Growth Dragons Weekly: Jiangxi Bank Collapse Fake News, But China's Bank Consolidation Continues

What happened in China this week:

China Consolidates Banks As Real Estate Loans Sour

TSMC Hits US$1 Trillion Market Capitalization

Alibaba Doubles Down On International Commerce

Baidu Shares Jumped 16% This Week As Robotaxi Found Success

Biokin Hong Kong IPO

#1 China Consolidates Banks As Real Estate Loans Sour

Over the past few days, rumors of Jiangxi Bank's collapse have circulated widely on social media in China.

Authorities have publicly denounced these claims as fake news. The individuals who gathered at Jiangxi Bank's headquarters were investors in a product sold by another financial company unrelated to Jiangxi Bank. They were misled online, leading to the gathering. Police are currently investigating the incident.

That said, it is true that many Chinese banks are running into trouble.

In the week ending June 24th, 2024, 40 banks vanished in China, highlighting the severe distress within the country's banking sector. According to The Economist, 3,800 banking institutions in China are under threat, with total assets of 55 trillion yuan, representing 13% of the country’s banking system. These banks reportedly hold portfolios with 40% non-performing loans. Many of the disappeared banks were taken over by larger institutions, with 36 of them absorbed by Liaoning Rural Commercial Bank. The primary issue stems from China’s troubled real estate sector, where borrowers are struggling to repay their debts.

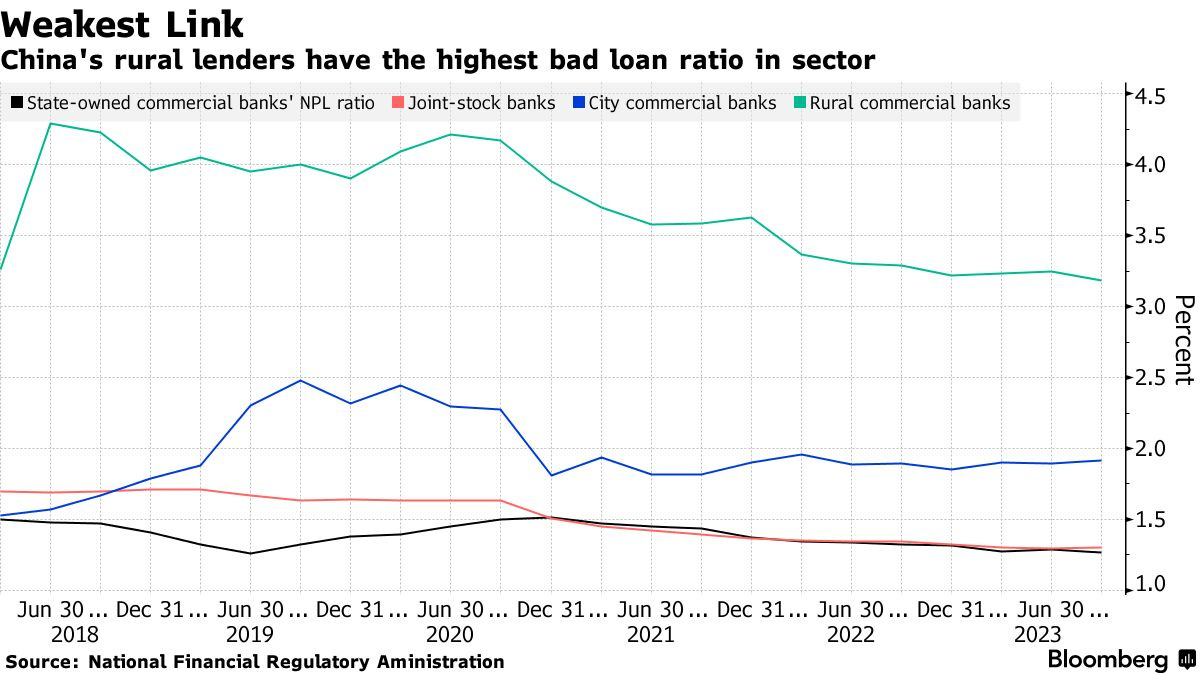

Back in February 2024, Bloomberg reported that China was already merging hundreds of small rural banks to address bad loans. These recent consolidations appear to be efforts to create larger regional banking institutions and stabilize finances. At the end of 2022, the bad loan ratio in rural banks was 3.48%, double the rate of the entire financial sector in China.

One notable example of this crisis is the bankruptcy of Zhongzhi Enterprise Group, a shadow bank in China. The consolidation of Zhongzhi and 247 related companies into a single entity revealed total liabilities of 9.585 billion yuan against assets of 9.385 billion yuan, resulting in net liabilities of about 200 million yuan. The business had only 1.8 million yuan in liquid assets, while its illiquid receivables stood at 2.9 billion yuan. The collapse of Zhongzhi was primarily due to the depressed real estate sector, mirroring the challenges faced by many regional banks.

The consolidation of banks is critical as interest rates are squeezed to record lows. Typically, low interest rates would lead banks to increase loan offerings to boost revenue, but this exacerbates the issue of non-performing loans in their already bad debt-laden portfolios. Smaller banks, in particular, offer extraordinary rates to attract deposits, increasing their risk. The consolidation and capital injections from special bonds by the government provide a buffer to keep these banks afloat. Additionally, the merging of rural banks into regional entities facilitates easier inter-provincial movement for individuals.

Further consolidation is likely, as special bond sales only account for about 0.9% of the risk-weighted assets of regional banks as of the end of 2022. Stricter regulations imposed by the National Financial Regulatory Administration (NFRA) may also drive this process. The NFRA now requires consumer lenders to have more than 1 billion yuan in registered capital and a major investor holding at least 50% of its equity, a significant increase from previous requirements. This impacts a third of consumer lenders who do not meet the capital requirement and about half of all companies without a qualifying major investor.

This consolidation is inevitable and mirrors the situation in the USA in March 2023, where a wave of bank failures led to acquisitions by larger players. Fewer banks will facilitate easier oversight by authorities, and larger banks with better risk management practices will ensure more prudent management of funds.