What ‘Moderately Loose’ Monetary Policy Means for China’s Stock Market

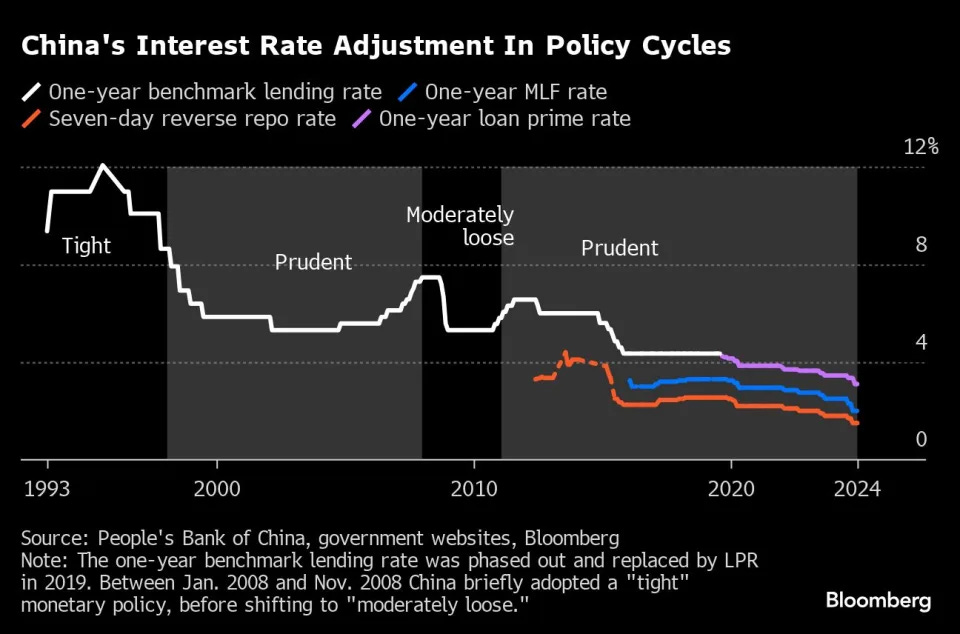

China’s most powerful political body, the Politburo, has shifted its monetary policy stance from “prudent” to “moderately loose” in 2025. This marks a significant long-term policy adjustment, as the “prudent” policy stance has been maintained for 14 years.

The term “prudent” has served as the baseline in China’s monetary policy hierarchy, with four additional levels indicating policy flexibility:

Tight

Moderately Tight

Prudent

Moderately Loose

Loose

Shifting to a “moderately loose” stance suggests that more aggressive rate cuts are likely ahead. This shift aligns with China’s preparation for potential trade tariff increases from the U.S., as anticipated under a Trump administration. The aim is to expand policy headroom for future rate cuts.

Lower interest rates typically stimulate lending, business expansion, consumer spending, export competitiveness due to a weaker yuan, and higher stock prices. However, the overall impact depends on complementary fiscal policies, international trade dynamics, and actual domestic consumption.

Bloomberg has charted China’s monetary policy language against its interest rates, highlighting that only in years between 2008 and 2010 did China adopt a “moderately loose” stance, responding to the Global Financial Crisis. During that period, U.S. banks were on the brink of collapse, prompting sharp rate cuts in China. By 2011, with the crisis stabilizing, China reverted to its “prudent” policy.

China has cut rates even during “tight” policy cycles, reflecting broader global monetary trends, particularly in response to falling U.S. interest rates. In recent years, China’s rate cuts have aimed to stimulate economic growth without triggering the inflation challenges faced by the U.S. Historically, rate cuts have been more gradual under a “prudent” stance, suggesting that sharper cuts could be expected in 2025.

What does this mean for the stock market?

We overlaid China’s policy cycles against the SSE Composite Index, as this policy has a direct impact on A-shares, unlike the Hong Kong market, which follows separate policies. While the CSI 300 Index would be preferable for such analysis, its data history only goes back to the early 2000s.

Historical data shows two major negative return phases for the SSE Composite Index: 1993-1997 (Moderately Tight) and 2008 (Tight).

During other periods, including “prudent” phases, the index generally delivered positive returns. The “moderately loose” phase from 2008 to 2010, though short-lived, saw the SSE Composite rise by approximately 65%.

Beyond monetary policy, the Politburo has also emphasized fiscal measures and boosting consumption. Phrases like “forcefully lift consumption” and “more proactive” fiscal stimulus suggest a willingness to tolerate higher deficits and increased government spending.

Although these announcements are directional rather than concrete, they signal that rejuvenating the economy has become China’s top priority. This policy direction will likely cascade through various government levels, with detailed measures expected soon.

The combination of a “moderately loose” monetary policy, stronger fiscal initiatives, and a consumption-focused agenda increases the likelihood of positive returns for the Chinese stock market in 2025.