HKBN Takeover Bid: What Shareholders Need to Know About the HK$5.23 Offer

The first signs of a potential HKBN takeover emerged in March 2023, when the company confirmed receiving a non-binding letter of interest from I Squared Asia Advisors, expressing intent to acquire it. Later, in April 2023, China Mobile was also reported to be exploring a buyout of HKBN. It took over a year to see an official offer made to shareholders. This likely involved a lengthy process of due diligence and valuation adjustments. But now that the offer is here, let’s evaluate whether it’s a good deal for HKBN shareholders.

China Mobile’s offer price is HK$5.23 per share in cash, though the actual payout may be lower as it will deduct any dividends distributed after the announcement.

When compared to the IPO price of HK$9, the offer appears low. The share price had reached highs of HK$15, meaning investors who bought at that level would face significant capital losses.

However, focusing solely on the share price may not paint a fair picture, as HKBN has distributed substantial dividends over the years—at times exceeding a 10% yield. Total returns, which factor in dividends, provide a clearer perspective.

Below is an adjusted stock chart showing that the share price is now at the same level as the IPO-adjusted price of HK$5. This means that an investor who bought HKBN at IPO and collected all dividends over the past nine years would have broken even. Meanwhile, an investor who purchased shares at the peak price would still experience a 52% loss, as dividends helped offset capital losses but weren’t enough to recover the full amount.

Even when considering total returns, the HK$5.23 offer isn’t particularly attractive.

It’s also crucial to consider HKBN’s financials and prospects, rather than focusing solely on historical prices.

The table below summarizes the 5-year and 10-year CAGR for revenue, earnings, free cash flow (FCF), and dividends. While revenue and FCF have grown steadily, earnings and dividends have declined.

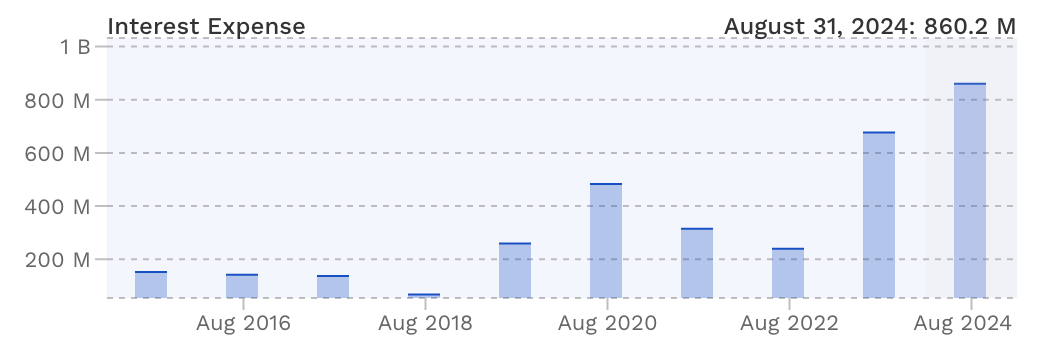

This decline can largely be attributed to rising interest expenses in the past two years, driven by higher interest rates. For most of the past decade, interest expenses remained below HK$400 million, but they ballooned to HK$600 million and HK$800 million in FY23 and FY24, respectively.

Another issue is HKBN’s declining market share over the years, despite growth in revenue and subscriber counts. This suggests the company is facing intense competition in the broadband market.

Even with these challenges, we believe the offer price undervalues the company. Key valuation metrics indicate room for improvement:

PS ratio: 0.6x vs. the 5-year average of 1.2x.

FCF yield: 18% vs. the 5-year average of 27%.

Dividend yield: 6.1% vs. the 5-year average of 11%.

With these numbers in mind, there is scope for a higher offer price, particularly as I Squared Asia has yet to disclose its offer.

China Mobile does have an advantage: it has secured irrevocable undertakings from the Canada Pension Plan Investment Board and an affiliate of TPG, which together own 25% of HKBN. However, this is still far from the 90% threshold needed to activate a compulsory acquisition clause.

HKBN shareholders can afford to take a wait-and-see approach, especially with the potential for a competing offer from I Squared Asia.