinese tech sector.

Beyond lending, net foreign direct investment saw a record high of $14.8 billion in withdrawals in the second quarter, according to data from the State Administration of Foreign Exchange (SAFE). This marks the second net FDI outflow in SAFE’s available data dating back to 1998. The indicator turned negative for the first time in the third quarter of last year, recording a $12.1 billion net outflow. A major contributor to the net outflow in the second quarter was a $22 billion decline in foreign investors’ holdings of Chinese corporate debt, the largest drop on record according to SAFE data.

China highlighted two main strategies in its Third Plenum: removing all restrictions on foreign investment in the manufacturing sector and introducing a new round of pilot measures to further open up the services sector. Despite China’s efforts, SAFE data also showed that net overseas funds allocated to Chinese equities dropped to $7.3 billion in the second quarter from $10.7 billion in the same period last year. This brings us to the next point: MSCI’s removal of 60 Chinese companies from its index.