Growth Dragons Weekly: China Maintains Interest Rate but Cuts Mortgage Rate, and Halts Quant Funds' Rot

Here’s what happened in Growth Dragons this week:

China Maintains Interest Rate but Cuts Mortgage Rate, and Halts Quant Funds' Rot

JD.com Bids For UK Leading Retailer, Currys

HSBC Earnings Boosted By Higher Interest Rates, But China Remains a Drag

Trip.com's Revenue Doubled as China Tourism Recovered

Luckin Coffee's Revenue Soars 91% Year-on-Year, Eclipsing Starbucks

#1 China Maintains Interest Rate but Cuts Mortgage Rate, and Halts Quant Funds' Rot

This week saw multiple developments in China's macroeconomy. Firstly, the People's Bank of China (PBOC) announced it would keep the rate on 500 billion yuan ($69.51 billion) worth of one-year medium-term lending facility (MLF) loans to some financial institutions unchanged at 2.50% from the previous operation. This decision, attributed to an anticipated delay in rate cuts from the Fed to avoid a larger interest rate differential between China and the US, disappointed investors who had hoped for a cut. The PBOC opted to prioritize maintaining a stronger yuan over bolstering the domestic economy and stock market.

Next, China announced a larger-than-expected mortgage rate cut, from 4.2% to 3.95%, for the "5-year loan prime rate" on Tuesday. This move aims to boost real estate demand within the domestic market. Most new and outstanding loans in China are based on the one-year LPR, while the five-year rate affects mortgage pricing.

This cut, surpassing expectations, was well-received by the public. Hong Kong's Hang Seng Index climbed to a seven-week high as many property developers saw their stock prices increase.

Lastly, the stock exchanges of Shanghai and Shenzhen announced late Tuesday that they would intensify their scrutiny of market trades by quant funds.

These announcements followed a three-day trading ban imposed on one of China's largest quant funds, Lingjun Investment, which had sold 2.6 billion yuan of stocks in the opening minutes between 09:30 a.m. and 09:31 a.m. local time on Feb. 19, causing rapid falls in both platforms' indexes. This action reflects Beijing's "zero tolerance" policy on malicious short selling and market manipulation. Additionally, a Bloomberg report noted that some firms are now prohibited from selling in the first and last 30 minutes of the trading day.

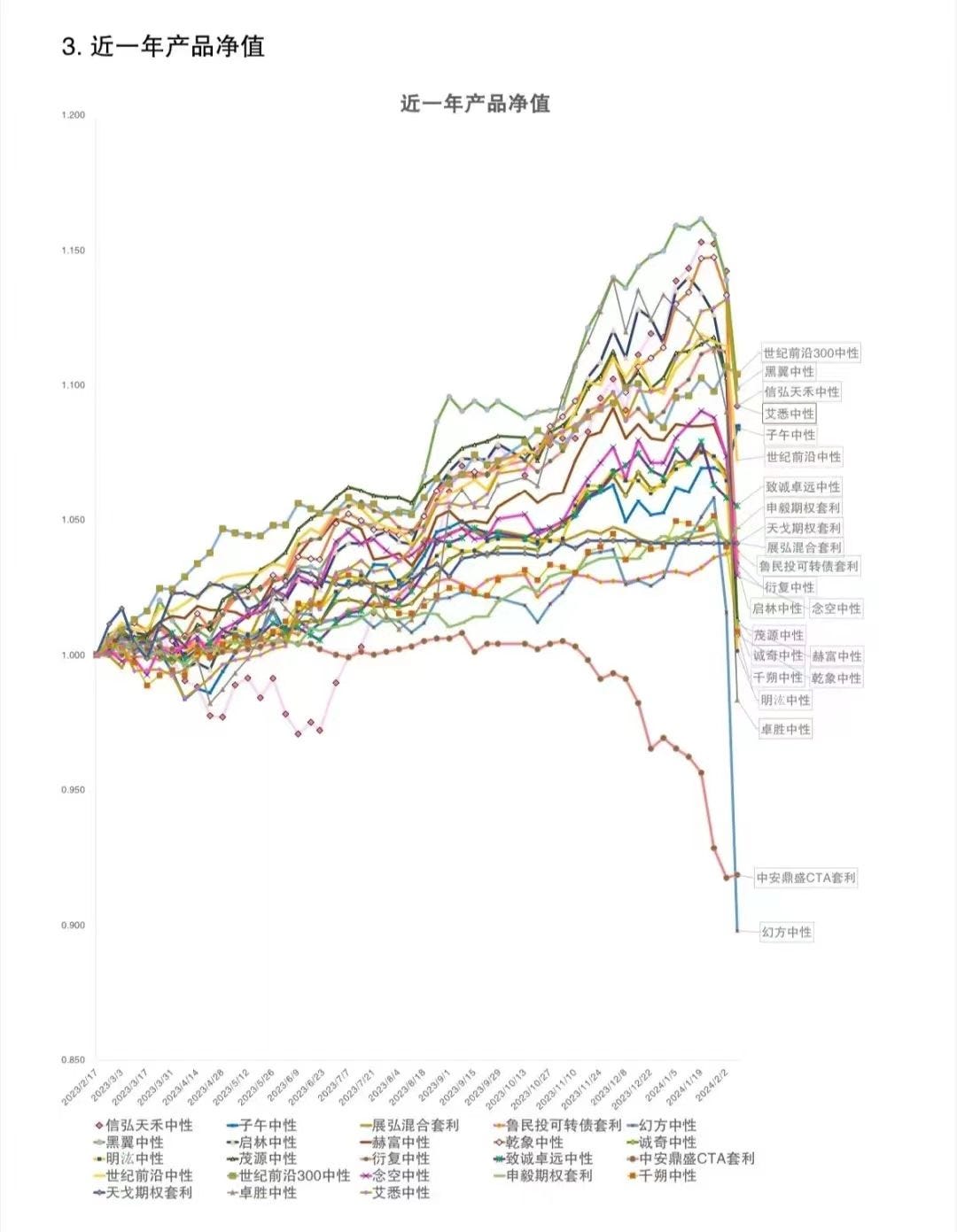

However, the situation with quant funds extends further. Many have focused on small and micro caps, achieving gains in recent years. Yet, the start of the new year has been challenging for these funds, with a 2024 performance down by 11.74% until Feb. 2. Another major quant fund, Shanghai Minghong Investment Management Co. Ltd., experienced a 22% drawdown. The meltdown among quant funds is significant, and authorities must address the issue promptly to prevent further damage to investor confidence.

This series of events showcases the Chinese government’s efforts in supporting the market and that is a good sign. The CSI 300 index has gone up for consecutively 9 sessions. The Index is also up by 3.1% year-to-date. Although not spectacular, it is a good start.