Will China Stocks Recover?

Dr Wealth held the Investors Mastermind event last weekend and the theme was “Will China Stocks Recover”.

This post is to recap some of the key points made during the event.

#1 Half-Empty or Half-Full Glass?

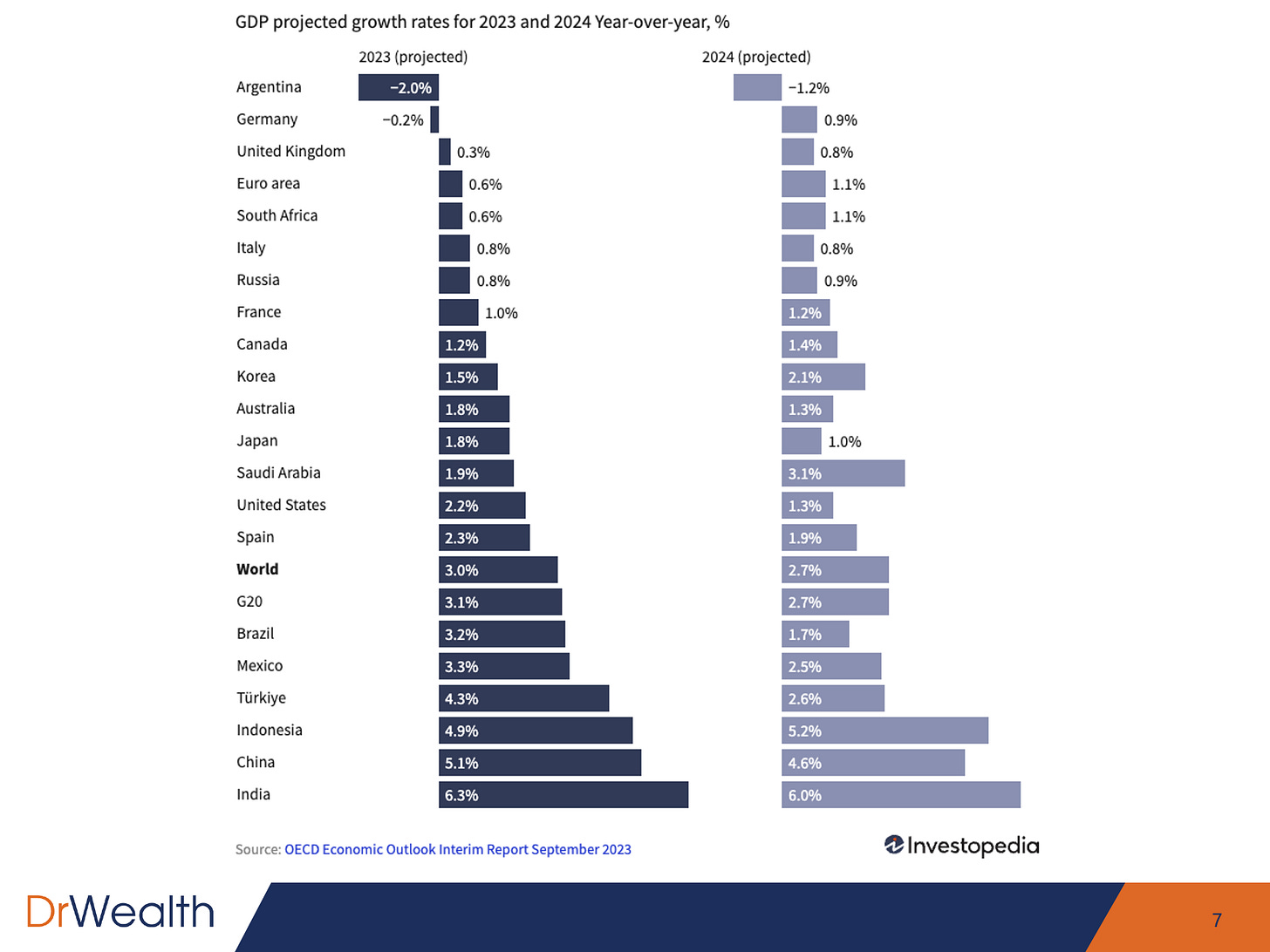

China can be perceived in two ways: as a half-empty or a half-full glass. Western media often adopt a half-empty perspective when covering China, frequently highlighting negative news. While it's true that China faces challenges (as any country does), there are also positive aspects worth reporting. For instance, China continues to experience a GDP growth that outpace the majority of nations and playing a significant role in global economic expansion. The purpose of this session was to emphasize the half-full perspective.

#2 The Second Largest Economy Is Still Growing Reasonably Fast

Within the G20 nations, China is expected to achieve a more rapid GDP growth in 2023 compared to all others except India. It's important to note that China boasts a substantial $18.1 trillion economy, while India has a GDP of $3.4 trillion. A 5% growth rate on an $18.1 trillion economy translates to an additional $905 billion in 2023. There are no other economies of this magnitude experiencing such a high rate of growth.

#3 Deflation Like Japan? Nah

Western media hastily proclaimed that China was on the verge of a prolonged deflation, like what Japan has experienced in the past 30 years, following just one month of a negative Consumer Price Index (CPI) in July 2023. However, by August 2023, the CPI had rebounded into positive territory. There are no signs of permanent deflation.

#4 China Companies are Growing Faster Than the Western Counterparts

During the second quarter of 2023, numerous Chinese companies have exhibited more rapid revenue and net profit growth when compared to their Western counterparts. However, their stock prices have not kept pace to reflect their improved fundamentals.