Growth Dragons Weekly: US Tariffs Rise, China Big Tech Earnings and Zeekr Bumper IPO

#1 US Increased Tariffs on China Have Little Impact, More to Win Votes

The US and China have hit their lowest trade levels since China joined the World Trade Organization over 20 years ago. In 2023, only 7% of US goods were exported to China, down from almost 10% during the pandemic. This trend is set to continue as the US increases its tariffs on China.

The tariffs are highly aggressive, with measures that increase tariffs between 25% to 100% on US$18 billion worth of Chinese imports. Investment bank Nomura mentioned that the targeted products account for merely 4.2% of China’s total exports to the US and less than 1% of China's global exports. Many sources, such as Reuters, have mentioned that these tariffs are election-driven, differing from Trump’s pursuit of a trade war. In light of the presidential elections, this implies that the tariffs may be more symbolic than impactful.

In April, President Biden also called for a tripling of US tariffs on Chinese metal products, which would apply to more than US$1 billion worth of steel and aluminum products. The US imposed a steep hike from 25% to 100% on China EVs, which is unlikely to be impactful since only 1% of the EVs sold in the US are from China.

While China is being investigated for subsidies in various sectors, it is part of President Xi’s strategy to increase and prioritize investments in the nation’s new productive forces. It is unlikely for him to change this course even under the pressure of tariffs, as these investments have been significant in driving growth in China. According to Barron, US export prices have risen 20% from 2019 levels, and European and Mexican export prices are 15% higher, while only China’s export prices remain flat. This suggests the ability of Chinese companies to increase their efficiencies.

President Xi’s stance is further supported by the launch of ultra-long bonds. These bonds are set to finance government debt to invest in critical industries. While such investments lead to innovation and increased efficiency, they inevitably result in higher production. For instance, China’s lithium-ion battery production was almost twice that of domestic demand in 2022. This suggests that China is unlikely to retaliate against US tariffs, as it still depends on trading with other countries to prevent a supply glut.

Despite warnings from US Secretary Janet Yellen about overproduction and potential actions from the West, it is unlikely that China will bend. The reason is that China does not only export to them. China’s share of global exports has risen to 14%, but its exports to G-7 countries have fallen to 29% from 48% in 2000, according to Barron. This indicates that China is also diversifying towards emerging markets, making protectionist measures less effective.

It is possible that China will accelerate bond issuance in the second half of the year. This conclusion is based on the percentage of net financing value in the second half averaging more than 70% over the last five years. This means that China’s output may further increase in the second half of the year, potentially spurring stronger economic growth than in the first half.

#2 Alibaba’s China Commerce and Cloud Growth Remain Sluggish

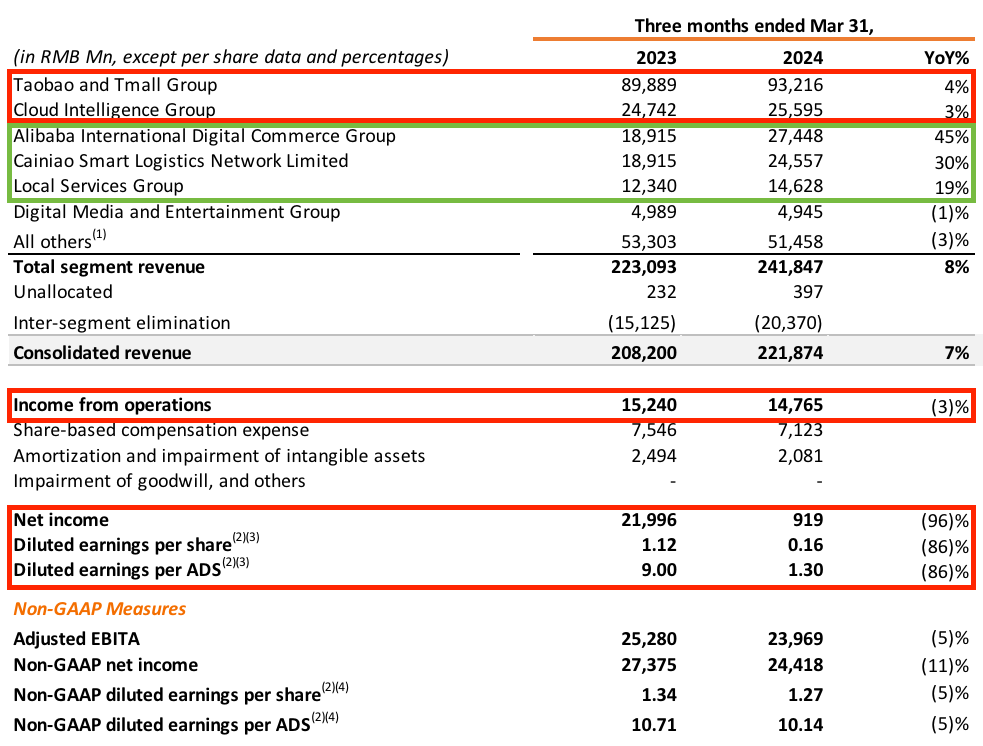

Alibaba reported an 8% growth in revenue to 241 billion yuan, but net income dropped 96% to 0.9 billion yuan.

Alibaba's international e-commerce led the growth with a 45% increase to 27 billion yuan, followed by Cainiao with a 30% growth to 24 billion yuan. Its local e-commerce, Taobao and Tmall Group, and Cloud Intelligence group reported low single-digit growth of 4% and 3% to 92 billion yuan and 25 billion yuan, respectively.

The significant decline of 96% in net income is attributed to paper losses from its stock investments. Fluctuations in share prices often distort the actual earnings from operations. Excluding these and other adjustments, earnings would have declined by 11%. Alvin explained this further in a video and highlighted three other positive signs for Alibaba:

Under the domestic e-commerce segment, notable achievements stem from double-digit growth in 88VIP members, which indicates the retention of premium shoppers. There is still much room for growth as the number was only 35 million for the quarter.

In its Cloud Intelligence segment, while overall growth was only 3%, there was significant growth in core AI applications. Core public cloud offerings, databases, and elastic compute recorded double-digit growth, while AI-related products saw triple-digit year-on-year growth. This success is attributed to aggressive price cuts to attract customers, which have been expanded to overseas products. The reason for the overall low revenue growth was due to the roll-off of project-based revenue. Alibaba CEO Eddie Wu stated that cloud revenue growth is expected to return to double-digit percentages in the second half of the current fiscal year.

The Choice business of AliExpress has been the driver of growth for the international e-commerce segment. The synergies between Cainiao and AliExpress have contributed to this growth. Cainiao’s withdrawal from its IPO was a strategic move to continue driving business growth.

Alibaba repurchased 524 million ordinary shares for a total of 4.8 billion yuan in the quarter. While the business may not be generating high profits, it remains prudent in its net cash position, increasing it to 446 billion yuan. Despite the numerous changes and news surrounding Alibaba, the management team has maintained good control over total costs and expenses, keeping the increase at about 1%. The next step is to reinvigorate its growth.

#3 Tencent Profits Jump 54%

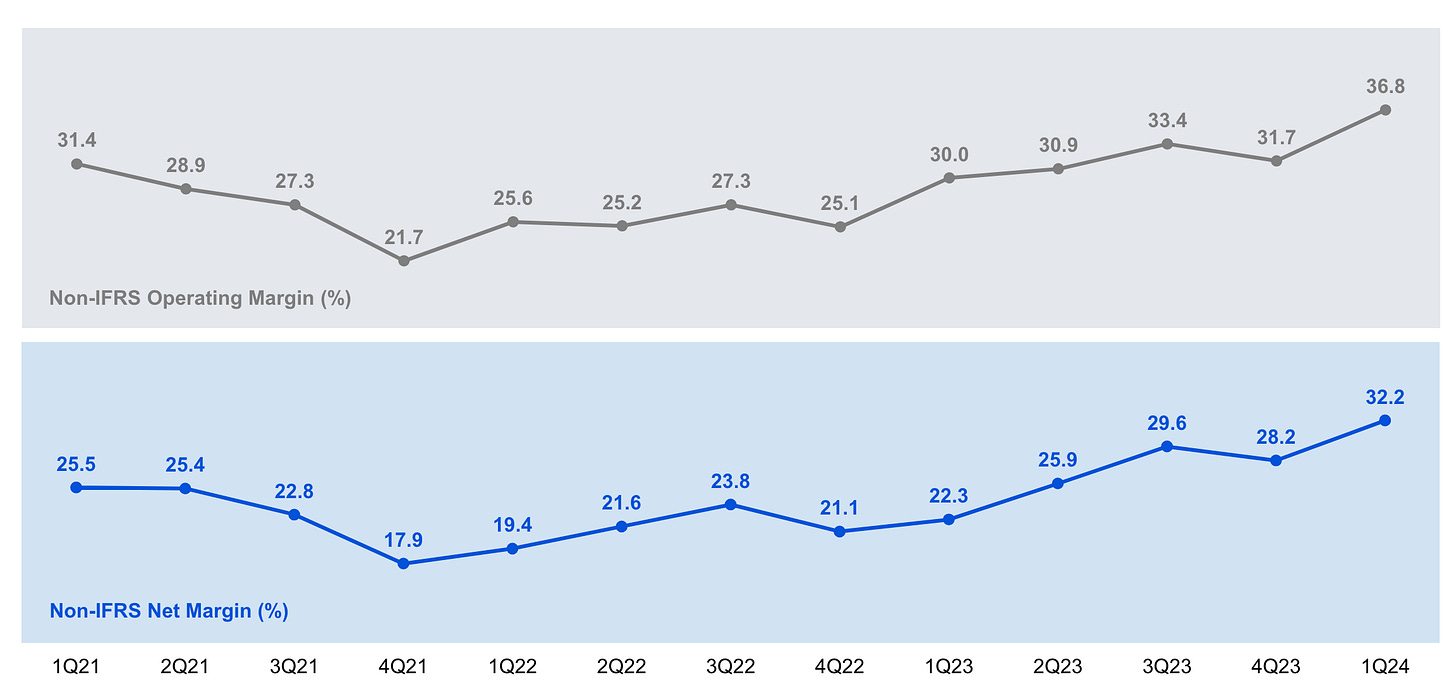

Tencent’s revenue increased 6% year-on-year to 159.5 billion yuan, while gross profit rose 23% to 83.9 billion yuan. Despite these gains, growth remains sluggish, particularly in its social networks and games segments. Online advertising was the only bright spot, growing 26% year-on-year.

The most impressive aspect is Tencent’s earnings growth and margin expansion. Operating and net profits grew by 30% and 54%, respectively.

Tencent has been disciplined in cutting expenses over the past several quarters, yielding significant efficiency gains. This discipline has enabled Tencent to achieve rising operating and net margins over the past three years. This marks a 180-degree shift from its previous acquisitive approach, where it invested in numerous companies and ventured into various opportunities. The regulatory crackdown created a challenging environment for Chinese tech companies, prompting Tencent to become more prudent and rein in its expenses.

Securing this strong financial position and efficiency is a good start to capitalize on China’s recovery. Similar to Alibaba, Tencent now needs to restore its growth rate to double-digit percentages to convince investors that Chinese big tech is back in business.

#4 Baidu Betting on AI and Robotaxis for Growth

Baidu recorded a 1% revenue growth year-on-year to 31.5 billion yuan, while net income fell by 6% to 5.4 billion yuan. Although these numbers may not seem impressive, they represent a decent improvement from the previous quarter, when Baidu reported a 48% decline in net income.

The primary cause for the revenue decrease was iQIYI’s revenue falling 5% year-on-year. However, the AI Cloud business drove non-online marketing revenue to 6.8 billion yuan. Revenue from Baidu Core increased by 4% to 23.8 billion yuan, and online marketing revenue rose by 3% to 17 billion yuan. Despite these gains, the AI-led segment still constitutes a relatively small part of the business.

Baidu’s AI continues to drive business growth. The PaddlePaddle developer community grew to 13 million by mid-April 2024, and Apollo Go provided up to 826,000 rides, a 25% increase. Baidu app’s mobile active users increased by 3% to 676 million, and managed pages accounted for 50% of Baidu Core’s online marketing revenue for Q1 2024.

The company expressed confidence that artificial intelligence will continue to drive future sales and profits, impacting both its core business and its robotaxi arm. Baidu expects its robotaxi segment to turn profitable next year. Significant progress has been made in this area, with Beijing allowing the company to charge fares for staff-free robotaxi rides since September 2023. Furthermore, the cost of producing Apollo’s 6th generation robotaxis has decreased to around 200,000 yuan, less than half the cost of the previous generation. This year, Baidu plans to deploy 1,000 of the 6th generation robotaxis in Wuhan city.

This robotaxi initiative could become Baidu's new revenue driver as it shifts away from its lower-performing businesses, such as the recently sold Baike app.

#5 Zeekr is Largest US IPO for a Chinese Company Since 2021, and Shein Files for Confidential IPO

Zeekr, a subsidiary of Geely, IPOed in the US at $21 per share, raising $441 million. This IPO values the business at $5.1 billion, making it the largest IPO by a Chinese company in the US since 2021. The IPO performed well initially, with the share price jumping 35% on the first day of trading. It has since retreated but remains 24% higher than its IPO price.

Zeekr plans to foray into premium BEV models in China. The ZEEKR 001 is its first vehicle model, and the ZEEKR X is the latest. According to Frost & Sullivan, Zeekr’s ability to deliver 10,000 units of the ZEEKR 001 in less than four months is one of the fastest among major mid and high-end NEV and BEV models in China.

As of 31 October 2023, Zeekr had delivered 170,053 units of its vehicles, showcasing its efficiency in production. Zeekr achieved this speed by utilizing Geely’s SEA platform.

While the company’s performance appears promising, it has yet to reach profitability and has been losing more money each year since 2020. Additionally, it is burning through cash, with a net decrease in cash for the six months ending in 2023. The funds raised from the IPO will be crucial for its operations.

On the fashion front, Shein has filed for a confidential IPO. Although there is limited information available about its IPO prospectus, there have been mentions of a valuation exceeding $60 billion as of May. Despite this, the deal size and valuation have not been confirmed. Shein, a fast fashion business that relies on consumer spending, has faced accusations of using forced labor in its supply chains. This timing may not be ideal for an IPO, given the high-interest rates that could depress the already thin margins of fast fashion businesses. Furthermore, the US government has been increasingly scrutinous of Chinese companies, and a US listing might attract additional scrutiny.

Despite the challenges, Shein has made significant efforts to distance itself from its Chinese background, claiming no revenue from Beijing according to the Wall Street Journal. However, this is unlikely to change the US government's perception of Shein.