China and Hong Kong stocks are traditionally known for their high dividends, driven by large, established companies in mature industries like banks and telcos. In recent years, China has seen the rise of big tech firms, but these companies largely reinvest their profits for growth rather than distributing high dividends. Different investors have varying preferences, but we observe that the appetite for dividend stocks remains strong in Asia. Hence, this post is dedicated to those who appreciate receiving consistent dividend paychecks.

Previously, we covered two high-yield dividend ETFs that were distributing more than 7% at the time of writing. Thanks to this year’s rally, those ETFs have seen over 20% gains in the past year, though their dividend yields have dipped slightly to over 6%. However, that still remains attractive for dividend-focused investors.

2 High Dividend ETFs in China and Hong Kong

We generally have reservations about dividend ETFs due to their tendency to underperform standard index funds. This is especially pertinent in the context of US-based ETFs, which are often subject to a 30% dividend tax. Moreover, US stocks frequently fail to offer sufficiently high dividends, and those that do often present issues and perform poorly.

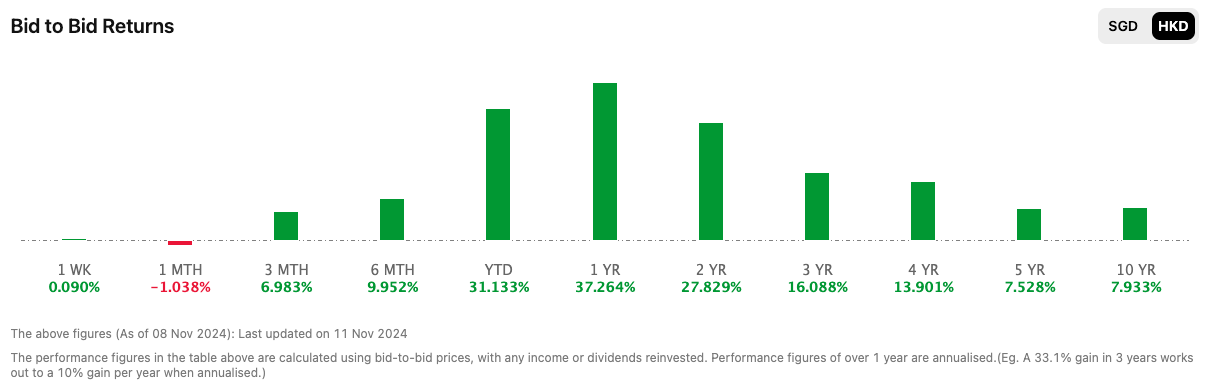

Recently, we discovered an even better-performing dividend ETF that has weathered the challenging sentiment in the China stock market remarkably well. While China stocks have delivered negative returns over the past three years, this ETF managed to generate positive returns during the same period.

In fact, the track record of this ETF is outstanding—it has delivered more than 7% annual returns whether you invested 1, 2, 3, 4, 5, or even 10 years ago. This consistent performance is impressive, given the volatility and underperformance seen in broader Chinese markets.