What happened in China this week:

China’s Manufacturing Activity Finally Expanded

Fund Managers Explain Why and How They Invest In China

Xiaomi Sold Impressive 88,898 EVs in 24 hours

Moutai Grew 19% Despite Fears of Weak China Consumption

#1 China’s Manufacturing Activity Finally Expanded

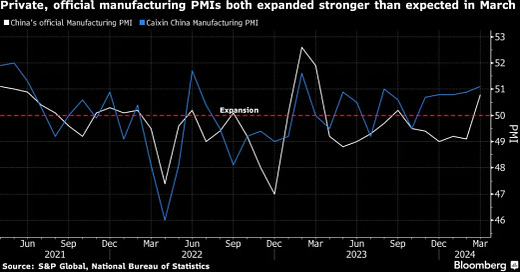

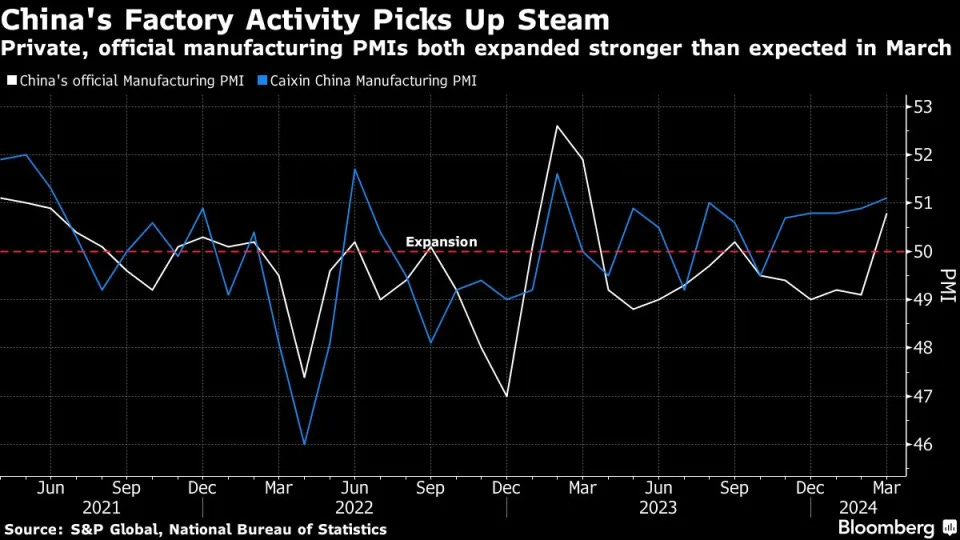

China’s Official manufacturing PMI finally grew into the expansionary territory of 50.8 from the previous 49.1. This index, which measures the economic activities of the large state owned manufacturing corporations, had been consistently treading beneath the 50 line for the past 5 months and has critically damaged many investors’ confidence in China’s economic recovery.

In addition, both Caixin and the Official service PMI reported growth to 52.7 and 53 respectively. Caixin PMI covers small and medium enterprises that comprises more businesses from the export industry while China Official PMI covers more of the larger state owned corporations. The results are very positive news for the country, showing that productions are picking up and consumer activities are slowly increasing.

The 5 sub-indexes that constitute the manufacturing PMI all reported an increase. The production, new order and supplier delivery time indexes were above 50 while raw material and employment indexes were below 50, where above 50 is expansionary but below is contractionary. This suggests that the overall economy is recovering albeit not at historical average. Data from the non-manufacturing index also indicated that employment remained lagging as other aspects of production improved. This goes back to the problem of high youth unemployment and highly competitive employment situation in China. The inability and unwillingness of the youth in China to find a job accompanied by the drag in the construction industry weighs on the index. The recovery would be more convincing if the stronger business sentiments translates to higher employment in the future months.

Moreover, input price index and sales price index are at 49.5 and 48.6 respectively. The input price index fell by 1.1 percent while the sales price index rose by 0.1 percent. This suggests that inflation is still very weak in China and demand remains sluggish.

Overall, the business activities are increasing but the subindexes suggest that the businesses could be over producing and might lead to oversupply in the market. Caixin has further reported that the Caixin Business Big Data New Economy Index which measures the contribution of high value-adding industries like Biomedicine to China’s total economic input dropped by 1.5% to 29.8%. The reduction in contribution of high value industries was largely due to a decrease in capital inputs by 5.9 points to 37.7, the lowest since last year July. Furthermore, net FDI of 2023 was reported to be at 23 year low for China at 42.7 billion yuan which was less than a quarter than 2022 FDI. This suggests that although China's official manufacturing PMI had a huge jump, it may not be sustained. The economic activity is likely to have improved but a lot of fundamentals have yet to follow suit. This rise in business activities is likely due to government driven support which will only last as long as the government is willing to spend.

While this is not the growth we would like for the long term, it is a good start as we see more state support. Employment and FDI inflows will have to pick up in order for China to experience high quality economic growth.