Here’s what happened in Growth Dragons this week:

Hong Kong Stocks To Go Up By 27%?

China Bank Stocks Rallied After Investments From Sovereign Fund and More Stimulus Expected

The US Supports Israel While China Supports Both to Cease Fire

JD.com Plunged to New Low Amidst Rumor of Founder Richard Liu’s Arrest

Longi: Solar King Expands to Hydrogen

#1 Hong Kong Stocks To Go Up By 27%?

We took interest in SCMP’s positive piece about Hong Kong stocks: “Bullish options underpin bets on Chinese stocks rallying by up to 27% in Hong Kong”

This report points to a positive outlook for the Hang Seng Index (HSI), as the number of call option contracts has outnumbered the put contracts.

Separately, we analyzed the put/call ratio chart for all stock options traded on the Hong Kong Stock Exchange. A put/call ratio below 1 signifies a higher prevalence of call options over put options.

Indeed, the put/call ratio has declined to 0.59, signifying that the current sentiment among market participants is predominantly bullish.

While we hope this is indicative of brighter prospects ahead, we remain cautious as the put/call ratio tends to exhibit significant fluctuations, making it an unreliable indicator. It's entirely possible that the put/call ratio could surge again next week, given the inherent noise in such data.

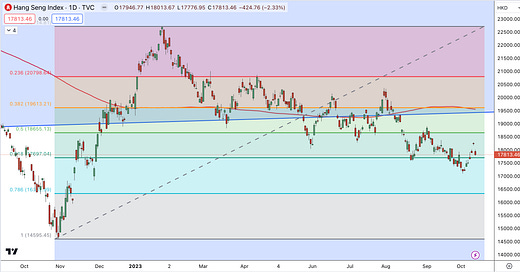

A look at the Hang Seng Index (HSI) chart reveals that it still resides in bearish territory, as it continues to trade below its 200-Day Moving Average (the red curve). Our analysis, incorporating a Fibonacci retracement, suggests that the HSI has already breached the 50% retracement level from its one-year high, indicating notably weak price performance. Currently, it's testing the subsequent level, down 62% from its one-year high. We hope for a rebound from this point; however, there remains the possibility of an additional 8% decline to the next lower Fibonacci level.

Our long-term outlook for Chinese stocks remains optimistic, but it's important not to expect a substantial rebound in the short-term. Moderating our expectations can better prepare us mentally and promote more steadfast stock-holding.