In a previous post, we shared insights about three Chinese stocks leading the recovery, while most others in the region continue to struggle. One notable example is PDD Holdings (PDD), better known as Pinduoduo in China. Recently, PDD reported an exceptional quarter, with a revenue increase of 94% from the previous year. The company also reported strong profits, marking a year-over-year increase of 47%.

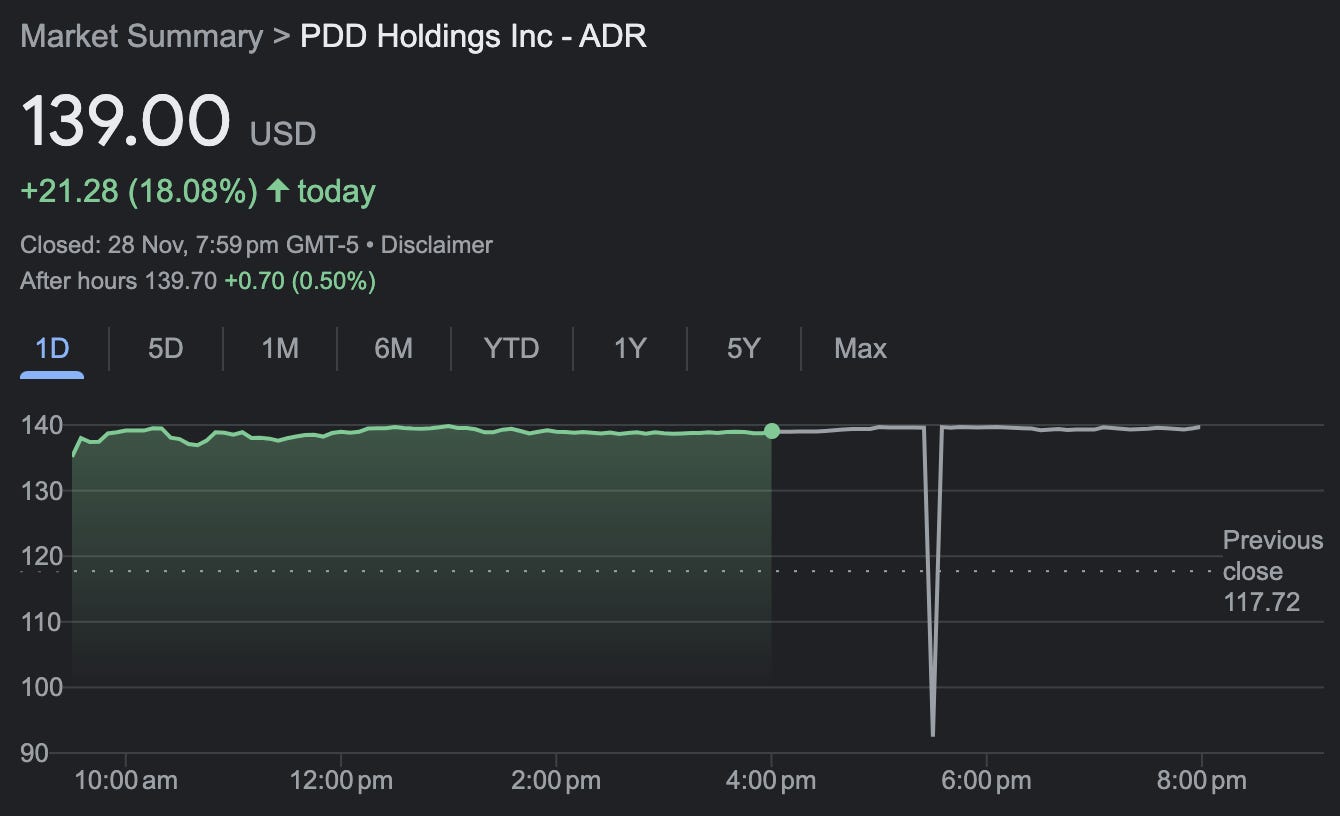

The share price surged by 18% following these remarkable results.

PDD operates as Pinduoduo in China and as Temu outside the country. Unfortunately, PDD does not provide separate financial breakdowns for these two entities, making it challenging to determine which one is driving growth.

Intuitively, Temu seems to be the likely catalyst, given its recent entry into the business and the significant attention it has garnered in the U.S. market. It's plausible that profits from Pinduoduo are being used to offset losses in Temu.

This hypothesis is supported by the fact that both Alibaba's international e-commerce business segment and Sea Ltd's e-commerce segment are reporting negative EBITDA. Consequently, in its pursuit of rapid growth and heavy advertising expenditure, Temu is unlikely to be profitable yet.

However, it's commendable that PDD still managed to achieve a 94% growth rate, while Alibaba's combined domestic and international e-commerce grew by only 11%.

Yes, Alibaba is larger and more established, with RMB 120 billion in e-commerce revenue, but PDD, at RMB 69 billion, is growing nine times faster, now accounting for more than half of Alibaba's size.

Jack Ma, the celebrated founder of Alibaba, even congratulated PDD on these results via Alibaba’s intranet. It's rare for Jack Ma to post, but he did so this time, not as a critique but to motivate Alibaba’s staff. He emphasized that the AI e-commerce era presents both opportunities and challenges for everyone and urged Alibaba's staff to offer constructive suggestions for the company's improvement.

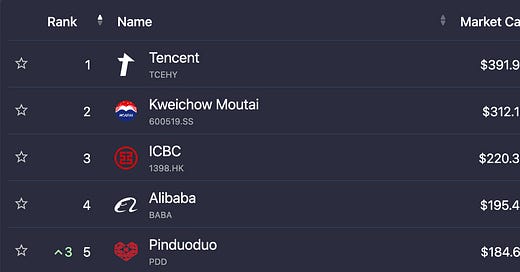

PDD’s market capitalization is close to surpassing Alibaba's by about $10 billion. A further 5% gain for PDD could see it overtaking Alibaba in market cap.

If one had switched from Alibaba to PDD at the start of the year, they would have avoided a 17% decline in Alibaba's stock and instead enjoyed a 64% year-to-date gain with PDD. This illustrates a clear case of opportunity cost, showing that one can often recoup losses from one stock by switching to another.

Currently, PDD doesn't seem like an undervalued investment but more likely fairly priced. It can work as a momentum stock though, whereby one continue to hold it as long as the upward trend continues.

Appreciate the sharing. If only Alibaba switches to PDD where investors make the bold move....despite Baba having a track record, clearly the management and team in Baba needs to have a charismatic and capable leader to lead and turn things around.