Happy New Year! May the Chinese stocks rise in the year of the Dragon!

Here’s what happened in Growth Dragons this week:

China National Team Pushing Up Chinese Stocks

Crackdown on Financial Sector Or Stabilize the Stock Market? China Wants to Do Both

Investors Disappointed by Alibaba’s Sluggish E-commerce Growth in China

Huya and Douyu Merger Back On the Table?

Giordano boardroom tussle, more upside for shareholders?

#1 China National Team Pushing Up Chinese Stocks

On Tuesday, the Hang Seng Index advanced 4% to 16,136.87 to log its biggest gain since July 25. The Shanghai Composite Index surged 3.2%, while the Shenzhen Composite Index logged a 5.1% gain for its best day in five years.

While the Chinese government has committed to arresting the stock market's decline, no concrete policies have been announced yet. For now, it has been mostly talk, with the exception of actual stock purchases.

Central Huijin Investment, a sovereign-wealth fund, announced its intention to purchase more exchange-traded funds and expand the scale of its holdings to "safeguard the stable operation of the capital market." This will provide liquidity to the market to pull the market afloat.

Bank of America noted that Chinese equity funds drew in 142 billion yuan ($19.8 billion) last week alone, which represented nearly the entirety of inflows into emerging markets (EM).

In addition, China’s securities regulator pledged to "create more convenient conditions and smoother channels" for Central Huijin to conduct market operations. The China Securities Regulatory Commission (CSRC) also stated its commitment to "coordinate and guide various institutional investors" to enter the market, although it did not provide further details. China seeks fund inflow into the market.

Next, the CSRC advised China’s listed companies to fully utilize "the toolbox" available to them to enhance investor confidence and market stability. This includes conducting share buybacks, increasing major shareholders' stakes, and issuing regular dividends.

Furthermore, a report by Bloomberg indicated that President Xi Jinping plans to meet with Chinese market regulators to discuss market conditions and recent policy moves which will provide hope for more stimulative measures.

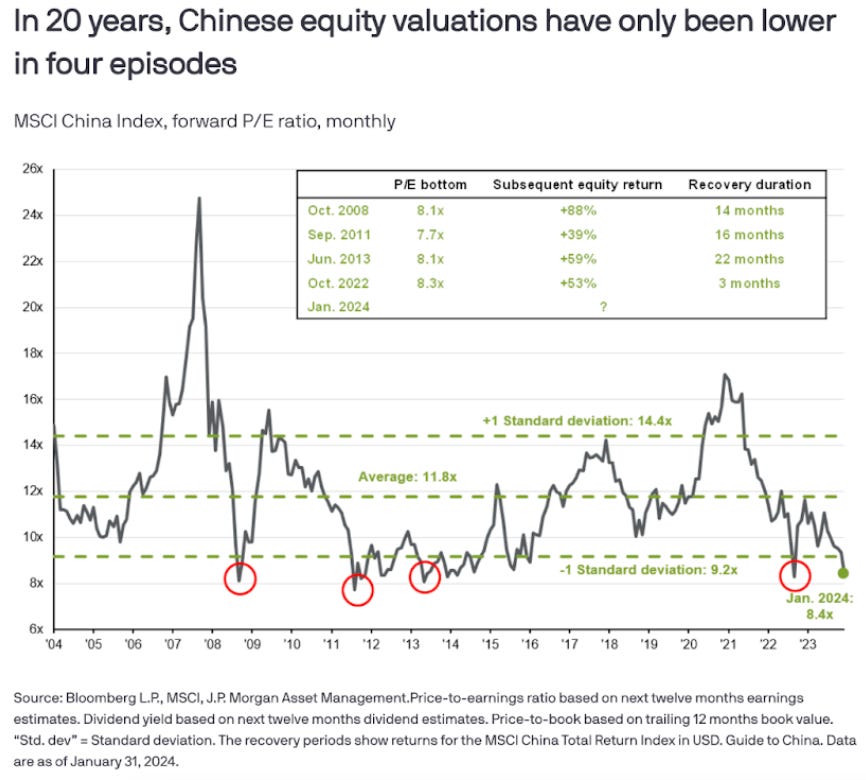

Another possible reason for the rebound is that more investors are recognizing the attractiveness of China’s equities due to their low prices and have started buying. The MSCI China Index has reached this low point in terms of forward P/E ratio only four times in history, and each instance was followed by a rebound. Will history repeat itself this time? We remain cautiously optimistic.