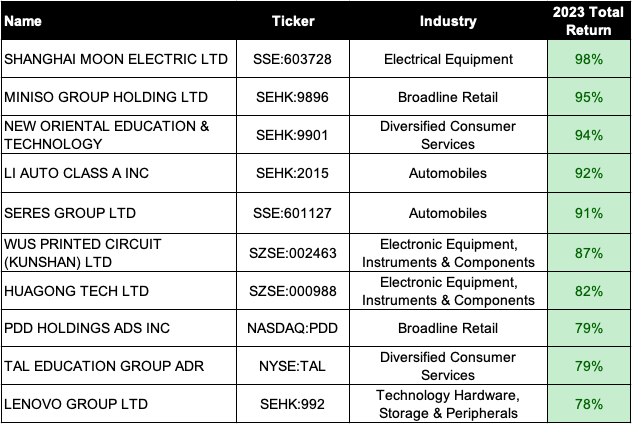

Top Performing China Stocks of 2023

China stocks closed 2023 with another year of losses; the iShares MSCI China ETF (MCHI) was down by 14%. Despite this, there were still some gainers worth noting.

Due to the large number of China stocks (more than 7,000 names), it is not sensible to simply rank their 2023 returns. Doing so would likely yield microcaps that most investors haven’t heard of, let alone invested in.

Therefore, we limit our ranking to the constituents of the MSCI China Index. Even so, there were more than 600 stocks in it, similar to a large-cap S&P 500 index in the US.

We always prefer to use the MSCI China Index because it comprises China stocks listed around the world (ADRs in the US, A-shares in Shanghai and Shenzhen, and H-shares in Hong Kong). This approach gives us a more comprehensive assessment of China stock performance.

Lastly, we excluded stocks that were not available for retail investors. These are typically listed on the STAR Market or the ChiNEXT market.

With these considerations in mind, here are the top 10 performers among the MSCI China Index constituent stocks:

The top name, Moons' Electric, may not be familiar to most, as it specializes in motion control and LED lighting systems. It is particularly known for its hybrid stepper motor and has managed to capture about 10% of the global market share, becoming one of the top three suppliers. These motors are used in various applications, including CNC machines, 3D printers, consumer electronics, automotive, robotics, and more.

The other two lesser-known names are Wus Printed Circuit and Huagong Tech. Wus Printed Circuit manufactures printed circuit boards (PCBs), as its name suggests. However, the notable aspect here is that it produces High Performance Core PCBs for AI servers. Huagong Tech, a laser technology specialist, caters to a wide variety of uses. Notably, it is involved in intelligent manufacturing, such as using lasers to cut silicon wafers and weld EV parts. Additionally, it possesses PTC (Positive Temperature Coefficient) heater technology, which is critical for thermal safety in electric vehicles (EVs).

The second name, Miniso, should be more familiar to many. With numerous retail stores worldwide, Miniso is known for selling cute lifestyle products featuring Japanese-inspired designs. The company saw its revenue grow by over 20% from the previous year, boasting an impressive Return on Equity (ROE) of 25% and Return on Assets (ROA) of 16%. Despite facing a short seller report, Miniso managed to deliver a substantial 95% gain in 2023.

New Oriental Education & Technology, a private education company, was significantly impacted by China's ban on primary school tuition. However, the company successfully pivoted to focus on adult education and examinations. Additionally, its rebranding of one of its units to East Buy and transition to e-commerce proved to be successful, putting the company back on a growth trajectory.

Another company in this sector, TAL Education, has shown similar resilience. Like many private education companies, TAL Education has managed to survive and rebuild its business. Although these companies’ share prices have rebounded considerably, they are still far from their all-time highs, suggesting potential for further upside.

Li Auto is the best-performing EV stock from China. It has emerged as a leader among EV startups, including NIO and Xpeng, especially in the luxury SUV segment. In 2023, Li Auto delivered 376,030 vehicles, in contrast to NIO's 160,038 and Xpeng's 141,601. With more than double the deliveries of its closest competitors, Li Auto justifiably experienced a 92% increase in its share price.

Seres, on the other hand, is known for partnering with Huawei to create the Aito brand of EVs. Sales have surged since October 2023, with Aito delivering 24,468 vehicles in December alone, marking a 141% increase from the previous year.

PDD requires little introduction, especially after surpassing Alibaba's market cap to become the largest e-commerce company in China. Its international division, Temu, is demonstrating promise. However, it remains to be seen whether PDD can surpass Alibaba in terms of revenue.

We were surprised to see that despite the downtrend in PC sales and a decline in Lenovo's revenue, its share price managed to rise by 78% in 2023. This increase is likely attributed to the company's foray into AI, with the introduction of AI servers and AI PCs for consumers. Such stories often captivate investors. That said, the PC market is expected to have bottomed out and is anticipated to see a resurgence in 2024. Hopefully, Lenovo can capitalize on this opportunity and translate it into actual revenue gains.

In conclusion, the performance of many top Chinese stocks in 2023 was primarily driven by key sectors such as AI and EV. Moreover, several companies distinguished themselves through actual growth in financial results, surpassing their competitors. Despite the challenges faced by China's stock market in 2023, these winners demonstrate that even in adverse conditions, there are always opportunities. Here's to 2024 being a year where the dragon rises!