Growth Dragons Weekly: Unpacking Financial Results of Tencent, PDD, Xiaomi, Ping An, and Wuxi AppTec

This week marks a busy period of earnings releases from Chinese companies, so we will focus on discussing their results, whether good or bad.

Tencent Ended 2023 with Modest Growth

PDD's Revenue and Profits Soar with Triple-Digit Growth

Xiaomi's Profits Soar 236%, Fueling Its EV Ambitions

Ping An Insurance Dragged By its Asset Management

Wuxi AppTec's Growth Moderates Amid US Blacklisting

#1 Tencent Ended 2023 with Modest Growth

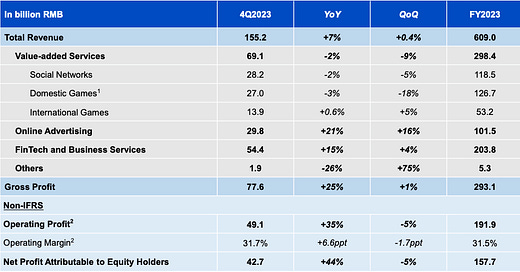

Tencent experienced a sluggish performance in gaming revenue within China, marking a 3% year-on-year decline in the fourth quarter of 2023. International gaming operations saw a marginal improvement of 0.6%. Despite this, popular games such as PUBG Mobile and VALORANT maintained robust growth. In China, users exhibited a heightened interest in Mini Games, with gross receipts soaring by over 50%. However, domestic games like Honour of Kings and Peacekeeper Elite faced challenges, resulting in a 3% revenue decrease year on year. This downturn was attributed to the cessation of daily incentives and reduced spending on domestic video games, which also led to diminished revenues from social networks, owing to lower earnings from games and music-related live streaming services. Consequently, the entire value-added services segment, encompassing social networks and gaming, hindered the company's overall performance.

Tencent's online advertising revenue saw a 21% increase year on year in the fourth quarter, reaching 29.8 billion yuan. This growth was fueled by the escalated usage of Video Accounts, which doubled the total user time spent.

Furthermore, the FinTech and Business Services sector witnessed a 15% year-on-year increase, totaling 54.4 billion yuan for the fourth quarter of 2023. This rise was driven by an uptick in commercial payment activities and the expanded use of wealth management and consumer loan services.

Overall, Tencent remains in a solid financial stance. The company's free cash flow surged by 48% year on year to 34.2 billion yuan, and it reported a net cash position of 54.7 billion yuan for the fourth quarter of 2023. This financial cushion is critical for navigating unforeseen business disruptions. With the Chinese government retracting the draft gaming law, further crackdowns on the gaming industry seem unlikely. This regulatory relaxation is expected to facilitate Tencent's recovery and reassure its investors. Supported by strong fundamentals, Tencent has increased its annual dividends by 42% to HKD 3.40 per share and plans to double its share repurchases to over HKD 100 billion in 2024.

#2 PDD's Revenue and Profits Soar with Triple-Digit Growth

PDD Holdings has witnessed rapid growth, bolstered by Pinduoduo's success in China and Temu's international expansion. In the fourth quarter of 2023, the company's revenue surged by 123%, while earnings saw a 124% increase year over year, reaching 88.9 billion yuan. This significant growth was driven by a strong uptick in advertising revenue and substantial commission earnings from Temu. Through aggressive investment and marketing strategies, PDD has attracted cost-conscious consumers, posing a challenge to traditional retailers like Dollar General in the U.S. The company's offerings, including home decor items priced around US$4 and gadgets for approximately US$10, have found their market in the U.S., Europe, the Middle East, and Asia.