What happened in China this week:

Will China Be Ready For Trump 2.0?

Alibaba Wins Xiaohongshu Business, Solidifying Its Cloud Dominance

NetEase and Blizzard Reunite To Bring Blockbuster Hearthstone Back to China

Huawei Surpasses Apple in China Sales After 46 Months, Reports 30% Revenue Growth

Low-Altitude Economy Development Takes Flight in Shenzhen

#1 Will China Be Ready For Trump 2.0?

Trump's victory in the presidential election has reignited concerns about how China would navigate any potential protectionist policies that he might introduce. There are even reports suggesting that China could increase its fiscal stimulus package by 10%-20%. While it's possible that an uptick in stimulus might be necessary if additional tariffs are imposed, we believe that focusing solely on the scale of stimulus relative to GDP is an oversimplification. The true impact of Trump's potential measures remains uncertain and may ultimately be more limited than expected.

Trump enjoys substantial backing from prominent business leaders, including figures like Elon Musk. To maintain favorable business conditions for his supporters, he will need to strike a delicate balance between being tough on China and achieving his broader political objectives. The Chinese market remains a crucial revenue stream for many U.S. companies, and firms looking to maintain operations in China are often required to meet minimum investment and tax thresholds. This reality may act as a restraint on Trump's protectionist ambitions, limiting the extent of his offensive measures.

China’s Preparedness and Strategic Shifts

The Chinese government appears ready for another Trump presidency, as indicated by its willingness to adjust stimulus measures if needed. China’s stimulus measures have historically emphasized quality growth and long-term investments aimed at restructuring industries and markets. This approach means that short-term effects on the economy are often minimal, rendering speculations about a large-scale stimulus largely unproductive and short-lived. For instance, China’s 10 trillion yuan debt swap program was designed to improve local government debt levels. This economic policy is particularly significant because it serves a dual role: acting as both a stimulative policy ("增量政策") and a stock policy ("存量政策").

A stimulative policy injects new capital into the economy, but it often has limited impact on the fundamentals. The real leverage comes through stock policies that optimize economic resources—such as removing non-performing loans and focusing on high-impact projects. This, in turn, stimulates consumption and borrowing, leading to organic growth and a more sustainable recovery.

Additionally, Chinese businesses have been diversifying their supply chains to mitigate risks from tariffs and sanctions. Companies like Huawei and Lenovo are expanding production across Southeast Asia and the Middle East. Meanwhile, firms such as Longi, Haier, and BYD have even established manufacturing facilities in the U.S. to reduce tariff impacts. Blacklisted companies like DJI and SMCI are also ramping up production in other parts of Asia to shield themselves from potential U.S. sanctions.

Chinese producers have learned valuable lessons from previous rounds of protectionism, and they are increasingly positioning themselves to withstand challenges—not only from the U.S. but also from European nations. This adaptability suggests that China is better prepared than ever to counter external economic pressures, ensuring its resilience in the face of potential protectionist policies.

As China braces for any renewed trade measures against it, the country appears to be well on the road to recovery, particularly in its high-tech sectors, which are increasingly taking the lead as economic drivers. The Caixin BBD New Economy Index recently reached a seven-year high, with new economy industries now contributing 32.5% of China's total economic activity.

China’s Economy Continues to Improve

From a manufacturing standpoint, China's latest PMI data has edged into the expansionary zone, indicating that recent government stimulus measures have had a positive effect. This recovery is further evidenced by China's exports reaching a 27-month high, despite ongoing protectionist pressures. Chinese businesses have demonstrated their ability to pivot and find new demand, even in the face of market restrictions imposed by various countries. This adaptability is a crucial factor, bolstering investor confidence in Chinese firms amid a challenging macroeconomic landscape.

The financial markets have also shown resilience, with Chinese stocks maintaining gains from recent stimulus-induced rallies. Notably, there was no adverse reaction to Trump's electoral win, signaling confidence in both Chinese businesses and the government's ability to navigate a Trump-led U.S. administration.

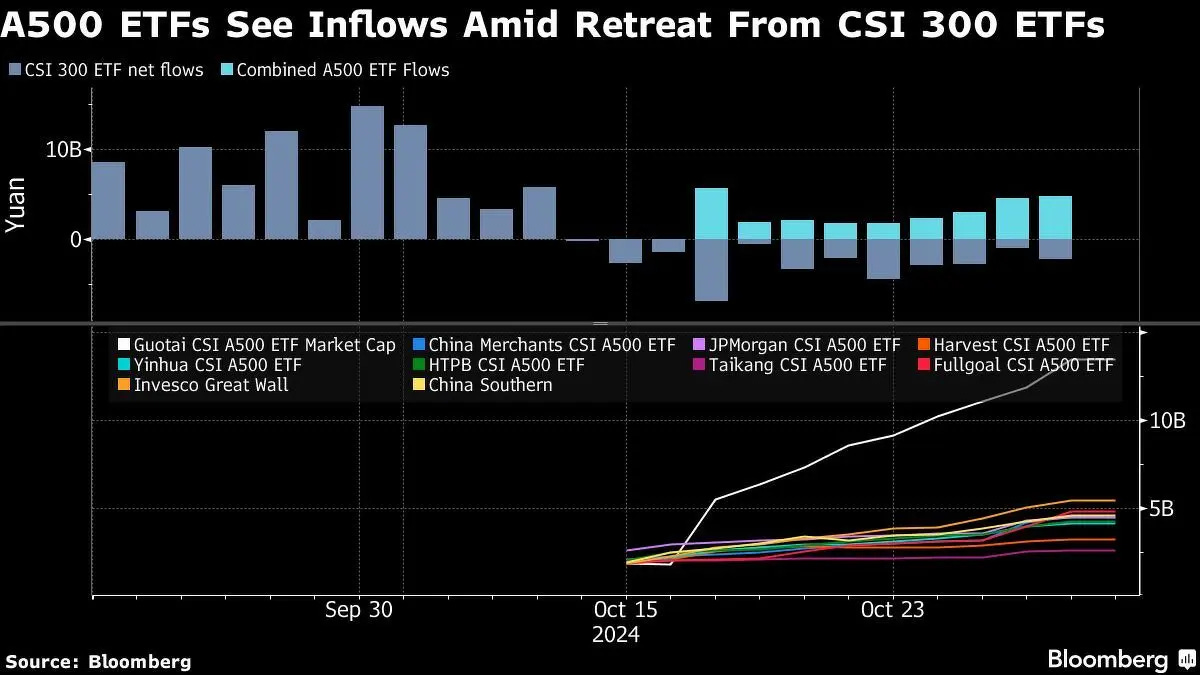

One of the most significant developments in the capital markets is the introduction of the CSI A500 Index, often promoted as China’s answer to the S&P 500. This new index has led to a wave of ETF issuances, with the first 10 ETFs tracking the CSI A500 garnering inflows of 30 billion yuan since trading began this month. Covering 56% of the market, the CSI A500 applies criteria such as market leadership and ESG impact in its selection process, making it a focal point for investors seeking exposure to high-quality Chinese firms.

It's not just the mainland that is benefiting from these shifts. Hong Kong’s exchange-traded product market saw a remarkable 48% year-on-year surge in net fund inflows. There is a noticeable shift in preference towards passively managed funds, like ETFs, over actively managed funds in both China and Hong Kong. This trend is a positive sign, indicating that more retail investors are channeling their savings into the stock market, which, in turn, supports stock prices.

Overall, China's market is showing multiple signs of strength across various sectors. While uncertainties remain, as they always do in the markets, the current developments underscore a steady progression toward long-term, sustainable growth. This foundation is deeply constructive for China’s ongoing recovery, offering a sense of optimism even amid global economic challenges.