JNBY Stock Soars 27% After Bumper Dividend, Defying China's Consumer Slowdown

JNBY (SEHK:3306) saw its share price surge by 27% after the release of its half-year results.

This is likely due to the bumper dividend that the company has announced. Revenue increased by 26% while net profit soared by 55%. As such, the management announced a generous interim dividend of HK$0.46, complemented by a HK$0.39 special dividend. This combined dividend payout nearly matches the full-year dividends of the past year, hinting at a potential doubling of the full-year yield to 12% in this fiscal year if results continue on this trajectory. This anticipation has evidently fueled the share price jump.

These stellar results went against the notion that China is experiencing a consumer slowdown, and that the Chinese are pinching their wallets and would not spend big on luxury brands like JNBY. Perhaps these results were so shocking that the share price had to jump so much.

JNBY (Just Naturally Be Yourself) is a relatively young luxury fashion brand based in Hangzhou, China. Li Lin, the designer of the fashion line, co-founded the company with her husband Wu Jian. Both are the executive directors of JNBY today, and Li Lin is also the chief creative officer.

Luxury fashion brands have always been dominated by Europe, and it is hard for anyone to think that China can produce its own. Of course, an annual revenue of over US$600 million is far from being called a successful fashion brand, but hey, managing to carve out a space for itself is already a feat - it is audacious to call your brand luxury and charge a premium when nobody really knows you. But JNBY managed to do it and convert to some degree of financial success.

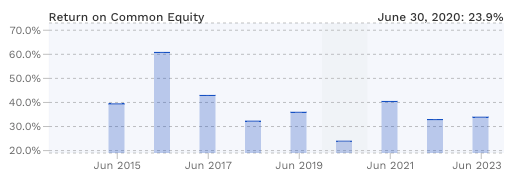

Because of its ability to charge a premium and sell the products, JNBY boasts high ROE and ROA figures of 34% and 16% respectively. Its ROE has always been above 30%, except for the Covid year in 2020 when its ROE dipped to 24%. That still makes many other companies envious.

Even its free cash flow margin is admirable at 18%. This is why it could continue to return loads of dividends to shareholders without sacrificing its growth, because the business doesn't consume much cash. It is the creativity and brand appeal that are more critical for JNBY to succeed.

Even after the recent price jump, we are looking at just a PE ratio of 9x, slightly below its 5-year average of 9.7x. This valuation suggests that, while the stock isn't overly expensive, the margin of safety for new investors has diminished somewhat. Investors should apply a large discount to Asian stocks because they always trade at a perpetual discount to US stocks. If JNBY were a US brand, it would be considered cheap at a PE of 9x because its average PE could be in the 20s or 30s. However, it is normal for Asian stocks to trade at single-digit PEs and still be fairly valued.

For those looking to invest, price levels of $6.20 and $8.75 represent more attractive entry points, offering a better balance between risk and potential reward. This also takes into consideration that JNBY share prices have exhibited significant volatility, with prices able to halve and double from time to time. Thus, always demand a good margin of safety.

It is impressive to see a burgeoning luxury brand coming out of China and achieving some commercial success. Also, the ground situation may not be as bad as what the media might be painting. If the Chinese consumer market is so bad, why would they buy more luxury products?

Good read and nice find!