Ping An Insurance (SSE:601318 / SEHK:2318)

One of the most comprehensive financial institution in China

Ping An was established in Shenzhen in 1988 and later became a publicly traded company. In June 2004, it was listed on the Hong Kong Stock Exchange (HKEX), followed by a listing on the Shanghai Stock Exchange (SSE) in March 2007.

Today, it is considered one of China's most comprehensive financial institutions, offering a wide range of services including life and health insurance, property and casualty insurance, banking, asset management, and fintech solutions.

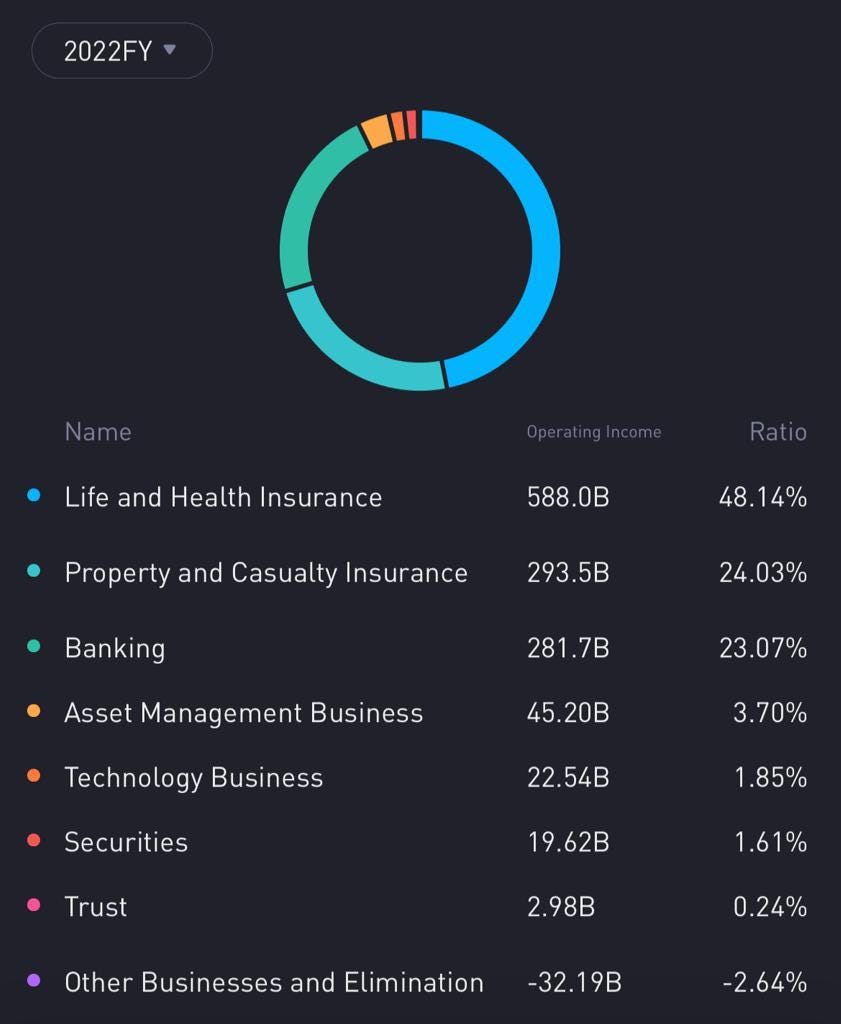

Below, we have provided a breakdown of Ping An's revenue by its various business lines:

As the revenue breakdown shows, Ping An's life insurance business generates the largest share of its revenues, accounting for 48% of the total. Overall, the company's insurance operations contribute approximately 72% of its revenues. While Ping An primarily operates within China, its customer base is concentrated in the coastal and Tier 1 cities.

In recent years, Ping An has been undergoing a transformation from a traditional insurer to a more technology-driven company, with a focus on building "ecosystems". The company has laid out a framework to achieve this goal:

Within its "ecosystem" segment, Ping An owns several notable and synergistic businesses.

Autohome

Autohome is China's largest online car dealership and auction platform, boasting a top market share of 40% within its industry. The brand is publicly traded on both the New York Stock Exchange (NYSE) under the ticker symbol ATHM and the Stock Exchange of Hong Kong (SEHK) under the ticker symbol 2518. Ping An is a major shareholder of Autohome, owning a 42% stake in the company.

Lufax

Lufax is widely regarded as one of China's largest and most successful online-only wealth management platforms, and it competes with major players such as Ant Group and Tencent Fintech Services. Prior to its spin-off, Lufax was a wholly-owned subsidiary of Ping An, but it became an independent publicly traded company after its listing on the New York Stock Exchange (NYSE) in 2020. Despite the spin-off, Ping An retained a significant stake in Lufax, owning approximately 41% of the company's outstanding shares.

Ping An Good Doctor

Ping An Good Doctor is one of the largest telemedicine platforms in China, boasting over 43 million paying customers and a network of more than 49,000 doctors. The company is publicly traded on the Hong Kong Stock Exchange (HKSE) under the ticker symbol 1833. Ping An is a major shareholder of Ping An Good Doctor, owning approximately 39% of the company's outstanding shares.

OneConnect

OneConnect is a technology-as-a-service provider that offers advanced software solutions to other financial institutions, including banks and insurance companies. The company is publicly traded on both the New York Stock Exchange (NYSE) and the Stock Exchange of Hong Kong (SEHK) under the ticker symbols OCFT and 6638, respectively. Ping An is a major shareholder of OneConnect, owning approximately 32% of the company's outstanding shares.