In Growth Dragons this week:

China Tech Had A Good Week

$28B Selling Wave? China Funds Cut Fees is Common Prosperity?

New Milestone: China Car Brands Gained Majority Market Share

Jay Chou Helped His Mother Get Rich And Should You Buy The Stock?

China Tech Had A Good Week

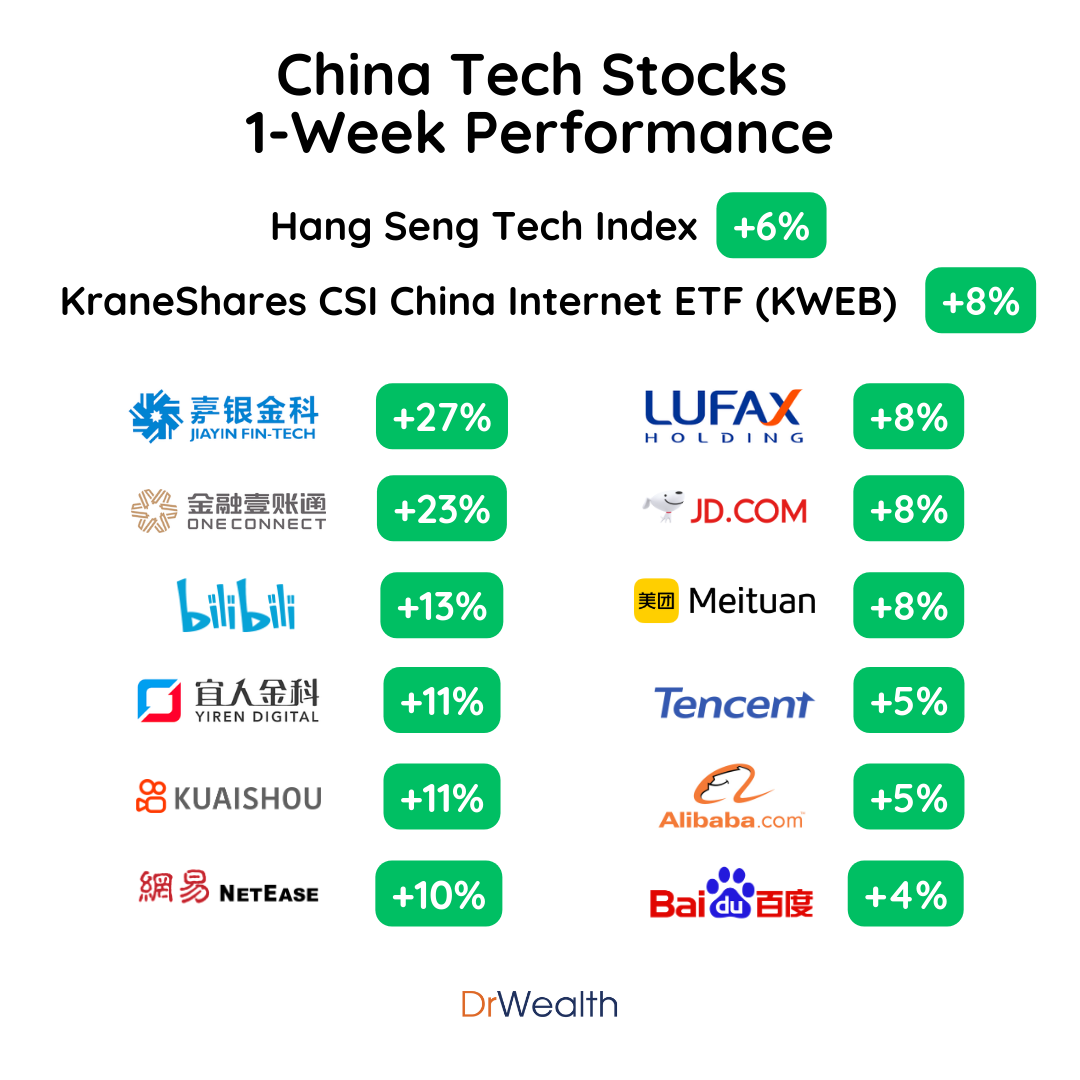

China's tech sector has recently experienced a positive upswing. Last week, the Hang Seng Tech Index rose by 5.6%, while the KraneShares CSI China Internet ETF (KWEB) saw a 7.6% increase. Fintech companies such as Jiayin, OneConnect, Lufax, and Yiren Digital were the most outstanding.

This positive trend was likely driven by the National Development and Reform Commission's (NDRC) favorable remarks during a meeting with tech companies regarding the development of the platform economy.

The NDRC praised Tencent for its advancements in artificial intelligence (AI) chips and service robots, specifically mentioning Enflame Technology and Yunji Technology.

Alibaba was recognized for its innovations in the agriculture and service industries.

Meituan received applause for its investments in chips and industrial robots, including Rong Semiconductor and VisionNav Robotics.

Premier Li Qiang attended the meeting and emphasized the platform economy's role in fostering innovation and development. He further expressed the government's commitment to improving policies and regulations to promote the sound and sustainable growth of the platform economy.

In our discussions on Growth Dragons, we have observed that tech regulation is no longer the primary concern, while competition remains a significant factor. However, the underlying fundamentals of China's tech sector are stronger than current share prices might suggest. The perception of the industry plays a crucial role, making positive announcements like these highly influential. To restore investor confidence and boost share prices, China needs to continue demonstrating its pro-business stance.

As for the future, we believe the odds of sustained improvement in China's tech sector are increasing, despite occasional setbacks and anticlimactic moments in the stock market. Premier Li Qiang's more capitalist-oriented approach adds further optimism to the outlook.