Growth Dragons Weekly: HK Tech Soars 27% YTD, Alibaba Up 6% on Apple Deal, CATL & Mixue Set for Blockbuster IPOs

What happened in China this week:

HK Stocks Rally 15% YTD, HSTECH Up Even More by 27%

Alibaba Stock Up 6% in a Day After Confirming Partnership with Apple

Dongfeng and Changan Merger Will Dethrone BYD as China’s Largest Carmaker

China’s Gaming Rebound Hits Record Revenue, Tencent and NetEase Benefit

Blockbuster IPOs: CATL + Mixue

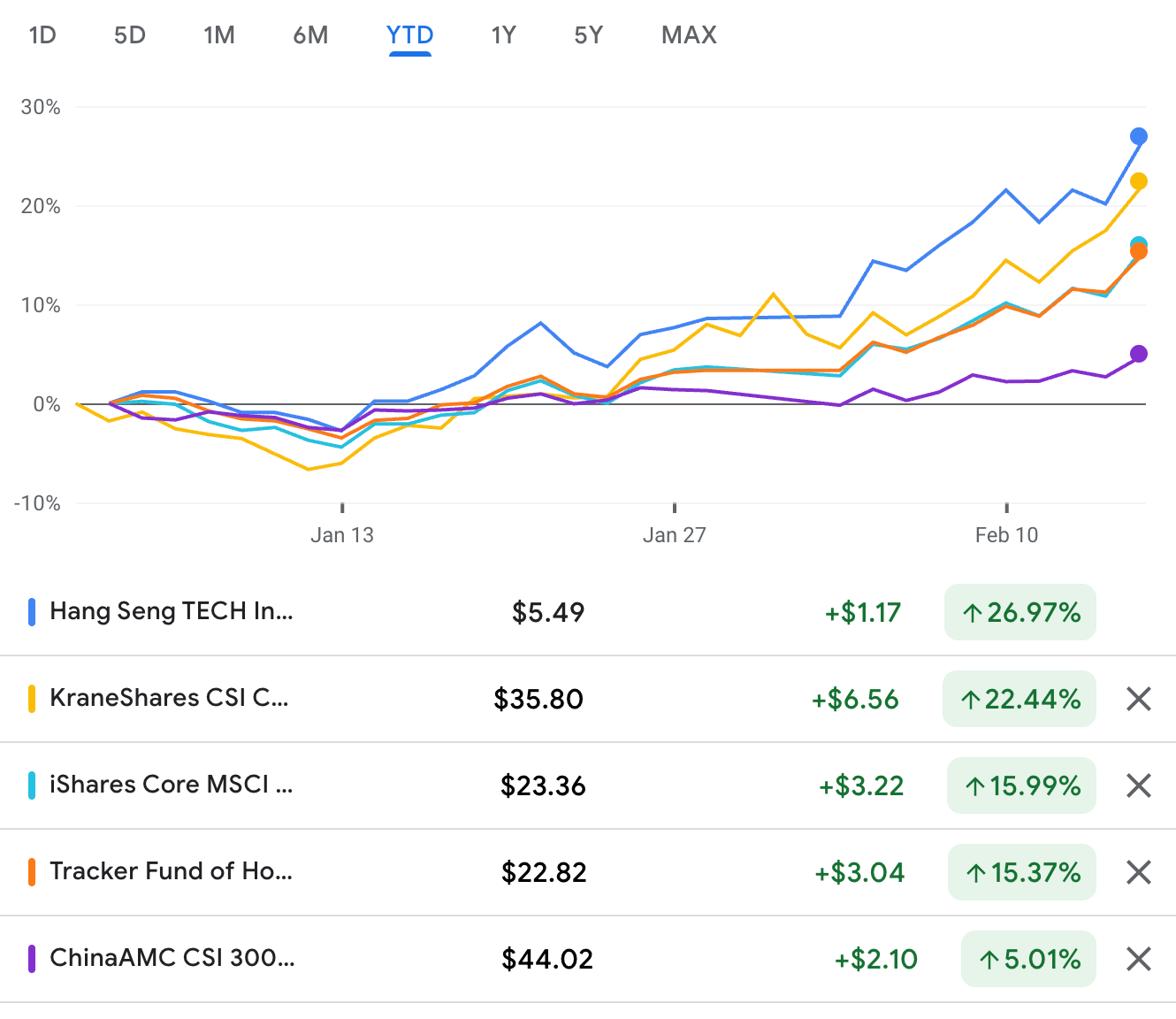

#1 HK Stocks Rally 15% YTD, HSTECH Up Even More by 27%

This week, the Hang Seng Index (HSI) surged 6%, bringing its year-to-date (YTD) gains to 15%. Chinese tech stocks led the rally, with the Hang Seng Tech Index (HSTECH) soaring 27% YTD. In contrast, A-shares have been relatively muted, with the CSI 300 up just 5% YTD. Still, even that outperforms the S&P 500’s 4% YTD gain. The renewed interest from global investors in Hong Kong stocks suggests a shift in sentiment toward Chinese businesses.

Among the Hang Seng Index constituents, nine stocks gained over 10% this week. Alibaba and its health information tech subsidiary posted the strongest gains. The rally was fueled by the rise of DeepSeek and major partnerships—such as Apple and Alibaba’s AI collaboration—which have strengthened investor confidence in China’s tech sector. DeepSeek’s advancements showcase China’s tech prowess despite U.S. regulatory headwinds, reinforcing optimism in the market. With Q4 2024 earnings approaching, sustained growth momentum could be pivotal in driving the next leg of asset price appreciation.

The Chinese government has also ramped up efforts to support the stock market. In January 2025, authorities announced policies to encourage medium- and long-term investment funds, including insurance funds, to boost their equity exposure. Key initiatives include:

Large state-owned insurers must allocate at least 30% of new premiums annually to A-shares.

Mutual funds are expected to increase their tradable A-share holdings by at least 10% annually for the next three years.

Hundreds of billions of yuan are set to be injected into the stock market to provide stability and fuel growth.

However, despite these measures, insurance companies still underutilize their existing equity investment allowances due to concerns over market quality. Many financial institutions cite the lack of high-quality listed companies as a key barrier to further equity investment. In response, the government has tightened IPO regulations and corporate governance requirements to enhance market integrity and attract long-term institutional investors.

While China’s capital markets still have a long way to go before reaching U.S. market maturity, investors in Chinese stocks are enjoying the current rally.