Growth Dragons Weekly: Yuan Weakens, Alibaba & Tencent Profits Surge, Lenovo Firing on All Cylinders

What happened in China this week:

China Weakens Yuan; More Depreciation May Be on the Horizon

Alibaba Profits Surge 63% as Cloud Growth Gains Pace

Tencent Domestic Games Growth Accelerates with 14% Surge; Profits Up 33%

Lenovo Reports Double-Digit Growth Across PCs, Smartphones, Tablets, Servers, and Services

#1 China Weakens Yuan; More Depreciation May Be on the Horizon

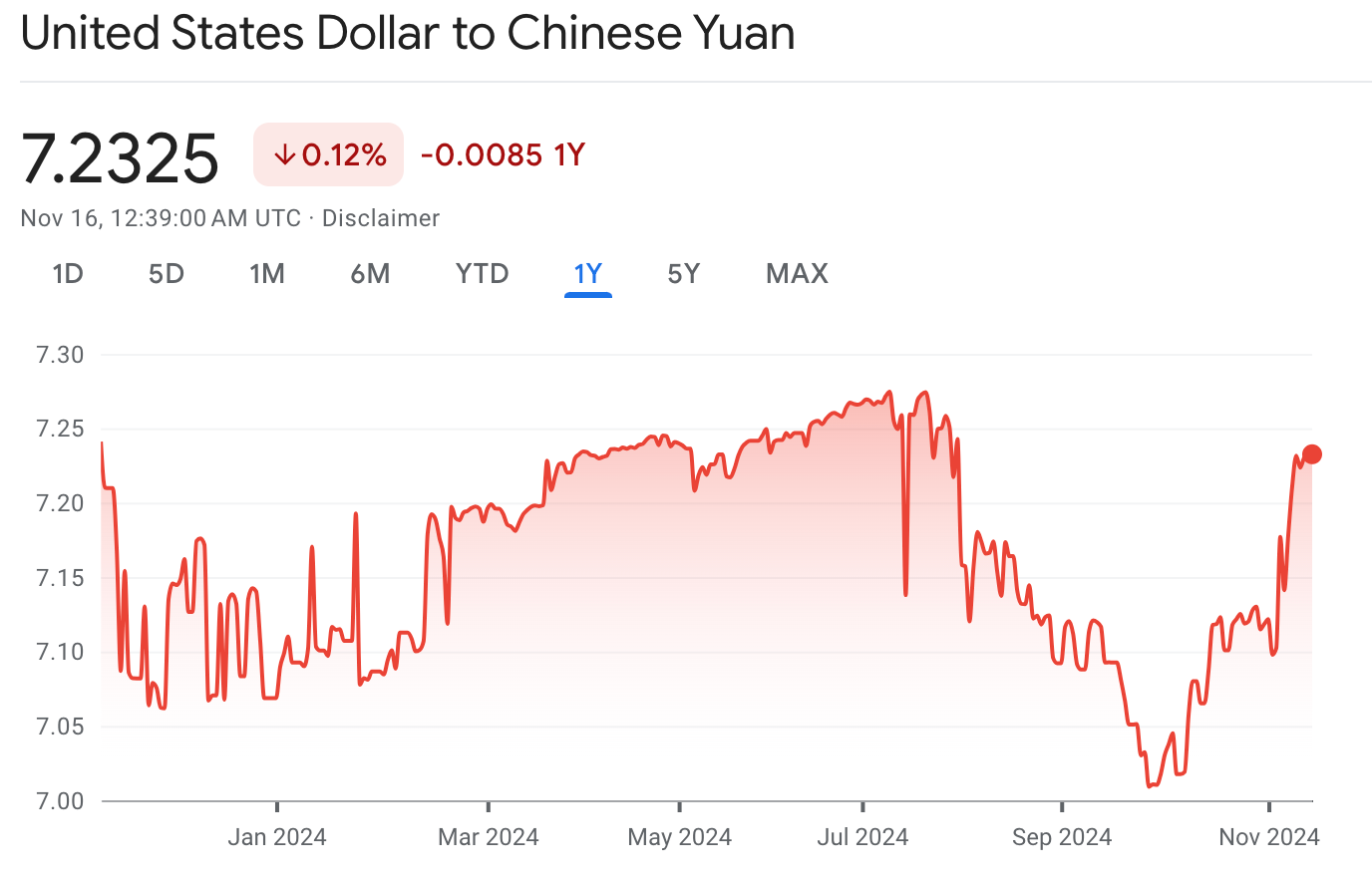

The People’s Bank of China (PBOC) fixed the yuan's rate at 7.1991 per U.S. dollar on Wednesday, marking a 0.64 percentage point drop from the previous day. This rate establishes the range within which the yuan can trade for the day, allowing a 2% appreciation or depreciation outside the midpoint figure.

There's a strong consensus that the PBOC may deliberately weaken the yuan to counter potential tariffs that could be imposed by Trump. While we share the view that the yuan is likely to depreciate, we believe the extent of this weakening may be limited, as China must balance multiple economic objectives.

On one hand, lowering interest rates to boost domestic demand and exports, alongside a weaker yuan, could be beneficial. On the other hand, a stronger yuan is needed to encourage the currency's use in global trade. However, we believe that preventing capital outflows and managing the ballooning USD-denominated debt of property developers are currently of lesser priority for China.

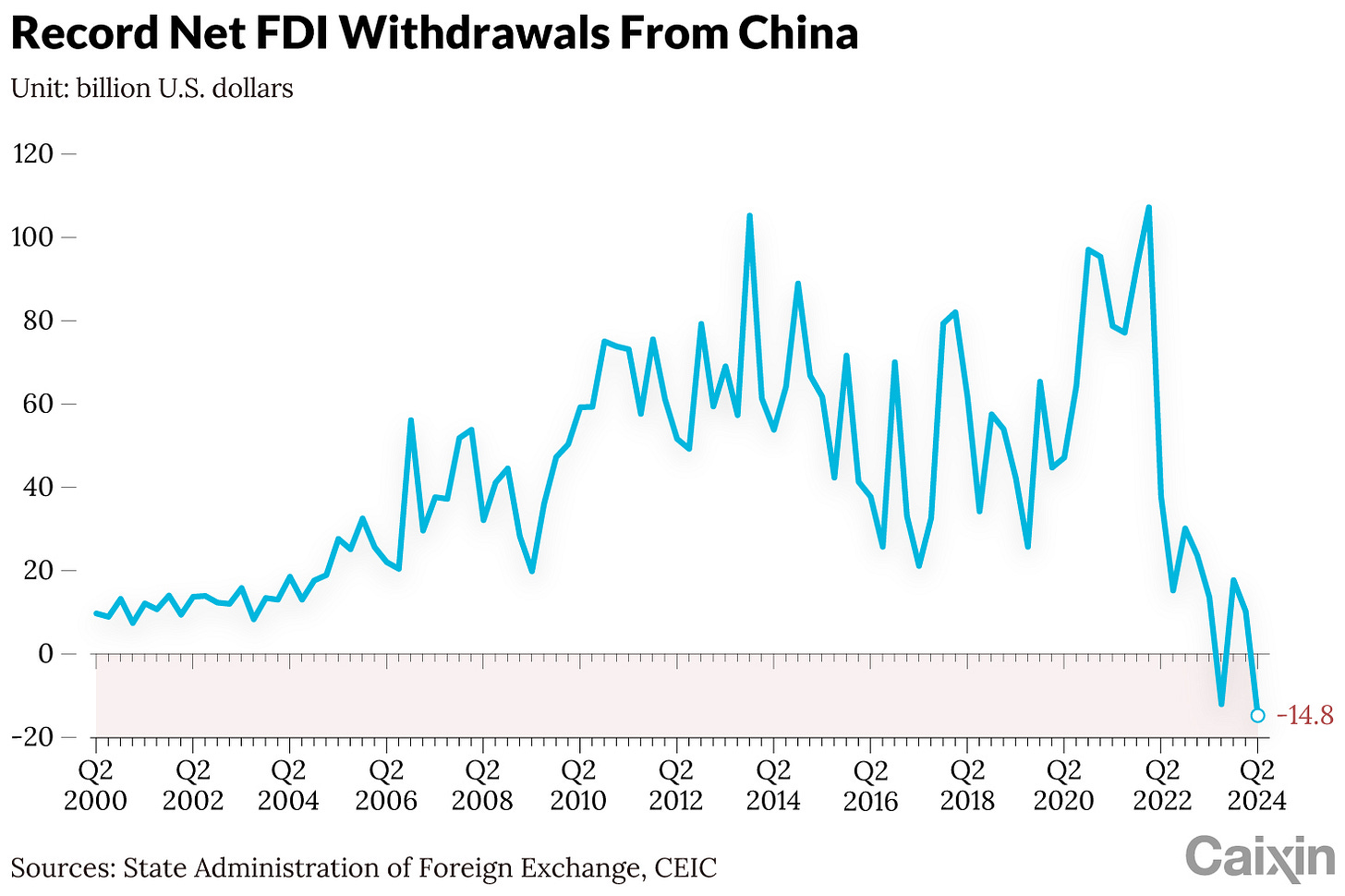

Foreign investments have historically driven China's economic growth, but with escalating geopolitical tensions and current economic challenges, FDI has significantly declined, turning net negative in both 2023 and 2024.

While it's unlikely that FDI will return to previous levels, China would want to recover from this outflow situation. However, the nation has developed strong domestic champions, particularly in sectors like electric vehicles (EVs). In the past, China needed partnerships with foreign automakers, especially the Germans, to gain technological know-how. Now, Chinese EV brands have surpassed many foreign competitors, and China is exporting these vehicles rather than importing or partnering with overseas firms to produce them domestically.

This shift is reflective of China's broader strategy to be more self-reliant, reducing its dependency on FDI. Over decades, China has honed its capabilities across various industries, and this focus on self-sufficiency is central to its ongoing economic restructuring.

As for the USD-denominated debt burden faced by property developers, we have seen the Chinese government demonstrate its willingness to support the beleaguered sector. Measures like debt swaps, mortgage rate cuts, easing property restrictions, and last week’s reduction in the deed tax are aimed at alleviating market pressures. There are early signs of recovery, as evidenced by a 0.9% year-on-year increase in new home transactions in October and an 8.9% rise in second-hand home sales for the seventh consecutive month.

These measures could enable developers to generate sufficient revenue to service their offshore debts, even as these obligations become costlier due to the yuan’s depreciation. However, China must tread carefully to avoid reigniting speculative behavior in the property market. After years of painful efforts to deflate the bubble, China is now focused on reducing its reliance on property investment, which has proven unsustainable. Reverting to a speculative environment would undo the hard-earned progress. Therefore, any property stimulus policies should remain measured.

We believe that the most challenging task for China is stimulating domestic consumption to power its economy. A mature economy relies heavily on strong domestic spending, but shifting Chinese consumers away from their deep-rooted culture of prudence—cultivated over thousands of years—will take time.

According to the PBOC’s Q3 monetary policy report, the balance of RMB deposits reached 300.9 trillion yuan, a 7.1% increase year-on-year, with an addition of 16.6 trillion yuan since the start of the year. The increase in M2 money supply (+6.8%) alongside a decrease in M1 (-7.4%) highlights that more people are saving in less liquid forms rather than spending, especially in a climate of economic pessimism.

Monetary and fiscal stimulus policies are relatively easier to implement compared to the challenge of instilling confidence and optimism among the people to encourage spending and drive economic growth.