In China, three prominent home appliance companies are Midea, Haier, and Gree, all specializing in white goods like air conditioners, refrigerators, and washing machines.

Midea leads the market in air conditioning, whereas Haier holds the top position in refrigerators. On the other hand, Gree has not secured a dominant market position, and its financial performance falls short compared to the other two. Hence, we consider Midea and Haier more favorable choices for long-term investments.

China has recently vowed to support the real estate sector, which could potentially bolster sales for home appliance companies such as Haier. The rationale behind this is straightforward: new home appliances are needed for new homes. Home appliances are a necessity today rather than mere luxuries.

Instead of directly investing in China real estate stocks as a recovery play, which some investors may be hesitant about, Haier presents itself as a suitable proxy and a compelling long-term investment with the potential for growth over time.

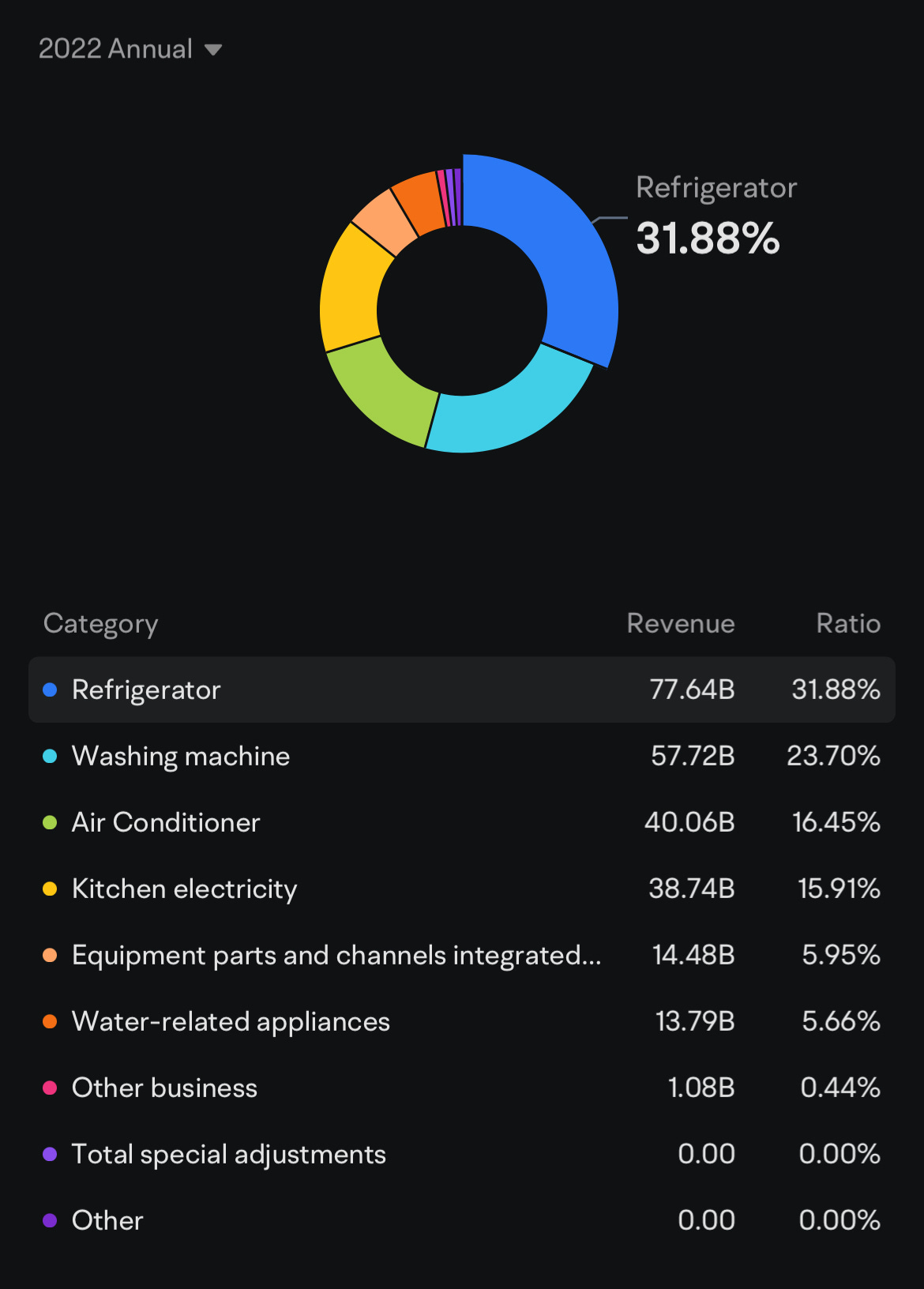

In FY2022, the primary revenue source for Haier was refrigerators, accounting for 32% of the total revenue. Significant contributions to revenue also came from washing machines, air conditioners, and kitchen appliances.

According to Haier's FY22 annual report, the company's retail share for refrigerators in China stood at 43.9% offline and 39.2% online. Similarly, Haier dominated the market with washing machines, holding a share of 46.0% offline and 40.4% online. Together, these white goods constituted more than half of Haier's total revenue.

However, Haier's business extends beyond China, with its overseas revenue making up a significant portion, approximately 52% of the total revenue. This global success is achieved through its multi-brand approach.