Growth Dragons Weekly: China Retaliates, Stocks Rose 7%, Record Travel and Spending during Lunar New Year

What happened in China this week:

China Retaliates Against U.S. Tariffs and Stocks Rose 7% This Week

China Lunar New Year Holiday Saw a Record 501 Million Trips, Spending Grew 6%

Huawei Revenue Up 22%: Global Trifold Phone Launch, DeepSeek AI Integration, and Luxury EV Debut

Fortior IPO: The Only Chinese Company Among Top 10 Sellers of BLDC Motor Chips

#1 China Retaliates Against U.S. Tariffs and Stocks Rose 7% This Week

China has formally initiated a dispute at the World Trade Organization (WTO) over tariffs imposed by U.S. President Donald Trump on Chinese goods. Trump’s tariffs, which aim to address issues such as fentanyl trafficking, have drawn Beijing’s ire. The Chinese government contends that these measures violate U.S. obligations under WTO agreements due to their discriminatory nature. The dispute underscores the ongoing trade tensions between the two nations—tensions further complicated by the WTO’s weakened dispute resolution mechanism, which has been largely inactive since December 2019 due to a shortage of judges.

While Trump has also imposed tariffs on Canada and Mexico, those measures have been suspended amid ongoing negotiations. In contrast, China opted for a different approach by imposing its own tariffs against the United States.

Amid the trade friction, the U.S. Postal Service (USPS) briefly suspended inbound mail and package deliveries from China and Hong Kong, only to reverse the decision within 12 hours. The initial suspension came on the heels of Trump’s executive order that imposed a 10% tariff on Chinese goods and eliminated the “de minimis” rule—which previously allowed duty-free entry for packages valued under $800—a policy that had greatly benefited Chinese e-commerce giants like Shein and Temu. In response, China levied retaliatory tariffs, including a 15% duty on certain coal and liquefied natural gas imports and a 10% tariff on crude oil and agricultural machinery. Although Beijing condemned the U.S. for politicizing trade, analysts note that China’s countermeasures have been relatively restrained, leaving room for further negotiation amid growing uncertainty over a potential trade war.

In addition to raising tariffs, China’s Ministry of Commerce has imposed export controls on five critical minerals—tungsten, tellurium, bismuth, molybdenum, and indium—and their metallic compounds. These restrictions, which apply to all countries rather than just the U.S., took effect immediately. Given that China dominates global production of these materials—accounting for 83% of tungsten, 75% of tellurium, 81% of bismuth, 42% of molybdenum, and 70% of indium in 2024—these controls could have significant implications for the technology and defense sectors worldwide.

Adding to the escalating trade tensions, China has also taken regulatory action against foreign companies. The Ministry of Commerce accused two firms—PVH Group, the parent company of Calvin Klein and Tommy Hilfiger, and genetic-testing company Illumina—of violating market transaction principles, disrupting business with Chinese companies, and implementing discriminatory policies. Meanwhile, China’s State Administration for Market Regulation (SAMR) announced an inquiry into Google, though it did not specify the alleged violations. While most Google services—such as Search, Gmail, and Maps—are unavailable in mainland China, the tech giant maintains a presence through its Android operating system, which is widely used by Chinese smartphone manufacturers like Xiaomi. Additionally, Bloomberg reported that SAMR is preparing a potential investigation into Apple’s App Store policies, including its commission structure of up to 30% on in-app purchases and restrictions on third-party payment services.

Together, these developments highlight the deepening economic and regulatory rifts between the U.S. and China, with trade barriers, supply chain controls, and corporate scrutiny all playing roles in shaping the evolving geopolitical landscape.

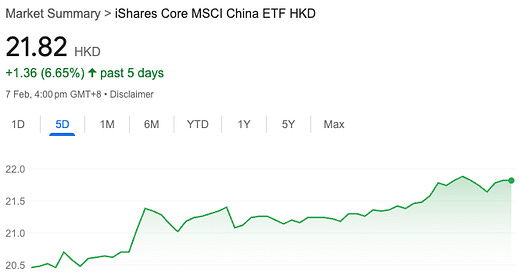

Chinese stocks appeared unfazed by the tariffs, with the MSCI China Index rising 7% this week. Another driver of market optimism may be the spillover effect from the virally successful DeepSeek: