What happened in China this week:

Xi Gives Boost to Tech Companies

Alibaba Surges 9% After Encouraging Quarterly Results

JD.com Enters China’s Fierce Food Delivery Market

Haier Joins Midea in Robotics With STEP Electric Deal

Laopu Gold’s Profits Set to Surge Over 200%, Stock Nears 700% Gain Since IPO

#1 Xi Gives Boost to Tech Companies

Chinese leader Xi Jinping hosted some of the country’s most prominent tech executives in Beijing on Monday, signaling a potential shift toward a more business-friendly approach after years of regulatory scrutiny. The high-profile gathering, held at the Great Hall of the People, was featured in a CCTV news broadcast and included leaders from Alibaba, Huawei, Tencent, BYD, CATL, Meituan, DeepSeek, and Xiaomi.

Such direct engagement with private sector leaders is rare for Xi, with his last known participation in a similar symposium dating back to 2018. According to China’s official news agency, Xinhua, Xi reassured executives that the country’s economic challenges were only temporary and reaffirmed the government’s commitment to removing barriers to fair market competition. “Now is the perfect time for private enterprises and entrepreneurs to thrive,” he stated, underscoring the administration’s renewed support for the private sector.

The presence of Alibaba founder Jack Ma was particularly significant, given Beijing’s previous regulatory crackdown on the tech giant and the broader industry. Xi’s outreach appears to be a strategic move to restore confidence in the private sector, especially as China seeks to compete with the U.S. in innovation and revitalize its slowing economy.

The meeting coincided with a strong rally in China’s tech sector. The Hang Seng Tech Index tested a three-year high early Monday, extending a multi-week surge fueled by optimism over AI advancements. Investor sentiment has been further boosted by DeepSeek’s recent AI breakthroughs, which have raised expectations for increased enterprise adoption of AI technologies and broader innovation within China.

China’s most valuable tech companies, including Alibaba, Tencent, and Xiaomi, have surged to multi-year highs, contributing to a $245 billion boost in Hong Kong’s stock market capitalization this year. With renewed government backing, opportunities are emerging across internet platforms, IT hardware, data centers, and power infrastructure, positioning China’s tech sector for potential long-term growth.

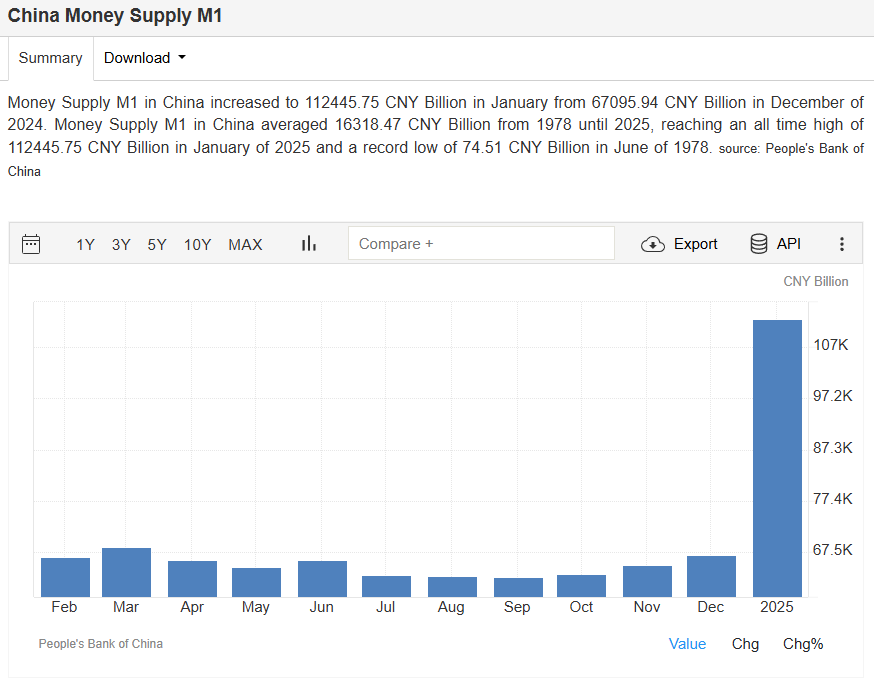

Additionally, fundamental shifts in China’s economy could drive further market gains. In 2025, a significant jump in M1 supply is expected, which could push markets even higher as more capital flows into equities through insurance and direct trading of Chinese shares.

Xi’s engagement with top business leaders signals a notable shift in China’s economic approach, reinforcing the message that private enterprises remain integral to the country’s development. Beyond policy adjustments, these fundamental changes in the economy suggest a new chapter for China’s markets—one that investors cannot afford to ignore.