On 7 April 2025, the Hang Seng Index (HSI) plunged 13%, while the Hang Seng Tech Index (HSTech) sank 17%.

This brutal sell-off erased all year-to-date gains and officially pushed the market into bear territory.

You know it’s a terrible day when headlines start comparing it to the steepest crashes in decades. The trigger? China’s retaliation against the latest round of U.S. tariffs, escalating tensions and rattling investors.

In this post, we’ll take a closer look at which stocks got hit the hardest—and ask the big question: Is the selling overdone, or is there more pain ahead?

7 HSI Component Stocks That Dropped More Than 20% in a Day

The sharpest casualties in the Hang Seng Index were unsurprisingly export-driven companies — especially those with significant exposure to the U.S. market. These are the stocks that would be directly hit by the new tariffs and geopolitical blowback.

Here are some of the biggest losers, and why they were hit so hard:

🧬 1. Wuxi Biologics

Wuxi Biologics suffered the steepest drop. It has been under intense scrutiny in the U.S. for national security concerns, including potential restrictions under the proposed BIOSECURE Act. There are also growing worries about intellectual property transfers. As a result, the company’s U.S. operations — a key part of its international expansion — are now at risk.

🔬 2. Wuxi AppTec

A sister company to Wuxi Biologics, Wuxi AppTec also faces similar threats. It operates facilities in the U.S., and its cross-border biomedical services are now under pressure due to tightening regulations and rising geopolitical risk.

💻 3. Lenovo

Lenovo is a household name, selling laptops and computer equipment globally — including a significant footprint in the U.S. market. However, the company has long battled accusations of having links to the Chinese government, which now puts it in a worse position as geopolitical sentiment turns hostile.

📱 4. BYD Electronics

While BYD’s electric vehicles aren't exported to the U.S., BYD Electronics — its components and assembly arm — has a broader customer base. It manufactures handset components, auto electronics, and intelligent modules, with only 30% of its revenue coming from China. That leaves significant room for U.S. exposure and potential tariff risk.

🚗 5. Geely Auto

Geely faces mounting trade barriers as countries implement protectionist measures to support their domestic EV industries. Though Geely’s exports to the U.S. are limited, it’s caught in the broader anti-China auto sentiment now sweeping across Europe and North America.

📱 6. Xiaomi

Xiaomi is a global consumer tech brand, and although it doesn’t have significant U.S. sales, it is still swept up in the broader crackdown on Chinese tech. The company is increasingly viewed as a strategic competitor, which raises risks around supply chains, software bans, and future sanctions.

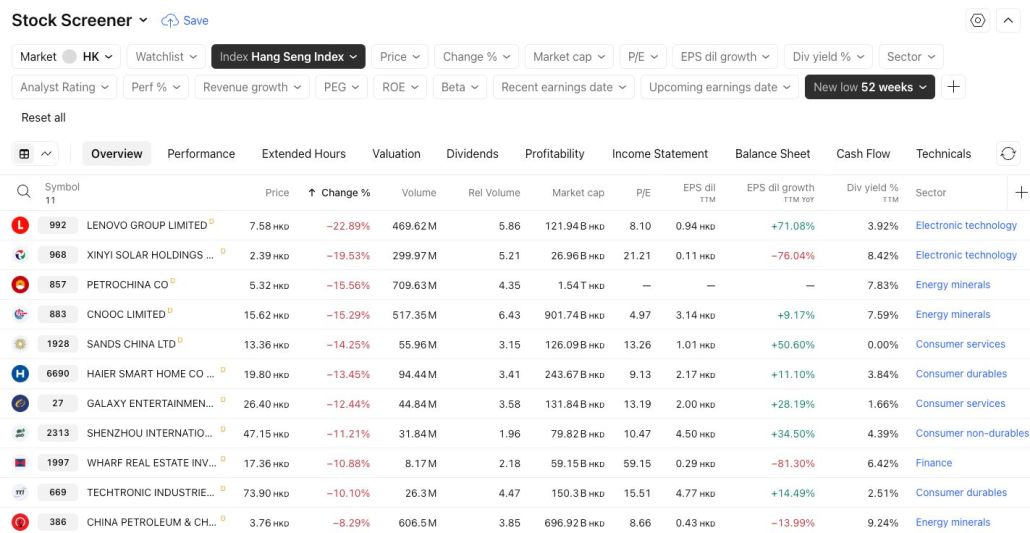

11 HSI Component Stocks Hit New 1-Year Lows

A total of 11 Hang Seng Index component stocks hit new one-year lows today. Many of these were companies exposed to tariffs due to their export-heavy business models — including names like Xinyi Solar, Shenzhou International, and Techtronic Industries.

Oil and energy stocks also slumped, dragged down by falling crude prices, which dipped below $60 a barrel. Lower oil prices are often seen as a leading indicator of weakening global demand. With fears of a sharp economic slowdown — or even a full-blown recession — sentiment in the energy sector turned increasingly negative.

Poor consumer sentiment also weighed heavily on casino operators such as Sands China and Galaxy Entertainment, both of which are considered discretionary plays. Wharf REIT, which owns a portfolio of shopping centres and commercial buildings, was not spared either. Even consumer durables like Haier Smart Home, which owns the GE Home Appliances brand in the U.S., joined the sell-off on tariff impact.

10 HSI Component Stocks That Outperformed Today

Unsurprisingly, with the HSI plunging 13%, not a single constituent stock closed in the green. Still, not all was doom and gloom — a handful of stocks managed to hold up better than the rest.

Interestingly, the day’s relative outperformers were mostly insulated from U.S. tariffs, though they remain vulnerable to broader macroeconomic risks.

Leading the pack were infrastructure and utility names such as CLP Holdings, Power Assets, and CKI Holdings. These companies tend to be more domestically focused and operate in regulated sectors, providing some defensive shelter during market chaos.

MTR Corporation also showed resilience. While known for its public transport network in Hong Kong, MTR also owns a significant portfolio of prime real estate, including luxury malls and commercial buildings — giving it a dual identity as both a transit and property play.

Nongfu Spring and Hengan International, producers of bottled beverages and consumer hygiene products like diapers and sanitary pads, also fared relatively well. As consumer staples, these businesses are less sensitive to economic cycles. While both have some exposure to export markets, their U.S. share is far less significant compared to more globally exposed peers.

Is the Selling Justified?

We may not have a crystal ball, but we do have some experience — and a dose of common sense.

When the market crashes this quickly and violently, a few things tend to happen. First, extreme volatility often feels unjustified, especially in the short term. But this is exactly what happens when the market is hit by a black swan event — in this case, a major geopolitical escalation that few saw coming.

Could the sell-off get worse? Absolutely. If the situation continues to escalate — or if new retaliatory measures are introduced — the market could fall further. At this stage, no one knows how or when this will end, and the total impact on the economy and individual companies remains uncertain.

There’s also a growing likelihood that supply chains could be restructured entirely, leading to a future landscape that looks very different from what we’ve known.

And it’s not just about tariffs. We may also see other forms of economic warfare emerge — from anti-monopoly investigations to regulatory hurdles that block or delay business operations in foreign markets. These are powerful tools governments can use without explicitly raising tariffs, and they could weigh heavily on companies with international exposure.

Are There Stocks That Don’t Deserve to Be Sold Down This Much?

In any market crash, some stocks inevitably get caught in the crossfire — even if they don’t deserve it.

In our view, the stocks that are least deserving of steep sell-offs are those unlikely to face long-term structural damage. While it's true that slower macroeconomic growth will impact everyone, some companies are better positioned to weather the storm.

In this case, we believe the HSTECH names — like Tencent, Meituan, and Alibaba — were unfairly punished, each falling more than 10% simply due to the broader market panic.

These Chinese tech giants derive most of their revenue domestically, and there are limited tools the U.S. can use to directly target them. While geopolitical tensions may persist, the scope for U.S. action against domestically focused Chinese platforms is narrow.

Moreover, many of these companies have shifted their primary listings to Hong Kong, insulating them from U.S. delisting risks. While they may face restrictions in global M&A or face headline risk, they’re also likely to receive support from Beijing, especially as the government seeks to shore up economic confidence and promote self-sufficiency in technology.

Final Thoughts

Extreme selling is rarely “justified” in a rational sense — but at the same time, uncertainty justifies fear, and fear leads to indiscriminate selling.

In any crisis, the wise investor goes back to fundamentals. Evaluate companies based on their long-term prospects, and ensure your portfolio allocation is sound. Balance potential risks with potential returns. You won’t always catch the bottom — but if you’re buying solid businesses at reasonable prices, you increase your chances of long-term success.

Hello there,

Huge Respect for your work!

New here. No huge reader base Yet.

But the work has waited long to be spoken.

Its truths have roots older than this platform.

My Sub-stack Purpose

To seed, build, and nurture timeless, intangible human capitals — such as resilience, trust, truth, evolution, fulfilment, quality, peace, patience, discipline, relationships and conviction — in order to elevate human judgment, deepen relationships, and restore sacred trusteeship and stewardship of long-term firm value across generations.

A refreshing take on our business world and capitalism.

A reflection on why today’s capital architectures—PE, VC, Hedge funds, SPAC, Alt funds, Rollups—mostly fail to build and nuture what time can trust.

“Built to Be Left.”

A quiet anatomy of extraction, abandonment, and the collapse of stewardship.

"Principal-Agent Risk is not a flaw in the system.

It is the system’s operating principle”

Experience first. Return if it speaks to you.

- The Silent Treasury

https://tinyurl.com/48m97w5e