Thanks to medical advancements, humans can extend their lives through medication and treatment, leading pharmaceutical companies to emerge as powerful global entities.

When examining the world's largest pharmaceutical companies, a significant number are based in the U.S. This is hardly surprising, given that the U.S. is renowned for its innovation, with many groundbreaking drug discoveries originating there. Additionally, the U.S. market's substantial purchasing power further incentivizes research and development efforts within the country.

Contrastingly, China's pharmaceutical industry lags in development. Jiangsu Hengrui (SSE:600276), the largest Chinese pharmaceutical company, ranks 27th globally by market capitalization. In fact, only seven Chinese pharmaceutical firms are among the top 100 worldwide, trailing behind India's 13 and Japan's 9. When ranked by revenue, China has eight companies listed, while India and Japan boast 10 and 13, respectively. This comparison underscores the relatively smaller scale of Chinese pharmaceutical companies in both market presence and revenue.

This analysis reveals several insights. Firstly, the relative position of Chinese pharmaceutical companies suggests they have yet to meet global standards, indicating a need for China to advance in this sector. This gap presents an opportunity for the U.S. to exert pressure on China by potentially restricting access to advanced medical treatments. While such measures have not been implemented—likely due to the existence of less contentious yet effective strategies, such as those in the semiconductor industry—restricting medical treatments could be perceived as morally reprehensible, casting the U.S. in a negative light. China's determination to achieve self-sufficiency, demonstrated during the COVID-19 pandemic by its preference for developing its own vaccines over using American ones, underscores its resolve.

From a more optimistic perspective, the lag in China's pharmaceutical development represents significant potential for growth and untapped revenue, particularly given China's large and aging population of 1.4 billion. This demographic trend suggests an increasing reliance on medication, promising greater production and revenue for Chinese pharmaceutical companies.

The third observation concerns the low market capitalization of Chinese pharmaceutical stocks, attributed to regulatory crackdowns on corruption and excessive profit-making in healthcare. However, the impact of such regulations is often temporary, and affected stocks frequently experience substantial rebounds. Considering these factors—the potential for growth driven by a vast and aging population, the opportunity to close the innovation gap, and the rebound potential of stocks post-regulation—it appears to be an opportune moment to consider investing in Chinese pharmaceutical stocks.

Analyzing pharmaceutical companies can be challenging due to the complex nature of drug names and their specific applications. Additionally, it's a sector fraught with risk, as research and development (R&D) require substantial investment without any guarantee of success. The initial stages of research are often shrouded in opacity, further complicating analysis.

However, when a pharmaceutical company develops a blockbuster drug and secures exclusivity, it stands to gain significant financial rewards. This achievement can lead to an appreciation in the company's stock price, benefiting investors.

There's another category of pharmaceutical companies that might not rely solely on patented drugs but maintain a portfolio with steady demand. Their competitive edge often stems from effective distribution networks and strong branding for specific drugs. Such companies are generally more appealing to us as their profitability, revenue, and cash flow tend to be more consistent. This makes them relatively safer investments compared to companies heavily reliant on the unpredictable success of innovative drugs.

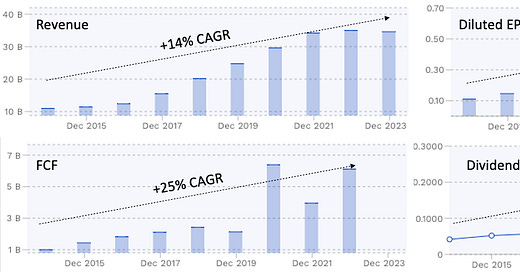

To identify high-quality pharmaceutical stocks within China's extensive market—comprising 266 companies—we will employ a quantitative screening method. This approach focuses on companies that demonstrate consistent growth in revenue, earnings, and cash flow, alongside healthy profit margins, thereby signaling higher quality. Additionally, we require that these stocks have delivered positive total returns over the past decade. Despite the current downturn in Chinese stocks, we're looking for those that have shown long-term appreciation.

After applying our quantitative filters and focusing on valuation metrics to determine undervaluation, we've identified three high-quality pharmaceutical stocks that are currently undervalued.