Perhaps the best place to hunt for deep value stocks now is among Chinese companies. Following Douyu’s huge dividend distribution, attention to such value stocks has increased. Recently, I came across another stock similar to Huya and Douyu trading below cash value: Sohu.

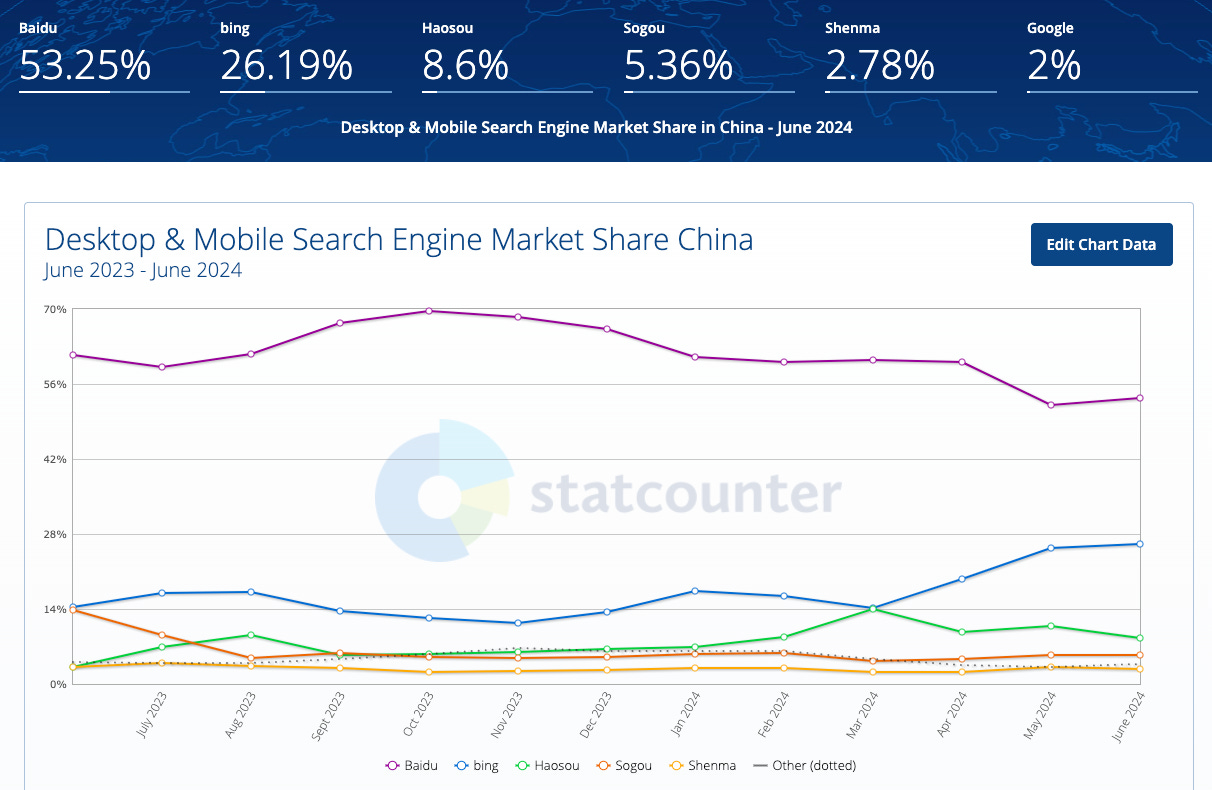

Sohu was one of the pioneers in search engines in China, with its Sogou search engine competing against Baidu in the year 2000. Fast forward to today, Baidu is number one in China, and even Bing and Haosou have overtaken Sogou.

Moreover, search engines are not the most popular way for Chinese users to navigate the internet. They have grown accustomed to social platforms such as WeChat, Douyin, and Xiaohongshu to get the content they want. Hence, the search engine business as a whole has not achieved much in China compared to the rest of the world. Even Baidu's dominance means little to its revenue and profits relative to Tencent’s.

Recognizing this, Sohu acquired Changyou, a gaming company, in 2020. However, it was too late to catch up with the bigger internet companies, and Sohu remains a relatively small and unknown player.

Nevertheless, it was a good move in hindsight because Changyou contributed 81% of Sohu's total revenue and enjoys an operating profit, unlike Sohu’s other businesses, which operate at a loss. Without Changyou, Sohu would be sinking deeper into losses.

The same picture can be seen in its cash flow statement, where it was still burning cash in 2023.

If it is a struggling business, why then are we looking at this company?

We first have to understand that stocks are generally cheap for a reason, and it is clear why Sohu is one of them - the business metrics are bad.

Because it is obviously bad, the stock has been significantly sold down, and at one point, it becomes ridiculous as it trades below its liquidation value. This means that if Sohu closed down today and paid back all its liabilities, it would still have surplus cash to return to shareholders, more than the price you pay for the shares today.

Let’s do a calculation based on its 1Q24 financials (figures in USD ‘000):