Growth Dragons Weekly: We Believe This Is the Best Way to Explain the Current State of China’s Economy

Here’s what happened in Growth Dragons this week:

We Believe This Is the Best Way to Explain the Current State of China’s Economy

China Speeding Up AI Development

Slowdown in Chip Industry Reflects in SMIC’s Financial Results

Shein Readies for $90 Billion IPO Amidst Challenges

WuXi Biologics Spins Off WuXi XDC in Hong Kong IPO

#1 We Believe This Is the Best Way to Explain the Current State of China’s Economy

Deflation, slowing GDP growth, negative PMIs, and falling exports—each month, China's economic challenges make headlines, with the media often sensationalizing individual economic indicators, linking them to deep-seated problems within the country.

It is crucial to consider various indicators to present a comprehensive picture of the situation, and that's precisely what we aim to do here.

Firstly, while China's GDP growth is slowing, it still maintains the fastest growth for its size. The target for 2023 is 5%, signaling a departure from the years of 8% annual growth.

However, instead of simply stating that China is in trouble or experiencing a slowdown, we need to delve into the contributing factors.

GDP growth can be dissected into four components:

Net exports

Investment (by businesses)

Public Consumption (Government expenditure)

Private Consumption (Household consumption)

Here's a breakdown of China’s GDP growth by these components in recent years:

China, being a major exporter and importer, sees a smaller net export figure. In 2022, China exported $3.77 trillion and imported $2.71 trillion, resulting in a net export of $857 billion.

With deglobalization and companies restructuring the supply chain, China is likely to face lower export growth in the future, making it less reliant on exports for growth.

Businesses are less inclined to invest in equipment and production with decreasing exports. The growth in the investment component of GDP contribution has been declining, especially since 2021 when the trade war began. Excess capacity and the trade war have dampened the Purchasing Manufacturing Index (PMI), making an increase unlikely in the near future.

Finally, we have consumption, divided into public and private. Government spending remains steady, contributing about 1%-1.6% to China’s annual GDP growth. This includes investments in world-class infrastructure, such as a dense high-speed rail network and highways. Such investments controlled by the Chinese government and independent of geopolitical matters. Thus, this is likely to continue.

Private consumption, the primary driver of China’s GDP growth in most years, collapsed in 2022 due to falling housing demand. With property market troubles and potential bankruptcies of more property companies, Chinese citizens have become risk-averse, affecting GDP growth driven by housing demand.

As accurately described by Peter Thiel, the Chinese exhibit a pessimistic outlook. Shaped by historical experiences like famine, they believe in preparing for bleak futures.

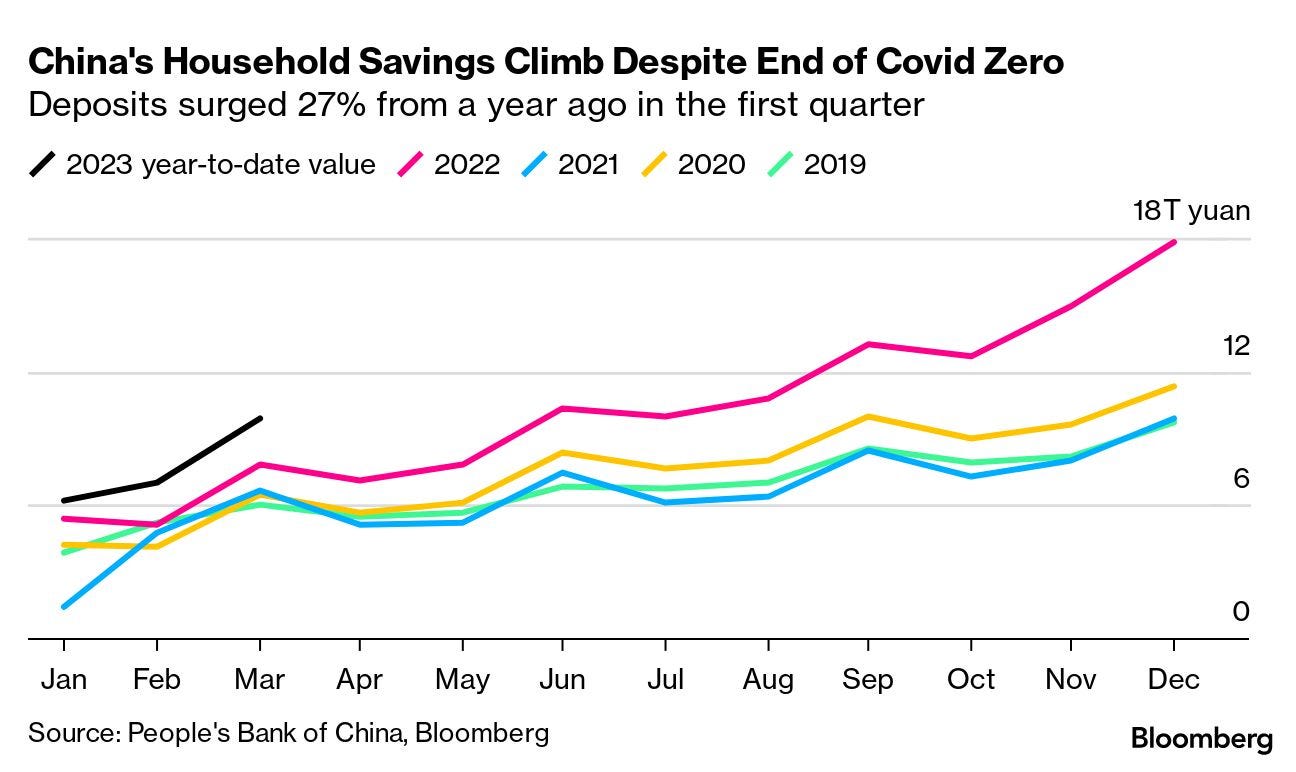

Culturally, they are taught prudence—avoiding gloating during good times, as bad times may follow. This mindset reflects in their high savings rate, which is one of the world's highest.

Culture and mentality are significant factors; the Chinese are unlikely to spend lavishly, unlike Americans, making economic growth dependent on domestic consumption challenging.

Previously, the property market supported private consumption. Now, with a struggling property market, declining stock markets, slow economic growth, and fear of income loss, the Chinese are more inclined to save than spend.

China faces challenges with three out of four GDP components experiencing reduced growth. However, the country continues to grow, albeit at a slower pace. To overcome these challenges, China must stay relevant in the global supply chain, maintain export volumes, and boost consumer confidence in the economy—a task that involves navigating both geopolitics and cultural factors, presenting a complex challenge.

Although reverting to an 8% GDP growth is unlikely, sustaining a 5% growth is already praiseworthy. In 2023, China's anticipated 5% growth is poised to account for 30% of global GDP growth, surpassing the contributions of any other nation.