This Cash-Rich Medical Device Stock Is Growing, Spinning Off a Unit, and Paying 9% Dividends

PW Medtech (HKEX: 1358) is a China-based medical device company involved in the research, development, production, and distribution of advanced infusion sets and blood purification equipment.

Infusion Set Business

This segment includes non-PVC infusion sets, precision filters, light-resistant sets, intravenous cannulas, and insulin needles and pens. PW Medtech owns patents such as its double-layer tubing design, which strengthens its position in the domestic market.

Blood Purification Business

This covers high-flux and low-flux hemodialyzers, hemodiafiltration devices, hemoperfusion systems, and full dialysis machines. It's a fast-growing vertical with meaningful scale.

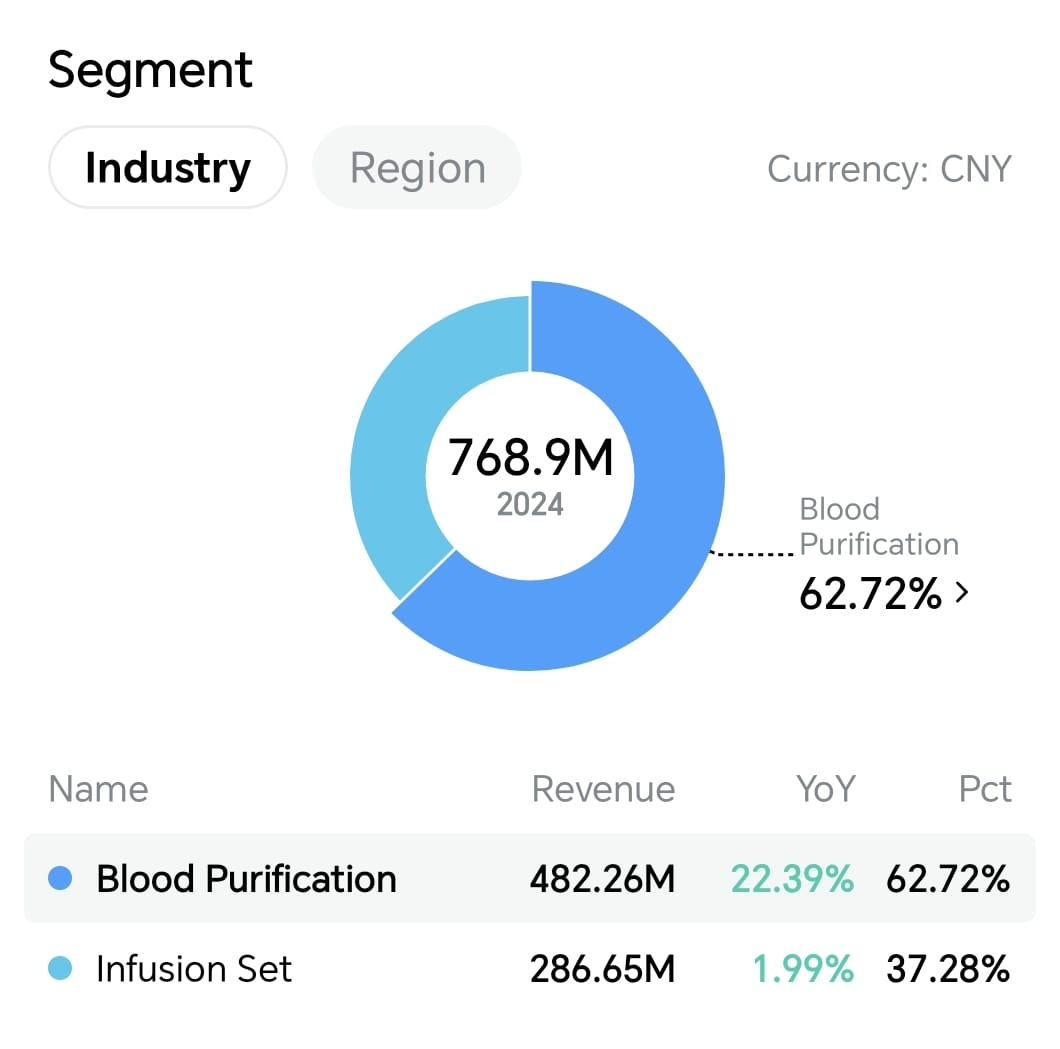

In FY2024, blood purification made up 62.7% of total revenue, growing 22.4% year-on-year. The infusion set business contributed the remaining 37.3%.

Growth Potential

PW Medtech has delivered a solid revenue trajectory over the past five years, driven by organic expansion across its core segments—even if profits have been more volatile in comparison.

FY2024 was another step forward. Revenue rose 13.9% to RMB768.9 million, while gross profit climbed 10.1% to RMB419.4 million. Gross margin stayed healthy at 54.6%.

In the Infusion Set Business, PW Medtech secured approvals for pump infusion sets and a closed-system drug transfer device. The latter is especially promising—it’s designed for handling hazardous drugs like antineoplastics, opening up a path into oncology-related applications.

In the Blood Purification segment, the company won approval for its own hemodialysis and continuous blood purification machines, allowing it to move beyond consumables into equipment manufacturing—a step up the value chain. More submissions are coming in 2025, including a continuous hollow fiber hemodiafilter to further strengthen its product lineup.