Growth Dragons Weekly: Mortgage Refinancing Sinks Banks, Alibaba Clears Antitrust, PDD Plunges, Meituan Thrives on Frugal Consumers

What happened in China this week:

China Allows Refinancing of Mortgages to Lower Interest Rates: Banks Down, Property Developers Up

Alibaba Officially Makes Peace with Authorities

PDD Shares Plunged 29% on Discouraging Outlook

Meituan Benefits From Frugal Consumers, Revenue Jumps 21%

Trip.com Recovers Outbound Travel Reservations to 100% of Pre-COVID Levels

Haier Reports High Growth in Southeast Asia, Middle East & Africa

#1 China Allows Refinancing of Mortgages to Lower Interest Rates: Banks Down, Property Developers Up

China is considering allowing homeowners to refinance up to US$5.4 trillion in mortgages, potentially lowering borrowing costs for millions of families and boosting consumption. For the first time since the global financial crisis, homeowners might also be able to refinance with a different bank. This move is promising for homeowners, as it is likely to reduce their mortgage rates, given that the China Prime Lending rates have been declining for the past few years. This is an opportune time to alleviate the burden on homeowners, increase disposable income, and encourage spending in other areas.

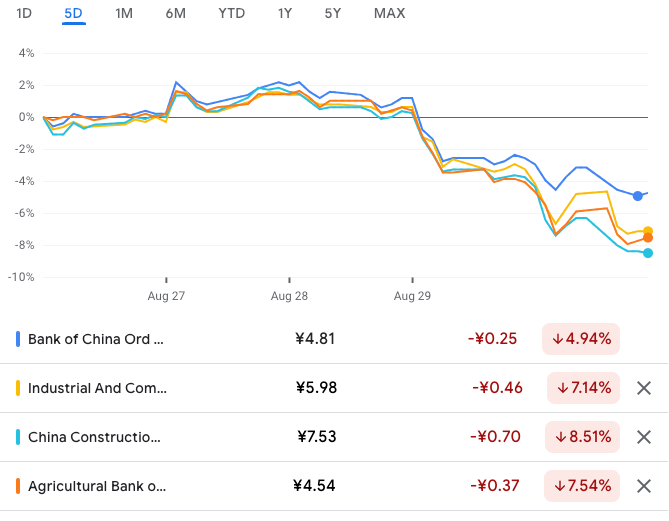

However, lower mortgage payments could mean reduced profits for banks. Following the news, the share prices of China's top four banks fell by 4.9% or more for the week. Banks have already seen their profits shrink due to falling lending rates and net interest margin compression over the years. While this news may not be favorable for banks in the short term, it isn't entirely negative. Homeowners unable to repay their loans would become bad debts, which is detrimental to banks. Moreover, if consumption improves, economic growth could lead to loan growth from other sources. Overall, this could be beneficial.

Property developer stocks, which had been under pressure, saw a surge in their share prices this week. More favorable mortgage conditions could stimulate property purchases and improve demand in China. That said, we don't see these as strong long-term investments. Instead, we prefer to focus on bank stocks for their quality and stability.

#2 Alibaba Officially Makes Peace with Authorities

“After three years, Alibaba has fully ceased its monopolistic practices. The company has taken significant steps to regulate its business practices, fulfill its responsibilities as a platform, and improve its compliance management systems,” stated the State Administration for Market Regulation (SAMR), China’s antitrust watchdog.

While the end of the probe may not provide immediate tangible benefits for Alibaba, the symbolic significance is crucial. It demonstrates that Chinese authorities are committed to their promise of easing tech regulation and are looking to tech giants to contribute to economic growth. This shift suggests that authorities might adopt a more supportive stance towards these companies, potentially introducing more favorable policies instead of imposing restrictions.

This development could also clear the path for Ant Group to pursue its long-awaited IPO, which was derailed due to regulatory scrutiny that began around the same time Alibaba’s issues surfaced. Alibaba will likely be relieved that this chapter is closed, enabling it to make bolder moves in restructuring and business strategy.

Investors have reacted positively to the news, with Alibaba’s share price rising 3% on Friday.

Another favorable development for Alibaba is its impending inclusion in the Stock Connect program. Previously, Mainland Chinese investors, including institutional funds, were limited by foreign exchange quotas from buying Alibaba stock because it was considered a foreign stock. With Alibaba’s inclusion in Stock Connect, there will be a new avenue and increased quota for purchasing the stock. Since Alibaba's business is predominantly in China, this could attract more buying support from Mainland investors, potentially boosting the share price.