What happened in China this week:

Is China Stock Market Rebound Sustainable?

Nongfu Spring - China's Leading Beverage Company Faces Backlash

AIA Records 33% Growth in New Business Mainly from Chinese Demand

Alibaba Plans to Invest $640 Million in Hong Kong's Film and TV Industries

Cathay Pacific Achieves First Profitable Year Post-Pandemic, Gives Dividends

#1 Is China Stock Market Rebound Sustainable?

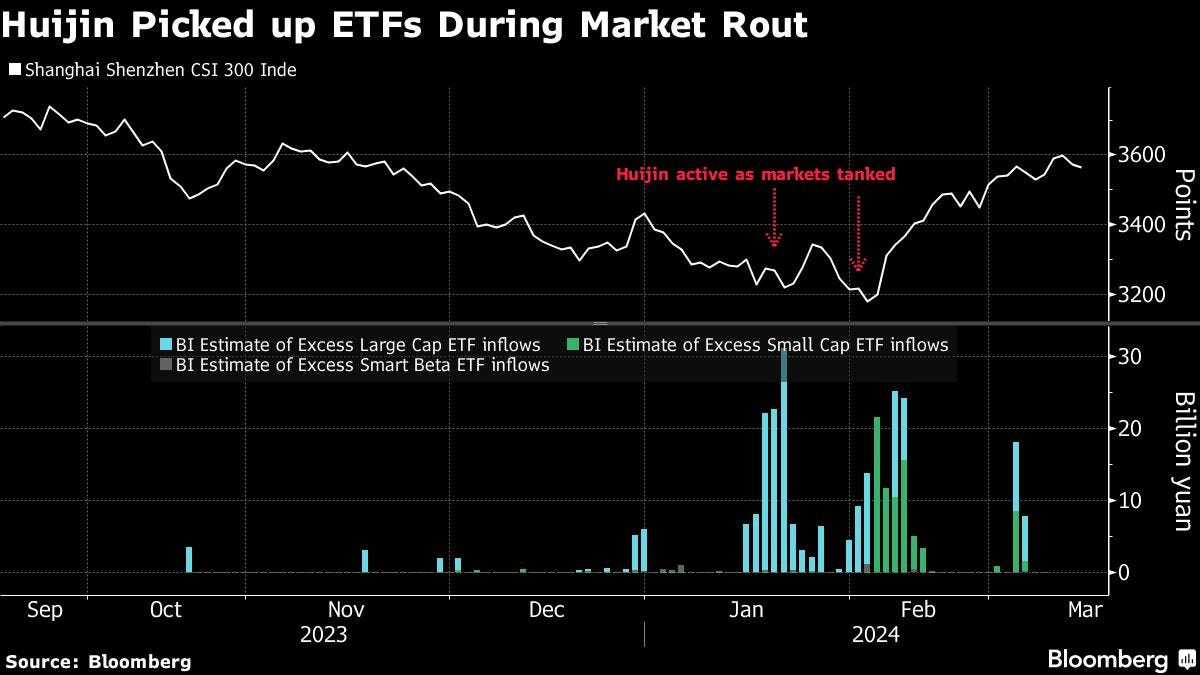

The buybacks from the Chinese national team and government stimulus have provided a decent rebound in the Chinese stock market, which has risen more than 10% from its February 2024 low. Businesses in China, such as Li Auto and Xinyi Solar, have also been rewarded for their positive performance, rallying when they reported strong earnings.

However, the Chinese central bank's decision to maintain the one-year medium-term lending facility rate at 2.5% dampened hopes for monetary easing. This decision signals China's focus on maintaining the strength of the RMB over stimulating the economy. It seems China is taking cues from the US Federal Reserve and would only consider cutting rates if the latter does so. Since the Fed has yet to cut rates, it is expected that China will maintain its current interest rates for the time being.

Despite the encouraging rebound in the China stock market, there has been no significant change in sentiment towards investing in China; institutional funds are only gradually moving into the country. Geopolitical tensions have escalated rather than diminished.

The recent rise in stock prices was primarily driven by the Chinese national team's buying—$50 billion over the past five months, according to Bloomberg. Although this buying has slowed as the markets have recovered, it is anticipated that more buying will follow. However, we believe that China alone is not sufficient to sustain a legitimate bull market; participation from foreign funds is necessary to truly buoy the market.

#2 Nongfu Spring - China's Leading Beverage Company Faces Backlash

Nongfu Spring (SEHK:9633), a prominent bottled water brand in China, experienced a 4% drop in its stock value since February 29, following an online boycott. The backlash was triggered when its founder, Zhong Shanshan, attended the memorial service of Zong Qinghou, the founder of the rival Hangzhou Wahaha Group. Zhong faced criticism for his alleged ingratitude towards Zong in past business interactions, as reported by Caixin. The controversy was further fueled by criticisms of "Japanese-style elements" in Nongfu Spring's packaging, which detractors claim conflicts with Chinese interests. These logo elements have been in use for years, but recent negative sentiments have intensified the scrutiny.

The incident has led to a significant impact on the company's market value, erasing nearly US$3.5 billion. The situation deteriorated when two 7-Eleven stores in Changzhou, operating as franchises, ceased selling Nongfu Spring products, as noted by Caixin. Consequently, sales of Nongfu Spring’s bottled water products plummeted by 31.7%, and tea beverage sales dropped by 22.6% between February 20 and March 7, according to data from retail sales tracker Win Win Network.